The final month of the year has traditionally held special significance for financial markets, and cryptocurrency is no exception. The phenomenon known as the “Santa Rally”, which is a tendency for assets to rise during the last five trading days of December and first two of January, has frequently blessed crypto investors with generous year-end gains.

Yet as December 2025 approaches, the crypto market finds itself at a critical crossroads, caught between bullish seasonal patterns and significant near-term headwinds. With Bitcoin coming off a sharp November correction that pushed it below $94,000 and the market sentiment indicator sitting at “Extreme Fear,” understanding the complex interplay of rates, liquidity, and regulatory policy becomes essential for navigating what may be one of the most consequential December periods in crypto history.

The Federal Reserve’s Pivotal Role in Crypto’s December Fate

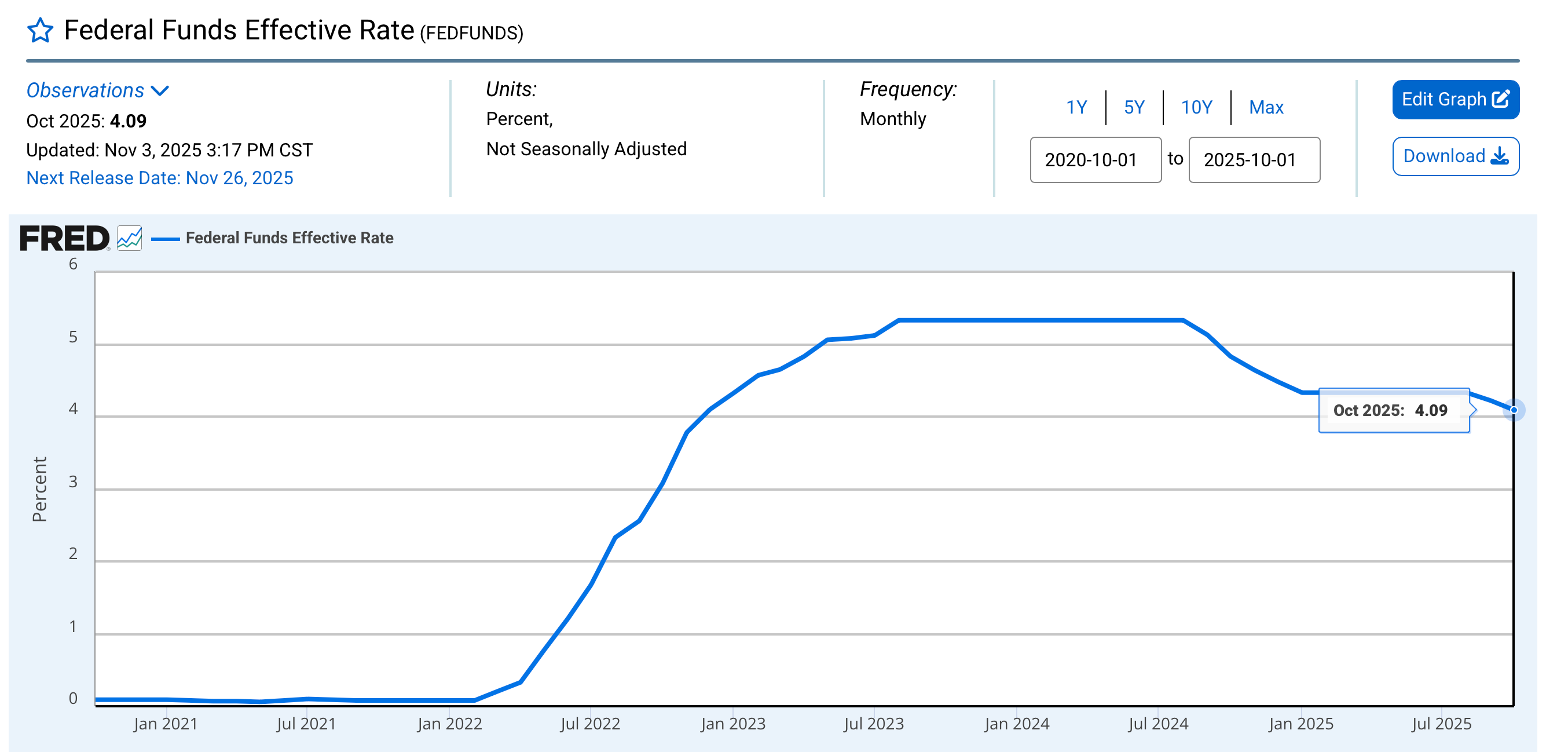

Fed rate. Source: FEDERAL RESERVE BANK

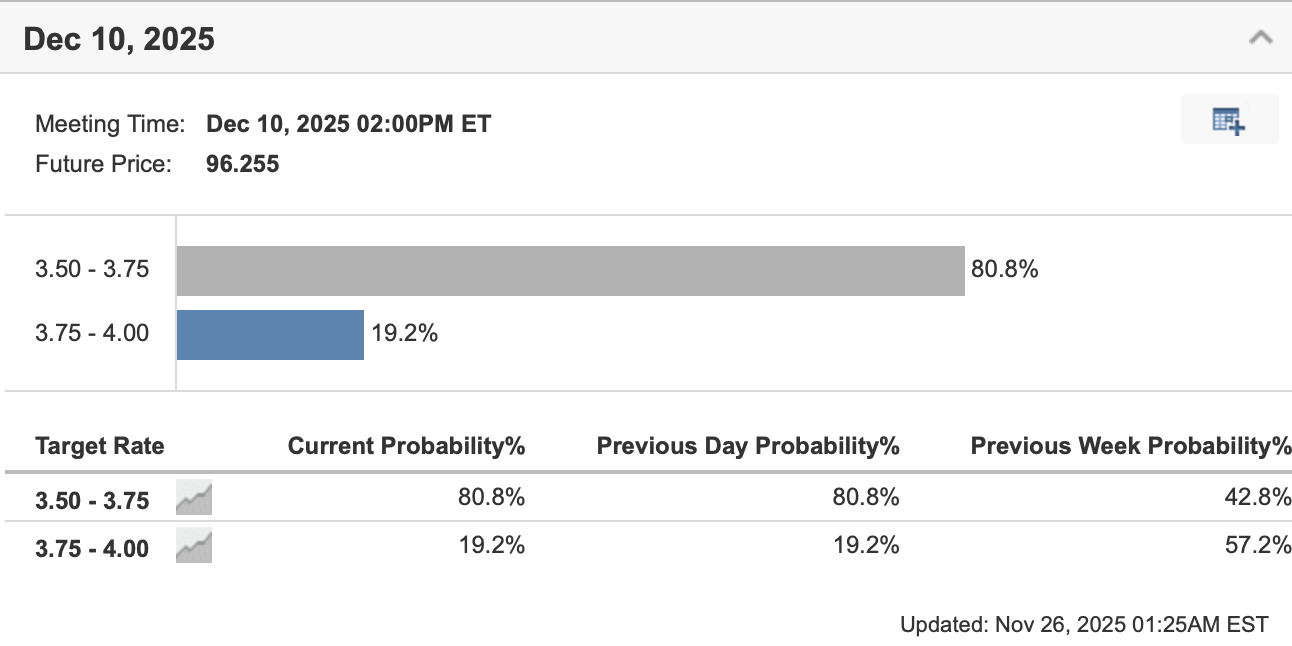

All eyes are fixed on the Federal Reserve as cryptocurrency traders seek clues about monetary policy direction. The probability of a December rate cut has skyrocketed to 84.7%, a dramatic increase from approximately 35% just one week prior. This surge follows softer-than-expected Core Producer Price Index (PPI) data released on November 25, suggesting inflationary pressures may be cooling faster than anticipated.

Fed rate monitor. Source: Investing.com

The implications for crypto markets are substantial. Lower interest rates typically weaken the US dollar, making risk assets like Bitcoin and Ethereum more attractive to global investors. According to financial analyst Cas Abbé, “When the Fed signals dovish policies, crypto markets tend to rally, with BTC frequently testing key resistance levels”. This relationship has strengthened since 2020, with crypto prices increasingly moving in sync with equities.

The timing of the Fed’s decision creates a potentially explosive setup for December. Should policymakers follow through with anticipated cuts, the resulting liquidity injection could drive substantial flows into cryptocurrencies. As noted in financial analysis, “rising rate cut probabilities often translate to increased liquidity and risk-on sentiment, driving inflows into high-volatility assets such as Bitcoin (BTC) and Ethereum (ETH)”.

However, the Fed’s decision comes with unusual uncertainty. The recent 43-day government shutdown delayed key economic data, creating what analysts describe as “flying a little blind” for policymakers. This information gap adds volatility to an already tense situation, where “unpredictable policy signals test investor nerves”.

Assessing the Damage From November’s Liquidity Crisis

Beneath the surface of price charts, crypto market structure shows signs of both strain and resilience. October 2025 witnessed what analysts have called “the most intense deleveraging event in history” with perpetual futures experiencing the largest forced liquidations ever recorded. The aftermath reveals a market that has been reset but not broken.

Liquidation chart. Source: Coinglass

The deleveraging cleanup eliminated over 30% of open interest in perpetual futures contracts within hours. This dramatic contraction particularly impacted altcoins and exchanges popular with retail traders. The positive outcome of this violent reset is that “systemic risk has been reduced” as leverage has been flushed from the system.

Spot liquidity remains concerningly thin, however. On major exchanges, the order book depth for Bitcoin, Ethereum, and Solana remains 30-40% below October levels. This creates a fragile environment where “small trades can trigger disproportionate price swings,” exacerbating volatility and amplifying forced selling effects. The situation is even worse for altcoins, where order books have experienced “more severe and prolonged deterioration”.

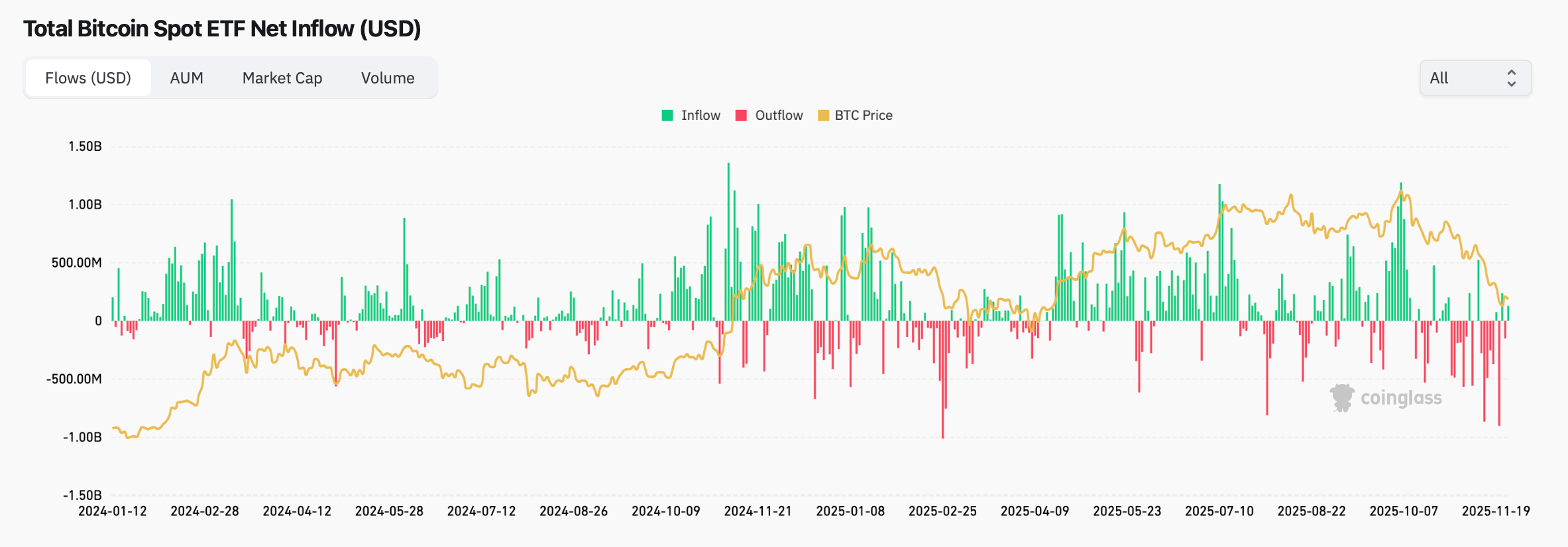

BTC ETF flows. Source: Coinglass

Institutional channels have weakened. Since mid-October, Bitcoin ETFs have witnessed massive outflows totaling $4.9 billion, which is the largest redemption since April 2025. This represents a significant reversal for what had been a stable source of demand throughout 2024-2025. Similarly, Digital Asset Treasuries (DATs) like Strategy which holds 3.2% of Bitcoin’s total supply, face pressure as their stock valuations decline alongside crypto prices, limiting their capacity to accumulate more assets.

Despite these challenges, the market’s foundation appears healthier than one might expect. The deleveraging process, while painful, has created “cleaner positioning with reduced systemic risk”. This sets the stage for a more sustainable advance should bullish catalysts emerge in December.

The CLARITY Act and Innovation Exemptions

December 2025 could mark a watershed moment for cryptocurrency regulation with several policy initiatives reaching critical decision points. The most significant of these is the CLARITY Act, which is scheduled for a Senate vote in December. This bipartisan legislation would assign clear oversight of spot crypto trading to the Commodity Futures Trading Commission (CFTC), resolving years of jurisdictional ambiguity between the SEC and CFTC that has left digital assets in a legal gray zone.

The impact of this regulatory clarity is already evident in institutional behavior. According to the 7th Annual Global Crypto Hedge Fund Report, “47% of institutional investors surveyed in 2025 cited the evolving U.S. regulatory environment as a reason to increase their crypto allocations”. A further 24% of crypto-focused fund managers directly linked their investment decisions to clearer regulatory guidance.

Simultaneously, the SEC’s “Innovation Exemption” is scheduled for December implementation. This framework will allow digital asset companies to launch products with reduced regulatory pressure while the SEC develops comprehensive rules for the industry. The exemption, part of “Project Crypto” launched in July 2025, aims to modernize outdated securities laws that have delayed blockchain services.

The regulatory calendar also includes an SEC roundtable on crypto privacy scheduled for December 15. This meeting will bring together industry leaders and SEC officials to discuss challenges and potential solutions regarding privacy and financial surveillance in cryptocurrency ecosystems.

These coordinated policy movements represent what one analysis describes as “a seismic shift” in the U.S. regulatory landscape. By resolving jurisdictional ambiguities and introducing structured oversight, these initiatives are “addressing the core concerns that have long held back institutional capital”.

Historical Patterns: What the Santa Rally Record Reveals

Despite recent market weakness, December’s historical performance statistics offer cautious optimism for crypto investors. Analysis of Bitcoin’s December performance from 2015-2024 reveals that:

-

7 out of 10 years ended in positive territory

-

The average monthly return stood at +9.48%

-

The best years saw gains of +46% (2017) and +36% (2020)

These numbers confirm that “December remains one of Bitcoin’s strongest months historically, even during broader bear markets”.

Several seasonal factors typically support these year-end rallies:

-

Holiday optimism that boosts risk appetite among traders

-

Year-end bonuses flowing into crypto investments

-

Tax-loss harvesting creates buying opportunities

-

Lower institutional selling pressure during holidays

-

Retail trader dominance in trading volume during late December

However, analysts have grown more cautious about the 2025 Santa Rally’s prospects. Where just a month ago probabilities stood at 70%+, current estimates range between 30-40% following November’s brutal correction. The formation of a “death cross” on Bitcoin’s daily chart further complicates the technical picture.

The failed forecasts of prominent analysts underscore uncertainty. As noted in market commentary, “Polish analyst Robert Ruszała publicly apologized after his detailed Santa Rally roadmap collapsed within weeks, highlighting how quickly sentiment can shift in crypto”.

Strategic Approach for Crypto Traders in December 2025

Navigating December’s complex landscape requires a balanced approach that respects both seasonal patterns and current market realities. Based on current conditions, several strategic considerations emerge:

Monitor key technical levels. Market technicians identify $95,000–$97,000 as the zone Bitcoin must reclaim to flip market structure bullish. Conversely, holding above $82,000 is crucial to prevent deeper selloffs. These thresholds offer objective markers for assessing market direction.

Focus on Fed policy and ETF flows. The two most immediate catalysts are the Fed’s rate decision and whether ETF flows return to positive territory. As one analysis notes, “A dovish Fed and renewed spot ETF inflows could reignite bullish sentiment”. These fundamental factors could override technical weakness.

Employ prudent risk management. With volatility elevated and liquidity thin, “avoid heavy leverage during extreme fear periods”. Instead, consider dollar-cost averaging instead of all-in trades, set stop-loss levels below critical support, and have predefined profit-taking targets near $100,000–$105,000 if a rally occurs.

Watch regulatory developments. The CLARITY Act vote and SEC innovation exemption could serve as positive catalysts for institutional adoption. As noted in analysis of the regulatory landscape, “By resolving jurisdictional ambiguities and introducing structured oversight, the CLARITY Act and CFTC initiatives are addressing the core concerns that have long held back institutional capital”.

Long-term perspective matters. Seasonal patterns are interesting but “never guaranteed, especially in cryptocurrency markets”. For long-term holders, the Santa Rally should be viewed as “interesting data, not a reason to change core strategy”.

Conclusion: Navigating the December Crossroads

December 2025 represents a critical convergence point for cryptocurrency markets, where seasonal tailwinds meet significant technical headwinds. The outcome likely hinges on three key factors: the Federal Reserve’s rate decision, the recovery of institutional demand through ETF channels, and whether historical December patterns can overcome recent technical damage.

What makes this December particularly compelling is how these catalysts align temporally. The Fed decision, regulatory clarity, and Santa Rally window create a concentration of potential volatility triggers within a short timeframe. This setup could amplify either direction, fueling a powerful rally if catalysts align or exacerbating declines if disappointments mount.

For traders and investors, success in this environment requires both conviction and flexibility—the conviction to maintain exposure to crypto’s long-term potential while remaining flexible enough to navigate near-term volatility. As market observers note, “The Bitcoin Santa Rally is not dead yet, December still carries strong historical upside bias. However, November’s brutal correction and ongoing bearish structure mean any 2025 rally would require a clear trend reversal first”.

In this complex landscape, information and perspective become invaluable assets. Understanding the interplay between macroeconomic policy, market structure, regulatory developments, and historical patterns provides the framework for navigating whatever December may bring—whether Santa arrives with rallies or the Grinch steals crypto Christmas.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.