The market showed tentative signs of stabilization on November 26th after a significant downturn. Bitcoin (BTC) is consolidating above a crucial support level, while Ethereum (ETH) is attempting to reclaim the $3,000 psychological level. Meanwhile, Texas has become the first US state to purchase Bitcoin for its treasury, making a $10 million acquisition as part of a broader strategic initiative. The U.S. PPI inflation data for September has come in higher than expectations, providing a bearish outlook for Bitcoin. Polymarket received an Amended Order of Designation from the U.S. Commodity Futures Trading Commission (CFTC), clearing the way for the prediction-market platform to operate as a fully regulated U.S. platform.

Crypto Market Overview

BTC (-0.10% | Current Price: $87,698.01)

BTC is trading around $87,698, finding support above the $85,000 level. It has fluctuated between $85,272 and $89,206 in the last 24 hours, indicating a battle between bulls and bears. The immediate resistance to watch is $90,000. A decisive break above this could signal a stronger recovery. On the downside, $85,000 is the crucial support that must hold to prevent further declines.

On November 25th, Bitcoin exchange-traded funds (ETFs) registered an inflow of $45.7 million, with Fidelity's FBTC saw an inflow of $170.8 million.

ETH (+1.17% | Current Price: $2,957.52)

ETH is trading around $2,957 and is struggling to find clear direction after reclaiming the $2,850 support level. The key psychological resistance is $3,000, with a stronger technical resistance near $3,200. There are nascent signs of recovery in US market sentiment. The Coinbase Premium Index, which had been negative, is improving, suggesting US investors are beginning to price ETH more favorably. Furthermore, US spot Ethereum ETFs recorded $32.5 million in net inflows on Tuesday, marking three consecutive days of positive flows after a prolonged streak of outflows.

On November 25th, ETH ETFs experienced a total net inflow of $32.5 million, with Fidelity's FETH saw an inflow of $47.5 million.

Altcoins

The Fear & Greed Index reading of 15 signals "Extreme Fear," a level that has historically preceded market bottoms. The Altcoin Season Index confirms that capital rotation into smaller assets is not yet occurring, with Bitcoin dominance likely still strong.

Macro Data

The probability of a Federal Reserve rate cut in December has surged to over 80%, providing a significant tailwind for risk assets like crypto. The US Producer Price Index (PPI) for September rose 0.3%, exactly in line with expectations, which calmed markets and contributed to a modest upward move.

On November 25th, the S&P 500 gained 0.91%, standing at 6,765.88 points; the Dow Jones Industrial Average increased 1.43% to 47,112.45 points, and the Nasdaq Composite gained 0.67% to 23,025.59 points. The price of gold is $4,163.69, up 1.67%, at 4:00 UTC, November 26th.

Trending Tokens

IP Story (+22.02%, Circulating Market Cap: $171.17 Million)

IP is trading at $2.99, up approximately 22.02% in the past 24 hours. Story is a Layer 1 (L1) blockchain designed to serve as the foundation for intellectual property (IP) on the internet. It enables creators to register, license, and monetize their IP assets seamlessly. By leveraging blockchain technology, Story provides a transparent and efficient framework for IP attribution, licensing, and commercialization. The Story Foundation has executed 60% of its expanded $100M buyback plan, purchasing ~60M IP tokens since November 15. This program now runs through February 2026, aiming to stabilize prices amid declining on-chain activity (TVL: $45M → $12M since September). Reduced circulating supply (331M IP) and direct market buys create artificial demand. However, long-term sustainability depends on ecosystem growth, as daily active users have dropped 76% since September.

ICNT Impossible Cloud Network (+17.32%, Circulating Market Cap: $39.63 Million)

ICNT is trading at $0.2370, up approximately 17.32% in the past 24 hours. Impossible Cloud Network is building a decentralized cloud infrastructure network focused on AI data centers. Its goal is to offer an alternative to traditional, centralized cloud services by providing high-performance, enterprise-grade infrastructure across major global markets. The recent official launch of the ICNT token is seen as a key milestone for the project, potentially drawing investor attention to its future potential. ICNT’s price ($0.237) surged above its 7-day SMA ($0.204) and 30-day EMA ($0.232), with RSI-7 at 66.14 nearing overbought territory. The MACD histogram (-0.0017) shows slowing bearish momentum. Traders likely interpreted the break above moving averages as a bullish signal, compounded by RSI strength. The Fibonacci retracement level at $0.238 (61.8%) now acts as support, with resistance near $0.278 (38.2%).

DEEP DeepBook Protocol (+15.57%, Circulating Market Cap: $217.93 Million)

DEEP is trading at $0.04984, up approximately 15.57% in the past 24 hours. DeepBook is a decentralized central limit order book (CLOB) built on Sui. DeepBook leverages Sui's parallel execution and low transaction fees to bring a highly performant, low-latency exchange on chain. DEEP’s price crossed above its 7-day SMA ($0.044) and EMA ($0.046), while the MACD histogram turned positive (+0.00011853) for the first time in weeks. The RSI-7 (45.19) also rebounded from oversold territory. These indicators suggest short-term bullish momentum, likely attracting traders anticipating a trend reversal after a 44% monthly decline. The pivot point at $0.046 now acts as support, with a break above $0.05 potentially targeting the 23.6% Fibonacci retracement level at $0.078.

Market News

Texas Becomes the First State to Buy Bitcoin

Texas has become the first US state to purchase Bitcoin for its treasury, making a $10 million acquisition as part of a broader strategic initiative. The move comes during a market pullback that some view as a favorable entry point.

This decision positions Texas as an early leader in state-level digital asset adoption and may influence how other states approach cryptocurrency in the future. State officials said Texas executed the transaction through BlackRock’s spot Bitcoin ETF as a regulated and practical entry point. The purchase was presented as a step toward integrating Bitcoin into long-term treasury planning and improving diversification.

Texas Blockchain Council President Lee Bratcher later confirmed the move, noting that treasury teams had monitored market conditions closely and executed the purchase on November 20, when Bitcoin briefly dipped to $87,000. Officials added that direct self-custody remains the goal, but the ETF offers a compliant solution while the state builds its custody framework.

The acquisition marks the beginning of a broader reserve strategy focused on developing infrastructure, oversight, and digital asset controls. This initial allocation will help test workflows, risk management, and governance processes before any future expansion. More broadly, Texas’s move comes as institutional interest in Bitcoin grows, supported by strong ETF inflows and wider participation from major financial firms.

Polymarket Secures CFTC Approval for Regulated U.S. Return

Polymarket received an Amended Order of Designation from the U.S. Commodity Futures Trading Commission (CFTC), clearing the way for the prediction-market platform to operate as a fully regulated U.S. platform.

The approval, granted Monday and announced Tuesday, allows Polymarket to offer intermediated access in the U.S., meaning bettors will be able to participate through futures commission merchants and traditional brokerage channels. The designation brings Polymarket under the full regulatory framework applied to federally supervised exchanges, including enhanced surveillance, market-supervision standards, clearing procedures and Part 16 reporting obligations.

The company said last month that it expected to open its doors in the U.S. in November after access was shut off to the U.S. citizens in 2022.

Paxos Acquires Crypto Wallet Startup Fordefi to Expand Custody Services

Digital asset infrastructure firm Paxos said Tuesday it has acquired Fordefi, a wallet provider startup, a move aimed at strengthening its custody offering as institutional adoption accelerates.

The deal brings Fordefi’s multi-party computation (MPC) wallet architecture, policy controls and decentralized finance (DeFi) integrations under the Paxos umbrella. The companies did not disclose the terms of the deal, but Fortune reported the price tag was more than $100 million.

Paxos serves as a regulated custodian for major financial institutions, including PayPal and Mastercard. The firm issues PayPal's $3.7 billion U.S. dollar stablecoin PYUSD, and is the leading entity of the consortium behind the $975 million USDG stablecoin.

Crypto wallet providers have increasingly been at the forefront of acquisitions as financial firms look to expand digital services. They are a crucial piece of infrastructure to hold, manage and transfer blockchain-based assets including crypto, stablecoins and tokenized assets. For example, fintech giant Stripe acquired wallet provider Privy, while Ripple purchased Palisade earlier this year.

U.S. PPI Inflation Rises 2.7% YoY, Bitcoin Falls

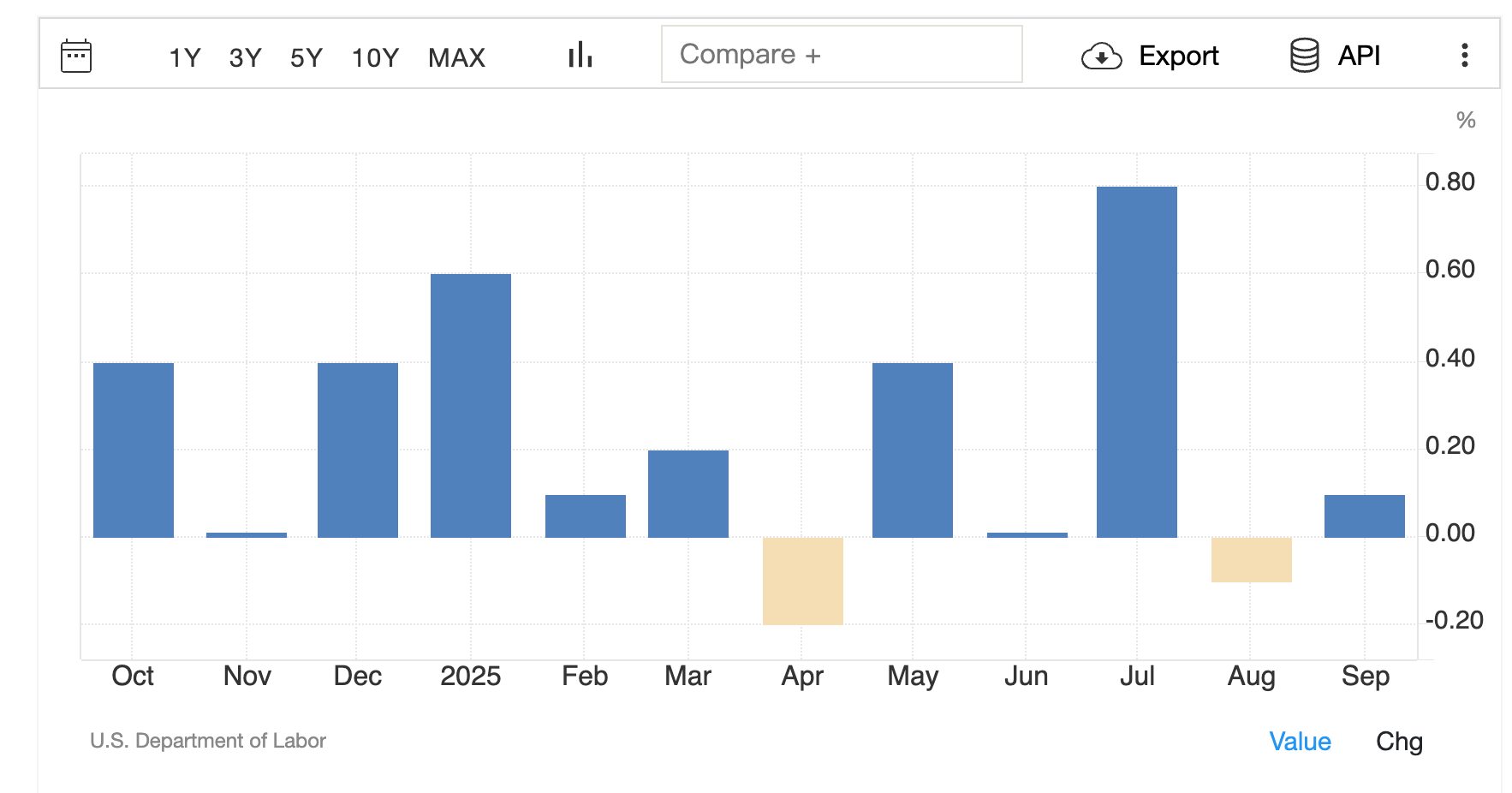

Core PPI YoY. Source: Trading Economics

The U.S. PPI inflation data for September has come in higher than expectations, providing a bearish outlook for Bitcoin. The flagship crypto quickly dropped after the PPI report, which could cast doubt on another rate cut at the December FOMC meeting.Bureau of Labor Statistics data shows that the September PPi inflation rose to 2.7% year-over-year (YoY), which is above expectations of 2.6%. However, the Core PPI came in at 2.6%, lower than expectations of 2.7%.

Core PPI MoM. Source: Trading Economics

Meanwhile, the monthly PPI for September came in at 0.3%, in line with expectations, and Core PPI came in at 0.1%, month-over-month (MoM), below expectations of 0.2%. Notably, the PPI inflation report has sparked a bearish sentiment, with the BTC price dropping following its release. Data shows that Bitcoin has dropped from around $87,800 to below $87,000 following the inflation report. The flagship crypto is now hovering around $87,000 at press time.

The PPI inflation data is significant as it could influence the Fed’s decision at the upcoming December FOMC meeting. The Fed is expected to cut rates, with the odds of a 25-basis-point cut above 80%.

However, some Fed officials remain skeptical of another cut amid rising inflation. The September inflation report paints a mixed picture, as the year-over-year PPI came in above expectations while the Core PPI came in below expectations.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.