The innovative financial products provide traditional investors with regulated exposure to

Solana

's native cryptocurrency (SOL) while integrating staking rewards mechanisms that generate potential passive income. The approval of these funds represents a crucial step toward mainstream financial acceptance of alternative digital assets and demonstrates evolving regulatory comfort with cryptocurrency-based investment vehicles.

The Solana ETF market has rapidly expanded with products from major asset managers including Canary Capital, Fidelity, VanEck, and Bitwise, creating a competitive landscape with varying fee structures, staking approaches, and value propositions. These developments occur against a backdrop of mixed market performance for SOL itself, which has experienced price volatility while simultaneously demonstrating remarkable resilience in investment product flows. This article examines the performance of these new financial instruments, provides a detailed comparison of leading Solana ETFs with particular focus on Canary Funds' offering, analyzes Solana's price trends, and explores implications for the broader cryptocurrency market.

SOLC debut. Source: Canary Capital

What are Solana ETFs?

A Solana

ETF is a fund traded on traditional stock exchanges, with its price linked to the value of Solana (SOL), the native cryptocurrency of the Solana blockchain. Unlike purchasing and holding cryptocurrency directly, investors can buy and sell shares of these ETFs just like stocks, bypassing the complexities of managing private keys or using cryptocurrency exchanges. This offers a convenient, regulated channel for both institutional and retail investors seeking exposure to Solana.

A core feature of current U.S. spot Solana ETFs is the integration of a staking mechanism. Since Solana operates on a

Proof-of-Stake (PoS) consensus model, staking is fundamental to its network operation and security. ETF issuers, like Fidelity, stake a substantial portion of the SOL tokens they custody. This action helps secure the network and generates staking rewards. These rewards are then passed back to the fund, creating an additional income stream for investors. Consequently, a Solana ETF functions not only as a price appreciation vehicle but also as an income-generating asset.

Fidelity is not the sole participant. Prior to the launch of FSOL, the market already included products such as the Bitwise Solana Staking ETF (BSOL), Grayscale Solana Trust ETF (GSOL), and offerings from other asset managers like VanEck and 21Shares. The sequential approval and listing of these products underscore that Solana has emerged as the next major crypto asset, following Bitcoin and Ethereum, to receive implicit regulatory consent for public offering via ETFs in the United States.

How Are Solana ETFs Performing?

Despite facing significant selling pressure across the broader cryptocurrency market in November 2025, with Bitcoin and Ethereum ETFs witnessing substantial outflows, the Solana ETF segment demonstrated remarkable resilience.

Capital Inflows and Market Sentiment

Data indicates that since the initial batch of products went live on October 31, 2025, U.S. spot Solana ETFs have recorded net capital inflows for multiple consecutive trading days, accumulating a total net inflow of $421 million. This steady influx starkly contrasts with the combined outflow of over $3.25 billion experienced by Bitcoin and Ethereum ETFs over the past five trading days. This divergent trend suggests that institutional capital is being strategically directed toward Solana through regulated channels.

Specific Product Performance

Among all Solana ETFs, the Bitwise BSOL fund has shown the most prominent performance. Its Assets Under Management (AUM) grew from an initial seed capital of $222.9 million to $388.1 million, indicating robust market demand. In comparison, Grayscale's GSOL recorded only $4 million in inflows on its first trading day, highlighting distinct investor preferences among the available products. These differences are likely influenced by factors such as fund fee structures, staking strategies, and the brand reputation of the issuers.

How Does the Fidelity Solana ETF Compare to Other SOL ETFs?

The arrival of Fidelity's FSOL introduces a formidable new competitor with a powerful brand and extensive distribution network to the Solana ETF market. To understand its positioning, we compare it across several key dimensions against its main rivals.

Table: Comparison of Major Solana ETF Offerings

| ETF Ticker |

Issuer |

Management Fee |

Staking Partner |

Key Differentiation |

| SOLC |

Canary Capital |

0.50% |

Marinade Select |

Specialized staking infrastructure from Solana's largest staking protocol |

| FSOL |

Fidelity |

0.25% |

Not Specified |

Low-cost option from traditional finance giant with massive distribution |

| VSOL |

VanEck |

0.30% (temporarily waived) |

Not Specified |

Fee waiver promotion for early investors |

| BSOL |

Bitwise |

Not Specified |

Internal Solution |

First-mover advantage with significant asset gathering |

Fee Structure

Fees are a critical consideration for ETF investors. Fidelity FSOL currently offers a highly competitive fee waiver: it is waiving all management and staking fees entirely until May 18, 2026. After this period, the fund will charge a 0.25% annual management fee and a 15% fee on staking rewards.

-

Bitwise BSOL: Charges a 0.20% management fee and a 6% fee on staking rewards (with these fees waived for the first three months on the first $1 billion in assets).

-

Grayscale GSOL: Carries higher fees, with a 0.35% management fee and a 23% fee on staking rewards.

-

21Shares TSOL: Has a management fee of 0.21%, though its staking fee was not explicitly detailed in the search results.

From a long-term cost perspective, Bitwise BSOL appears most competitive post its fee-waiver period, while Fidelity FSOL offers a compelling zero-cost window during its waiver period.

Staking Strategy

The staking strategy and resulting reward rate directly impact potential investor returns.

-

Fidelity FSOL: Plans to stake up to 100% of the fund's assets through custodians like Anchorage Digital Bank, BitGo, and Coinbase (it may retain a portion un-staked for liquidity and operational reasons).

-

Bitwise BSOL: Adopts the most aggressive approach, operating its own validator via partner Helius, staking 100% of assets, and promoting a potential reward rate of up to 7.1%.

-

Grayscale GSOL: Also aims to stake 100% of its holdings.

Fidelity's model of utilizing multiple, established third-party custodians and staking services may prioritize operational security and robustness.

Brand and Scale

Fidelity manages immense assets and is already the sponsor of the second-largest U.S. Bitcoin ETF (FBTC) and the third-largest U.S. Ethereum ETF (FETH). Its vast existing client base and mature distribution channels provide a natural advantage in attracting capital. However, Bitwise, as a specialized crypto asset manager, has established a significant first-mover advantage with its BSOL fund currently commanding the largest market share and inflows.

Solana Price Trends and Market Insights

Solana (SOL) has experienced considerable price volatility recently, influenced by broader market sentiment and developments within its own ecosystem.

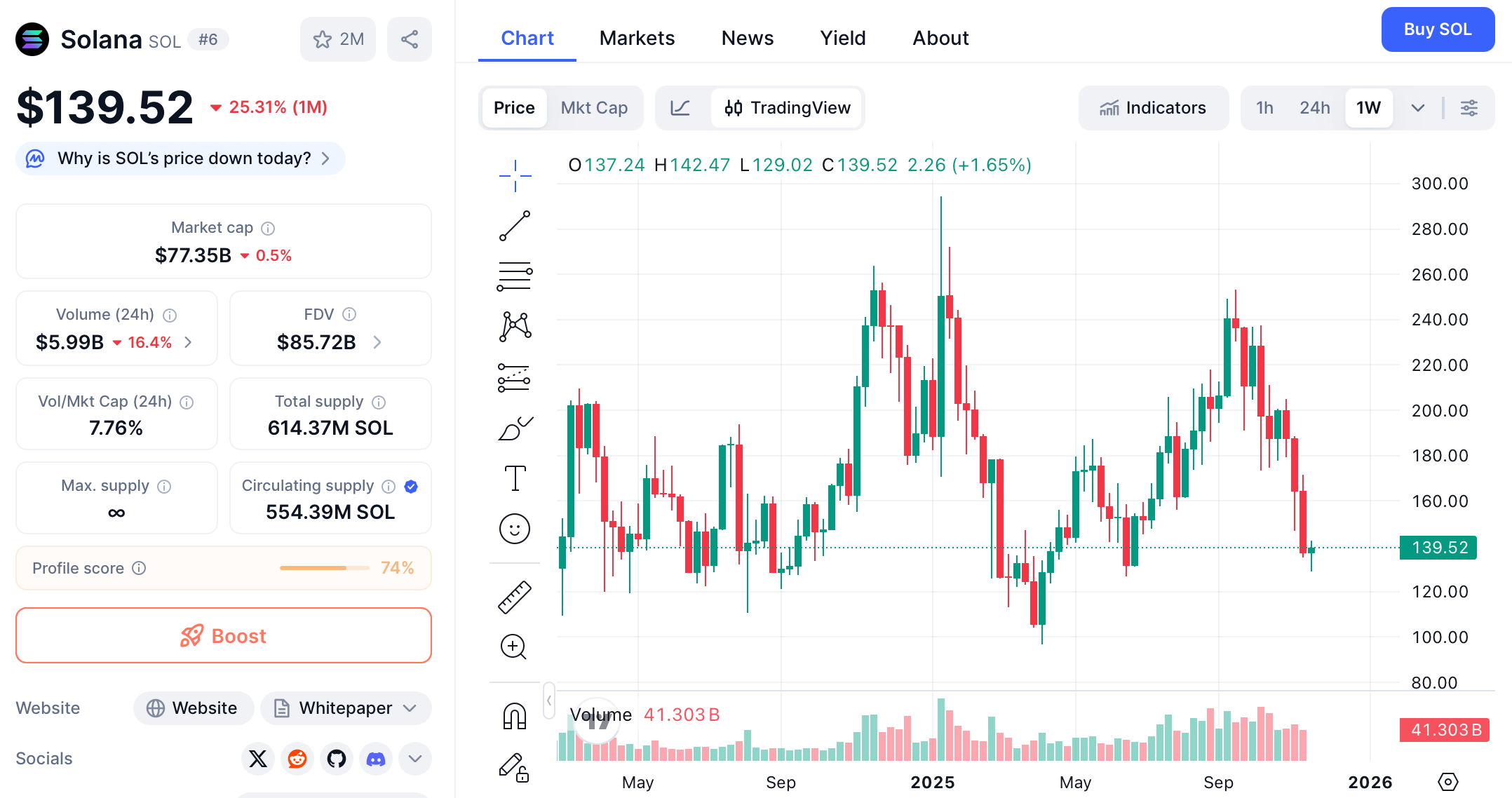

Recent Price Action

SOL price chart. Source: CoinMarketCap

On the day of Fidelity's FSOL launch, Solana's price saw a bounce of approximately 7%, attempting a recovery from a demand zone around $130. However, taking a broader view, SOL's price had declined about 27% over the preceding month, trading around $139. This represented a drop of over 50% from its all-time high of $293 reached in January 2025. This price correction coincided with a global cryptocurrency market capitalization decrease of roughly $700 billion over a 30-day period.

Technical Analysis and Predictions

From a technical analysis perspective, Solana recently broke below a long-term ascending structure and was trading below all major moving averages, which were trending downward. A failed breakout attempt from a recent symmetrical triangle pattern and rejection near the $185 resistance level reinforced a pattern of lower highs. A key near-term resistance level resides near the 20-day Exponential Moving Average (EMA) around $157. A successful close above the 50-day EMA would be the first technical signal of returning buyer strength. Failure to advance from current levels could lead to a retest of the support zone between $128 and $122.

Despite short-term challenges, some analysts maintain a cautiously optimistic outlook for Solana's near-term prospects. Bitget Chief Analyst Ryan Lee predicted that SOL's price could recover to the $156 to $160 range by the end of November, supported by ecosystem development and ETF traction. However, prediction market data from Polymarket appears more conservative, showing only a 1% probability of SOL reaching $300 before the end of November 2025.

Ecosystem Development and Institutional Views

The continued expansion of the Solana ecosystem across Decentralized Finance (DeFi), consumer applications, and Memecoin trading volume forms the core of its long-term value proposition. Its high-speed Proof of History (PoH) consensus mechanism and growing developer community are also key factors attracting institutional interest. Grayscale executive Zach Pandl has previously suggested that Solana ETFs could potentially attract up to $5 billion in investments. Maria Carola, CEO of StealthEx, commented that the entry of firms like Fidelity means "institutional investors are being invited to consider Solana as a standalone macro asset for the first time," representing a significant shift in market perception.

Fidelity Crypto ETF Schedule

Fidelity's foray into the Solana ETF space is not an isolated event but a logical extension of its strategic buildup within the digital asset ecosystem.

Existing Crypto ETF Product Line

Fidelity currently operates three significant cryptocurrency ETF product lines:

-

Fidelity Wise Origin Bitcoin Fund (FBTC): With AUM of $18.3 billion, it is the second-largest Bitcoin ETF in the U.S.

-

Fidelity Ethereum Fund (FETH): With AUM of $2.1 billion, it ranks as the third-largest Ethereum ETF in the U.S.

-

Fidelity Solana Fund (FSOL): The newest addition, completing its coverage of major digital assets.

This product suite clearly demonstrates Fidelity's commitment to providing investors with a comprehensive set of regulated investment tools for major digital assets.

Strategic Positioning and Future Outlook

Fidelity's decision to enter the Solana ETF arena at a time when asset management behemoth BlackRock has yet to participate is seen as a move to capture market leadership. Bloomberg Intelligence Senior ETF Analyst Eric Balchunas noted that in BlackRock's absence, Fidelity is undoubtedly the "largest asset manager in this category." Leveraging its strong brand credibility, extensive network of financial advisors, and direct-to-consumer platform, Fidelity possesses unique advantages to rapidly scale FSOL's assets.

Looking ahead, Fidelity will likely continue expanding its footprint in the digital asset space, potentially exploring ETFs for other sizable crypto assets with clearer regulatory pathways. The mature infrastructure it has built for its Bitcoin, Ethereum, and now Solana products lays a solid foundation for future additions to its crypto ETF lineup.

Conclusion

The launch of the Fidelity Solana ETF (FSOL) represents a pivotal moment in the integration of digital assets into the traditional financial system. It provides investors with a regulated, convenient, and yield-generating instrument for accessing Solana, while significantly bolstering the credibility of Solana as a legitimate asset class. Although Solana's price faces short-term market volatility and macroeconomic headwinds, the robust inflows into the Solana ETF segment, particularly into new products like Fidelity's FSOL, reveal a firm institutional conviction in Solana's long-term fundamentals.

As the Solana ecosystem continues to evolve through technological upgrades and expansion in DeFi and consumer applications, supported by the powerful distribution channels of financial giants like Fidelity, Solana stands at a crucial juncture in its institutional adoption journey. For investors, the current market environment presents a unique opportunity to gain exposure to the narrative of Solana's and the broader blockchain industry's future growth through a structurally sound product like the Fidelity FSOL, even amidst a period of price consolidation.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.