Crypto market operates on a foundational principle of transparency: every transaction is recorded on a public ledger. While this data is inherently accessible, its raw form is often too complex and voluminous to interpret directly. This is where

on-chain analytics

comes into play. By transforming raw blockchain data into actionable insights, on-chain analytics platforms empower traders, investors, and developers to decode market trends, assess risk, and make informed decisions. In 2025, these tools will have evolved from niche resources to essential components of the crypto ecosystem, integrating artificial intelligence, predictive modeling, and cross-chain interoperability to provide a competitive edge. This article explores the leading platforms in this space—including DeFi Llama, CoinGlass, CryptoQuant, and others—and examines their unique roles in shaping modern crypto strategies.

The Evolution and Importance of On-Chain Analytics

On-chain analytics refers to the process of analyzing data from blockchain networks to derive insights into market behavior, network health, and investor sentiment. Unlike traditional financial markets, where data is often opaque or centralized, blockchains like Bitcoin and Ethereum offer a transparent view of transactions, wallet addresses, and smart contract interactions. This transparency enables tools like

Glassnode to track metrics such as active addresses, exchange flows, and holder behavior, providing a macro-level view of market cycles.

The significance of on-chain analytics has grown alongside the crypto market’s complexity. In 2025, these tools will no longer be optional for serious participants. For example, the surge in decentralized finance (DeFi) and institutional involvement has heightened the need for platforms that can monitor liquidity, token distribution, and smart money movements. As noted by industry experts, on-chain metrics like the

Fear & Greed Index or

NUPL (Net Unrealized Profit/Loss) serve as critical indicators of market sentiment, helping users avoid emotional decision-making during volatility.

Leading On-Chain Analytics Platforms: Capabilities and Use Cases

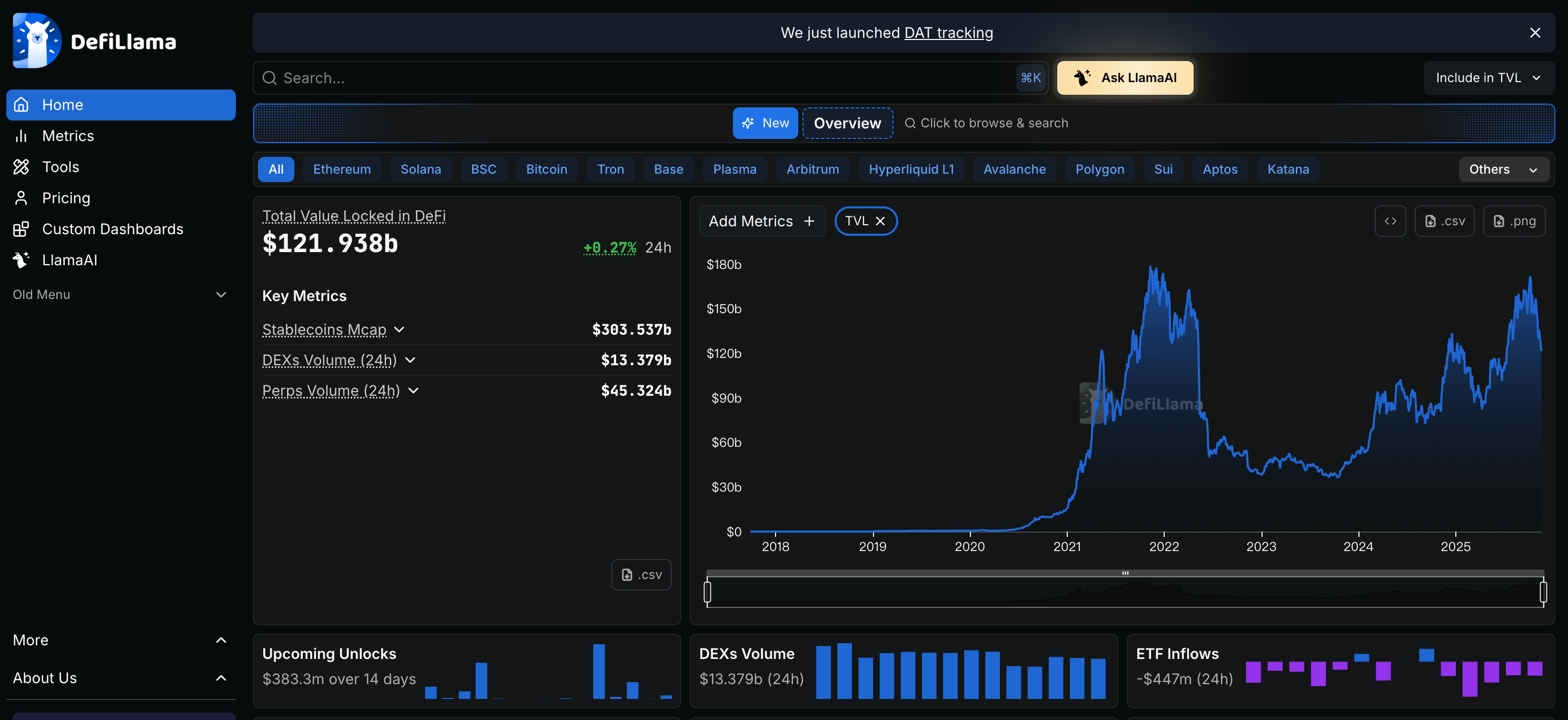

DeFi Llama: The DeFi Ecosystem’s Compass

DeFi Llama specializes in tracking the

Total Value Locked (TVL) across decentralized finance protocols. As the DeFi space expands across multiple blockchains, DeFi Llama provides a comparative view of protocol performance, yield farming opportunities, and chain dominance. Its data is particularly valuable for identifying emerging trends, such as the rise of Layer-2 solutions or the adoption of new DeFi primitives. The platform’s free, user-friendly interface has made it a go-to resource for both retail investors and institutional analysts.

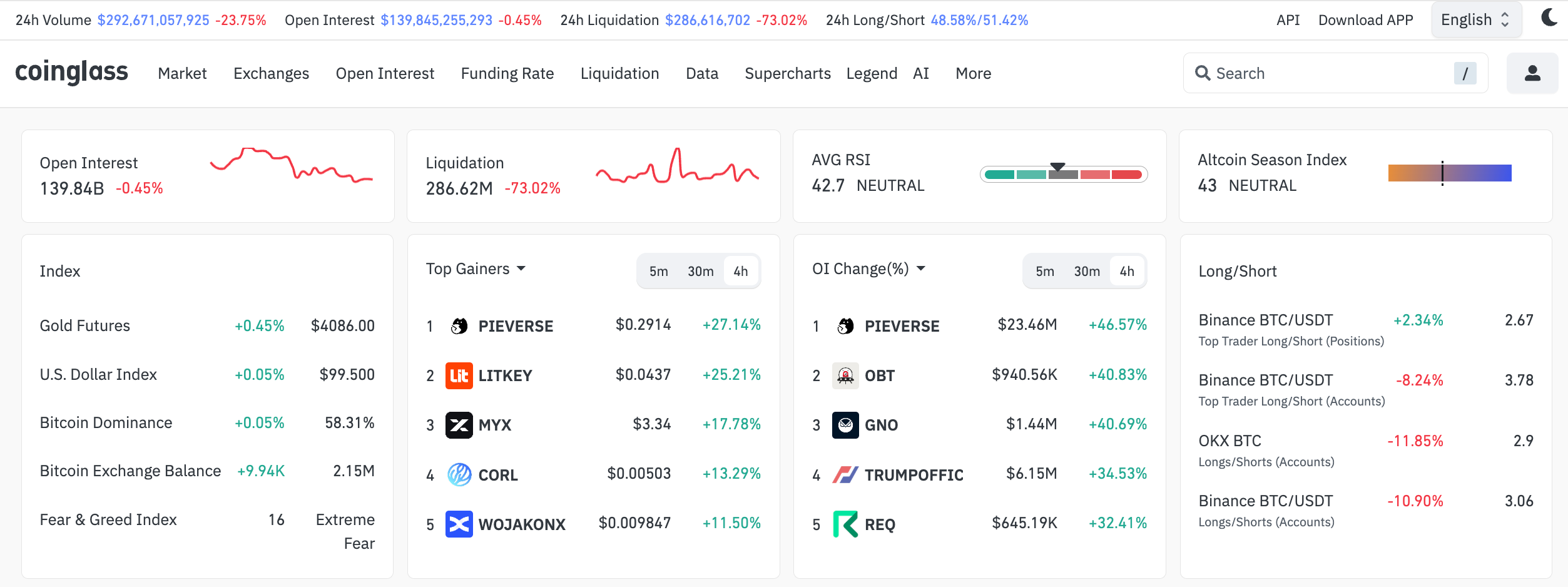

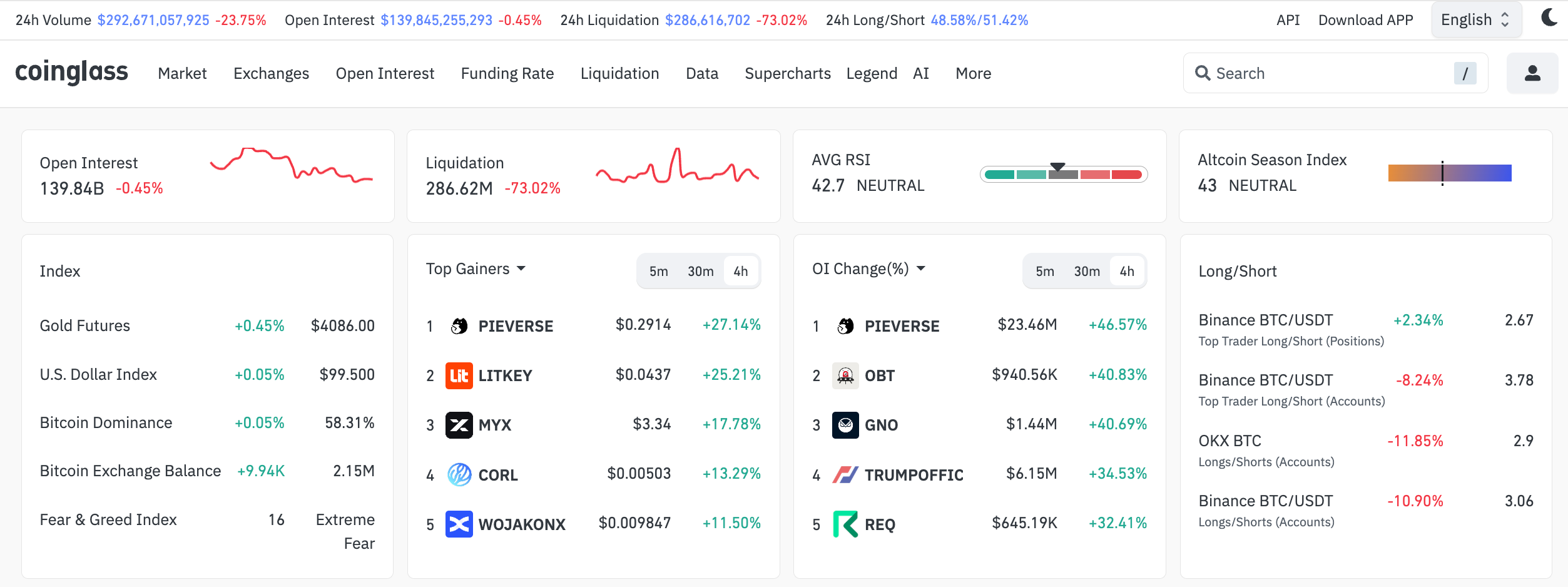

CoinGlass: Mastering Derivatives and Risk Management

CoinGlass focuses on derivatives data, offering real-time insights into liquidation levels, funding rates, and open interest. Its

Liquidation Heatmap tool visualizes potential price levels where cascading liquidations may occur, helping traders manage risk in highly leveraged markets. Additionally, CoinGlass monitors ETF flows and institutional activity, providing a bridge between traditional finance and crypto markets. For traders navigating volatile conditions, these features are indispensable for anticipating market movements.

Dune Analytics: The Power of Community-Driven Insights

Dune Analytics stands out for its flexibility, allowing users to write SQL queries to create custom dashboards. This open-ended approach has fostered a community of developers and analysts who share insights on everything from NFT sales to protocol revenue. For example, Dune dashboards can track real-time metrics like the adoption of a new token standard or the impact of a governance proposal. Its support for multiple blockchains makes it a versatile tool for cross-ecosystem analysis.

Glassnode: Institutional-Grade Market Intelligence

Glassnode offers one of the most comprehensive suites of on-chain metrics, with over 3,500 indicators covering Bitcoin, Ethereum, and other major networks. Its strength lies in contextualizing data for institutional users, providing metrics like

MVRV (Market Value to Realized Value) and

entity-adjusted flows to identify market tops and bottoms. The platform also offers API integration, enabling quantitative firms to incorporate on-chain data into algorithmic strategies.

Nansen: Tracking Smart Money

Nansen distinguishes itself by labeling wallet addresses based on behavior (e.g., "smart money," "whales," or "funds"). This allows users to track the movements of influential investors, providing early signals of market shifts. For instance, if smart money wallets begin accumulating an obscure DeFi token, it could indicate upcoming catalysts. Nansen’s integration of AI and predictive analytics in 2025 has further enhanced its ability to forecast trends.

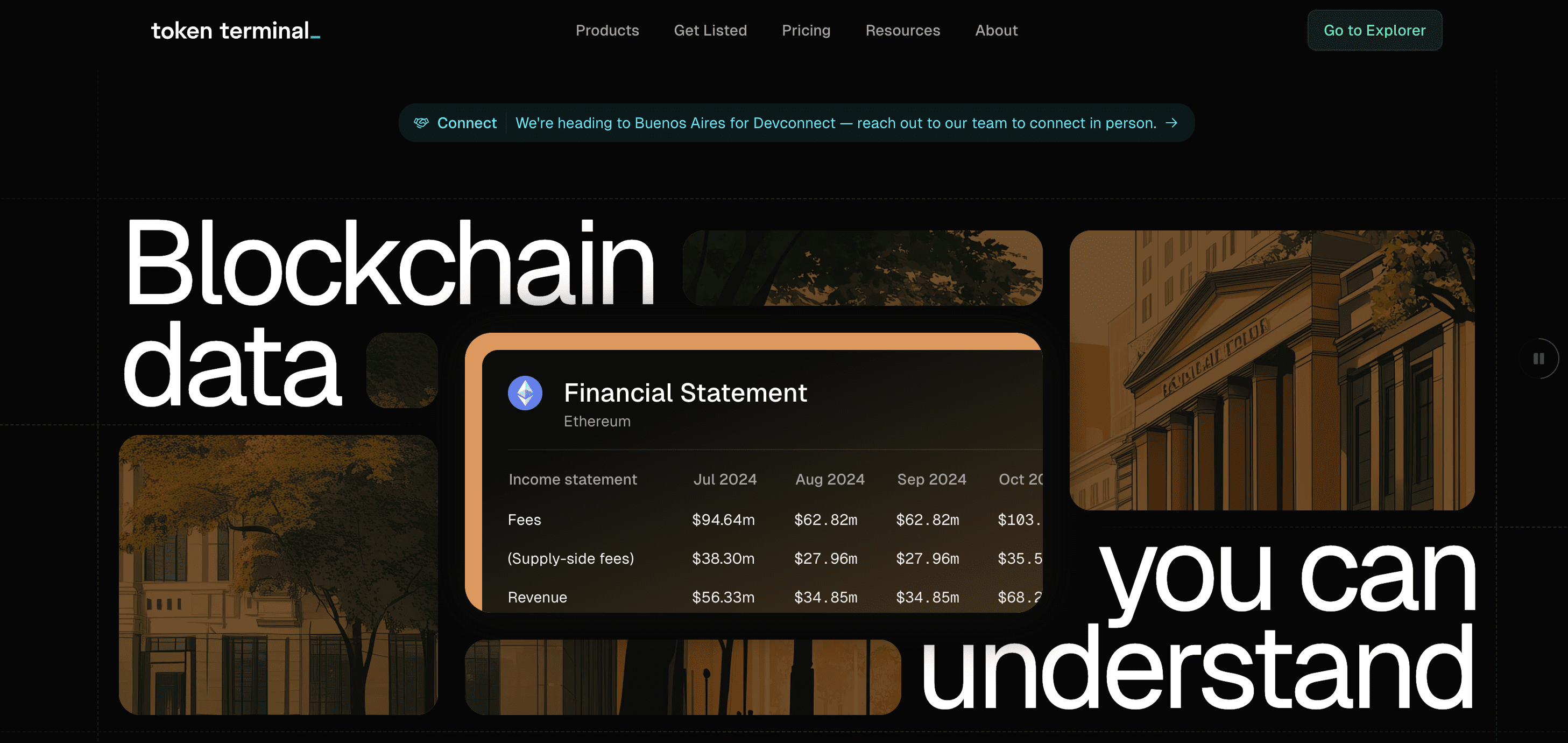

Token Terminal: Financial Reporting for Crypto

Token Terminal applies traditional financial metrics to crypto projects, tracking revenue, fees, and developer activity. By standardizing data across protocols, it enables comparisons similar to those in equity markets. This is particularly useful for investors evaluating long-term viability, as projects with sustainable revenue streams often outperform those reliant on speculation.

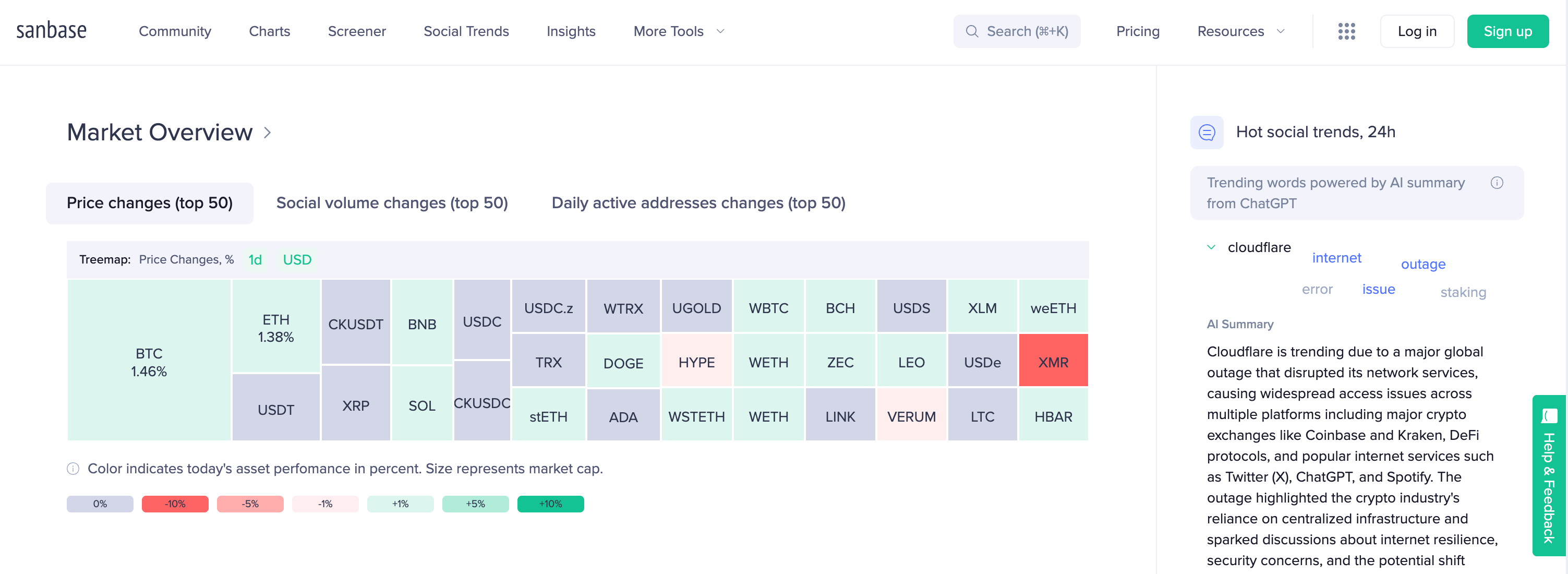

Santiment: Behavioral Analytics and Market Sentiment

Santiment combines on-chain data with social sentiment analysis, using AI to process social media posts, news, and developer activity. Its metrics gauge crowd psychology, helping users identify periods of extreme fear or greed. For example, a spike in social volume around a token, coupled with negative sentiment, may signal a buying opportunity.

Lookonchain and Bubblemaps: Transparency for Token Distribution

Lookonchain and Bubblemaps address the critical issue of token concentration. Lookonchain tracks whale transactions in real-time, alerting users to large deposits or withdrawals. Bubblemaps uses visualization to expose wallet clustering and potential manipulation risks, such as overly concentrated holdings in a few addresses. These tools are vital for assessing the fairness and security of token ecosystems.

The Role of AI and Predictive Analytics in 2025

The latest generation of on-chain tools leverages AI to transform data into predictive insights. Platforms like

Hubble AI and

Nansen now use machine learning models to forecast price volatility, detect emerging trends, and optimize trade timing. For example, AI algorithms can correlate shifts in whale behavior with macroeconomic events, providing traders with actionable alerts. These advancements are democratizing access to institutional-grade strategies, enabling retail users to compete in an increasingly efficient market.

Challenges and Limitations of On-Chain Analytics

Despite their utility, on-chain tools are not infallible. Data interpretation requires context. For instance, exchange inflows could signal either selling pressure or preparation for lending activities. Additionally, privacy-enhancing technologies like zk-SNARKs and mixers are making certain transactions opaque, challenging the completeness of on-chain data. Finally, while platforms like

CoinGlass and

Glassnode offer extensive datasets, their cost can be prohibitive for casual users, creating a gap between professional and retail investors.

The Future of On-Chain Analytics

As blockchain technology evolves, so too will on-chain analytics. Key trends to watch include:

-

Cross-Chain Interoperability: Tools like DeFi Llama are expanding support for Layer-2 networks and modular blockchains, enabling unified views of multi-chain ecosystems.

-

Regulatory Compliance: Platforms may incorporate KYC/AML metrics to help projects adhere to global regulations.

-

Real-Time Automation: AI-driven tools will increasingly automate decision-making, from executing trades to rebalancing portfolios based on the on-chain triggers.

Conclusion:

On-chain analytics has matured from a niche discipline into a cornerstone of crypto market strategy. Platforms like

DeFi Llama,

CoinGlass, and

Glassnode each offer unique lenses for interpreting blockchain data, while AI-powered tools like

Nansen and

Hubble AI are pushing the boundaries of predictive capabilities. For traders and investors, mastering these platforms is no longer optional, which is essential for navigating the complexities of the modern crypto landscape. As the industry continues to evolve, the ability to harness on-chain insights will separate the informed from the speculative, ultimately driving greater transparency and efficiency in digital asset markets.

References:

Coinglass Technology Co., Limited. (n.d.). CoinGlass. Retrieved November 19, 2025, from https://www.coinglass.com/

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.