On November 19th, The cryptocurrency market is experiencing a severe corrective phase with major digital assets plunging to multi-month lows amid intense selling pressure. Meanwhile, U.S. Senate Banking Chair Tim Scott said Tuesday that he aims to have the committee vote on the crypto market structure bill next month. Tether, the world’s largest player in the digital asset sector, has taken a deeper step into crypto-backed credit markets with a new investment in Ledn, one of the most established providers of Bitcoin-backed loans. Bitcoin’s hashprice has fallen to its lowest level in five years, according to Luxor, now sitting at $38.2 PH/s.

Crypto Market Overview

BTC (+1.33% | Current Price: $92,031.54)

Bitcoin has breached the critical $90,000 support level, trading at approximately $92,031 and now sitting approximately 30% below its late-October peak above $126,000.

The breakdown accelerated rapidly after this development, with BTC plunging to as low as $89,471.40 before finding temporary stabilization. The weekly chart shows a dominant downtrend with the latest candle breaking the most recent uptrend structure and penetrating a key support area between $99,000-$101,000. With the current price action, attention now turns to the next strong historical support around $78,000, where Bitcoin may test liquidity and potentially absorb remaining sell orders.

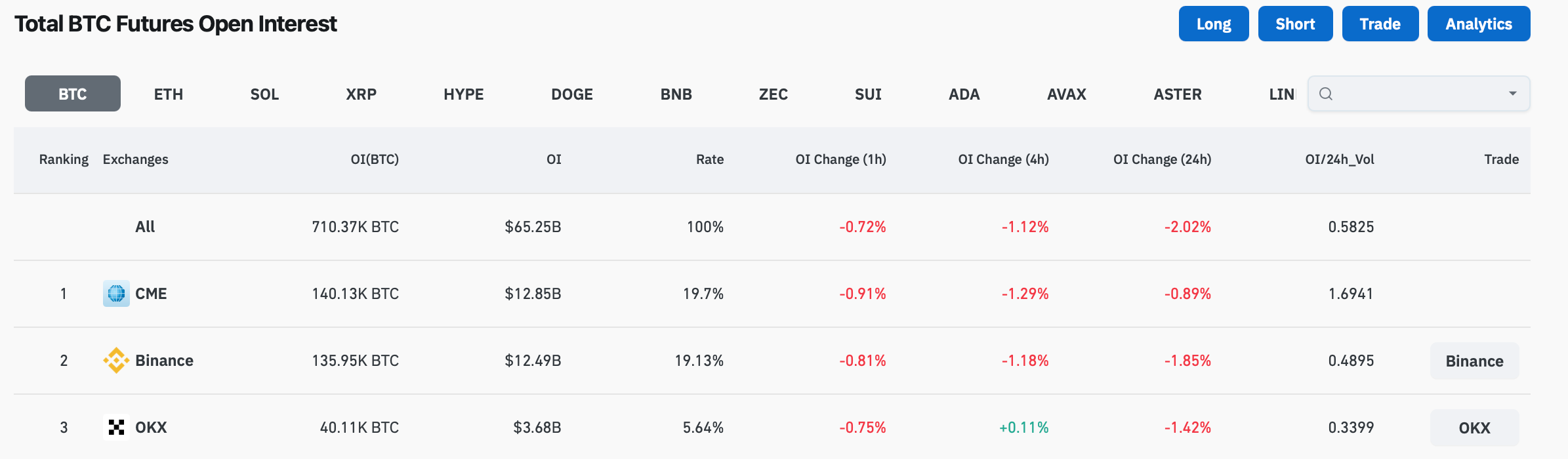

BTC open interest. Source: Coinglass

The derivatives market reflects this pessimism, with Bitcoin's aggregate open interest plunging approximately 30% to $66.54 billion by November 18, indicating a massive exodus of speculative capital and reduced market liquidity. This decline follows a record $19 billion liquidation eventearlier in October that triggered forced selling across crypto derivatives markets. Options traders are positioning for further downside, with over $740 million in short-dated contracts betting on Bitcoin falling below $80,000, reflecting deepening pessimism about near-term prospects.

On November 18th, Bitcoin exchange-traded funds (ETFs) registered an inflow of $156.4 million. Grayscale's BTC saw an inflow of 139.6 million.

ETH (+1.72% | Current Price: $3,069.72)

Ethereum has mirrored Bitcoin's bearish momentum, failing to maintain support above $3,150 and extending its decline dramatically. ETH is now trading below $3,200 and the 100-hourly Simple Moving Average, with a key bearish trend line forming with resistance at $3,150 on the hourly chart. The breakdown gathered momentum after ETH dipped below $3,120 and ultimately collapsed through the critical $3,000 psychological support, reaching a low of $2,955 before attempting a feeble recovery.

The current technical structure suggests Ethereum faces significant headwinds in mounting any sustainable recovery. If another recovery wave emerges, ETH would likely encounter immediate resistance near $3,050, followed by more substantial barriers at $3,150 (coinciding with the bearish trend line) and $3,260 (the 50% Fib retracement level of the recent decline from the $3,562 swing high to the $2,955 low). A clear move above the $3,260 resistance might send the price toward the $3,350 resistance, but this scenario appears unlikely in the near term given current market structure.

On November 18th, ETH ETFs experienced a total net inflow of $90.9 million, including an inflow of $62.4 million from Grayscale's ETH.

Altcoins

Market sentiment indicators have plunged to levels historically associated with potential reversal zones, though timing a bottom remains challenging. The Crypto Fear & Greed Index is 16, solidly in "Extreme Fear" territory and approaching levels that have historically coincided with short-term bottoms, including those seen in July 2021, June 2022, December 2022, August 2024, and March 2025. The Altcoin Season Index collapsed to 29, indicating almost exclusive dominance by Bitcoin and minimal appetite for speculative assets.

MVDASC. Source: MarketVector

The current market downturn has been particularly brutal for alternative cryptocurrencies, with small-cap tokens experiencing devastating losses. A MarketVector Digital Assets 100 Small-Cap Index, which monitors the 50 smallest digital assets in a group of 100, has plunged to its lowest level since 2020, declining approximately 60% this year alone. This dramatic underperformance highlights how altcoins typically bear the brunt of risk-off sentiment in crypto markets, with traders fleeing the most speculative assets during periods of uncertainty and volatility.

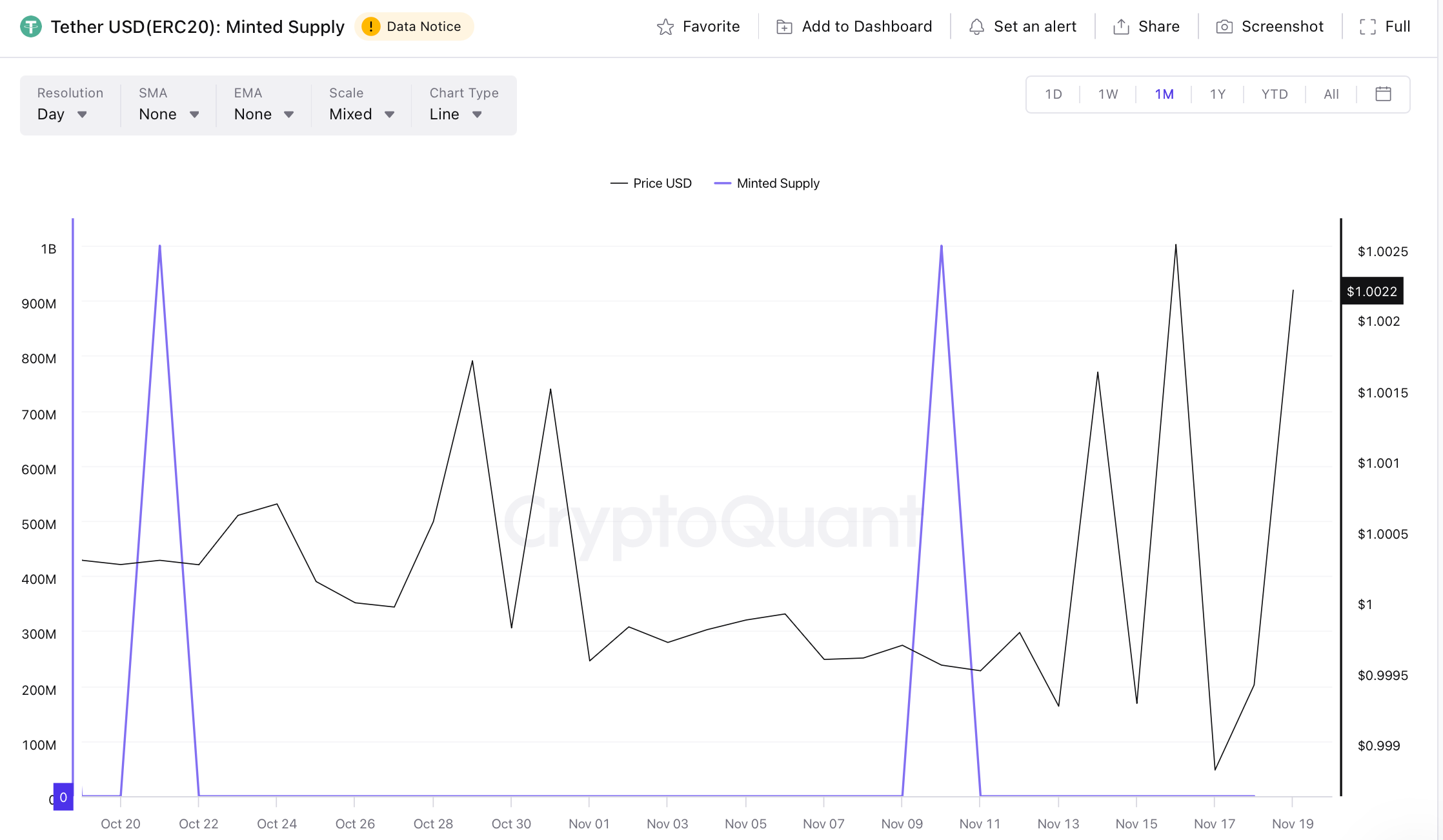

Stablecoin Liquidity

Despite the pervasive bearish sentiment, one potentially encouraging metric has emerged in stablecoin dynamics. According to analytics firm Lookonchain, stablecoin issuance has surged dramatically in recent weeks, led by giants Tether (USDT) and Circle (USDC). Together, these two firms have minted over $14 billion in new stablecoins since the October 10 market crash, with Circle alone minting an additional $750 million in USDC recently.

Macro Data

The cryptocurrency downturn is occurring against a backdrop of shifting expectations for U.S. monetary policy, which has significant implications for global liquidity conditions. Investors have grown increasingly doubtful that the Fed will deliver a rate cut at its December meeting, with expectations plummeting to approximately 40% from 90% in early November. Fed officials, including Chair Jerome Powell, have signaled reluctance to ease policy further, creating uncertainty about the central bank's next move and reducing the appeal of risk assets like cryptocurrencies.

On November 18th, the S&P 500 fell 0.82%, standing at 6,617.37 points; the Dow Jones Industrial Average dropped 1.07% to 46,091.68 points, and the Nasdaq Composite fell 1.21% to 22,432.85 points.

Trending Tokens

STRK Starknet (+23.01%, Circulating Market Cap: $494.90 Million)

STRK is trading at $0.2242, up approximately 23.01% in the past 24 hours. StarkNet is a permissionless decentralized Validity-Rollup (also known as a “ZK-Rollup”). It operates as an L2 network over Ethereum, enabling any dApp to achieve unlimited scale for its computation – without compromising Ethereum’s composability and security, thanks to StarkNet’s reliance on the safest and most scalable cryptographic proof system – STARK. Starknet’s BTCFi initiative enables Bitcoin staking with STRK rewards, attracting $72M in BTC deposits since November 10. This bridges Bitcoin’s liquidity into Starknet’s DeFi ecosystem, creating new demand for STRK as a governance and fee token. The Starknet Foundation’s 100M STRK incentive program ($14M) further fuels participation.

GRASS Grass (+18.34%, Circulating Market Cap: $49.08 Million)

GRASS is trading at $0.3334, up approximately 18.34% in the past 24 hours. Grass is building the first open internet scale web crawl. Today, the network is powered by over 3 million users who are running nodes to scrape petabytes of data for AI models. KuCoin halted GRASS margin trading on Nov 5-6, forcing users to close leveraged positions. While initially bearish, this reduced systemic sell pressure from liquidations. Margin delistings often trigger short-term volatility but can stabilize prices by removing high-risk leverage. GRASS’s 18% rally aligns with reduced forced selling.

SPX SPX6900 (+17.31%, Circulating Market Cap: $56.69 Billion)

SPX is trading at $0.5428, up approximately 17.31% in the past 24 hours. SPX6900 ($SPX) is a multichain meme coin combining satirical commentary on traditional finance with viral internet culture, positioning itself as a community-driven alternative to conventional market benchmarks. SPX was highlighted in a November 18 CCN article as a memecoin with a “triple bullish divergence,” alongside Solana (SOL) and ASTER, amid a rising Altcoin Season Index (29, up 16% monthly). While the index remains below the “Altcoin Season” threshold (75), SPX benefits from rotation into high-beta tokens during market relief. However, Bitcoin dominance (58.3%) and extreme fear (CMC Fear & Greed Index: 16) limit upside.

Market News

US Senate Banking Chair Eyes Vote on Crypto Market Bill Next Month

U.S. Senate Banking Chair Tim Scott said Tuesday that he aims to have the committee vote on the crypto market structure bill next month. The market structure legislation requires approval from both the Senate Banking and Agriculture committees, as it deals with both securities and commodities regulations. Scott said the legislation would protect consumers while helping cement America's dominance as the world's most powerful economy for the next century.

The Senate has been working on its own crypto market structure legislation after the House passed its version — the CLARITY Act — this summer.

The Republican-led Senate Banking Committee seeks to delineate jurisdiction between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), while creating a new term for "ancillary assets" to clarify which cryptocurrencies are not securities. Republicans would need Democratic support to advance the bill.

Amid ongoing bipartisan discussions on the legislation, a proposal from Senate Democrats was leaked. The six-page proposal focused on decentralized finance and would task the Treasury Department and other financial regulators with defining when an entity or person "exercises control or sufficient influence." This draft drew heavy criticism from many in the crypto industry, with some arguing it would essentially ban DeFi.

Following the incident, both the Senate Democrats and Republicans each held meetings with industry leaders. Solana Policy Institute President Kristin Smith, who was present at the Democrat meeting, told The Block that there is a group of Democratic Senators that want to "get this done."

Tether Dives Into Bitcoin-Backed Lending as Market Soars Past $1B in Loans

Tether, the world’s largest player in the digital asset sector, has taken a deeper step into crypto-backed credit markets with a new investment in Ledn, one of the most established providers of Bitcoin-backed loans.

The move comes during a renewed wave of activity across the lending sector, which has already surpassed $1 billion in loan originations this year and is now showing signs of a broader comeback after the severe collapse of 2022–2023. Ledn has originated more than $2.8 billion in Bitcoin-backed loans since launch, cementing its position as a major lender in the crypto credit market.

The company has already issued over $1 billion in 2025 alone, its strongest year on record, and nearly equaled its entire 2024 lending volume in the latest quarter with $392 million in Q3. Its annual recurring revenue now exceeds $100 million, showing growing demand from both retail and institutional borrowers seeking liquidity without selling their Bitcoin.

Tether said the investment reflects its long-term vision of building financial infrastructure that allows users to unlock credit while continuing to hold their digital assets.

Chief Executive Paolo Ardoino said the partnership strengthens the role of digital assets in real-world finance and supports self-custody models that many crypto users rely on.

Ledn’s platform includes custodial safeguards, risk controls, and liquidation systems designed to protect users’ collateral throughout the life of each loan. The investment arrives as the Bitcoin-backed lending market begins to expand again. According to DataIntelo’s outlook, the broader crypto-collateralized credit segment is forecast to grow from $7.8 billion in 2024 to more than $60 billion by 2033. The sector already reached $90 billion in October and is currently at $65.87 billion.

Bitcoin Hashprice Falls to Five-Year Low

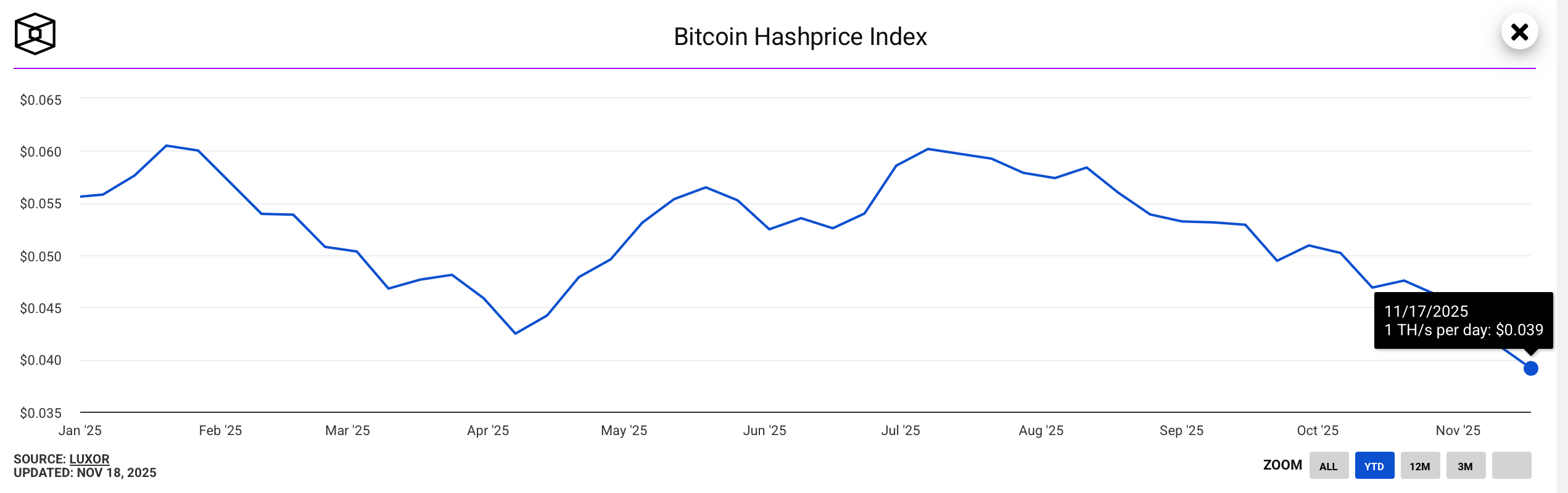

BTC hashprice index. Source: The Block

Bitcoin’s hashprice has fallen to its lowest level in five years, according to Luxor, now sitting at $38.2 PH/s. Hashprice, a term introduced by Luxor, measures the expected daily value of one terahash per second of computing power. The metric reflects how much revenue a miner can expect from a specific amount of hashrate. It can be denominated in any currency or asset, although it is typically shown in USD or BTC.

Hashprice depends on four key variables: network difficulty, the price of bitcoin, the block subsidy, and transaction fees. Hashprice rises with bitcoin’s price and fee volume, and falls as mining difficulty increases.

Bitcoin’s hashrate remains near record levels at more than 1.1 ZH/s on a seven day moving average. Meanwhile, the bitcoin price is at $91,000, down roughly 30% from its October all time high of more than $126,000, and network difficulty remains near all-time highs at 152 trillion (t). Transaction fees remain extremely low, with mempool.space quoting a high priority transaction at 25 cents or 2 sat/vB.

This decline in hashprice is occurring alongside a broader pullback in publicly traded bitcoin mining stocks, even as many in the sector have pivoted business plans away from BTC mining and to AI infrastructure.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.