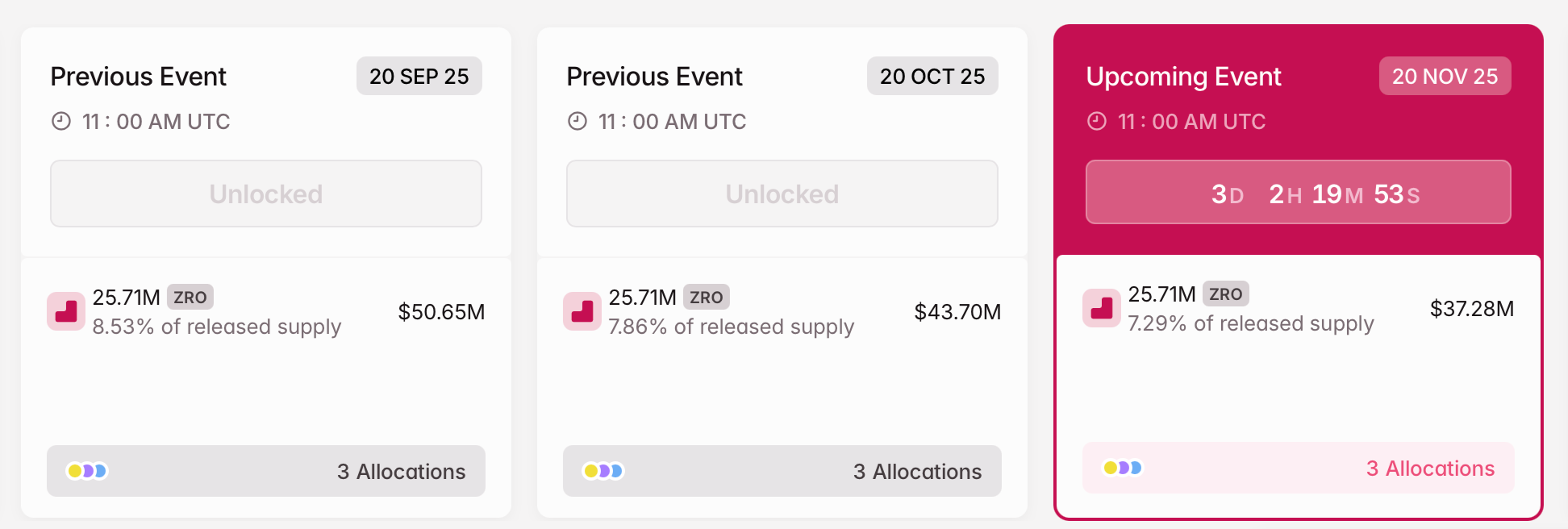

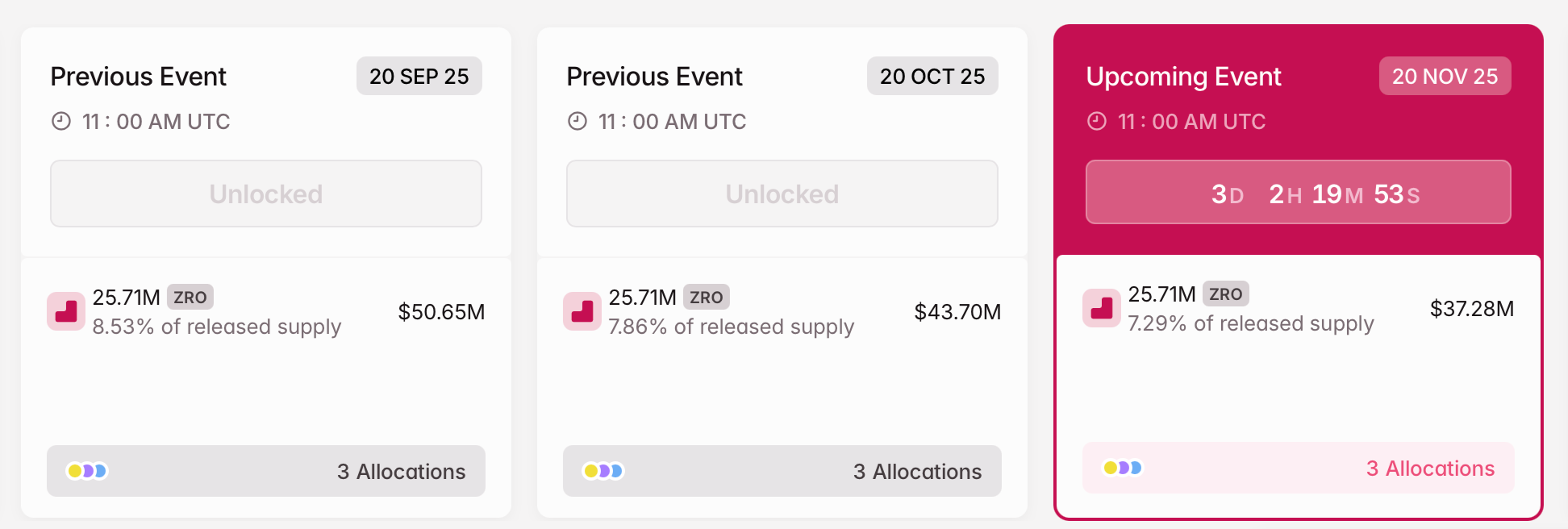

In the coming days, the LayerZero (ZRO) ecosystem is poised for a significant test with the release of 25.71 million ZRO tokens, valued at approximately $38.3 million and representing 7.29% of its circulating supply, scheduled for release on November 20. This single event has captivated market attention, serving as a live case study in how planned supply expansions can ripple through liquidity, volatility, and investor sentiment. The phenomenon of token unlocks is far from monolithic; its impact varies dramatically based on the token's economic design, the recipients of unlocked assets, and the broader market context. Understanding the mechanics and market psychology behind these events is no longer a niche skill but an essential discipline for anyone involved in crypto markets. This analysis delves into the multifaceted nature of token unlocks, using ZRO's impending release as a central example while exploring historical precedents, strategic frameworks, and the delicate balance between short-term volatility and long-term project development that these events represent.

ZRO token unlocks. Source: Tokenomist.ai

How Does Crypto Locking Work?

Crypto locking, or "token vesting," is a process where a portion of a project's tokens is set aside and made inaccessible for a specific period. This mechanism is crucial for fostering trust and stability within a cryptocurrency project. During the locking period, these tokens cannot be sold or traded, effectively reducing the circulating supply.

The idea behind crypto locking is to align the interests of the project's team, early investors, and the community. By locking tokens, developers and stakeholders show their commitment to the project's long-term success, ensuring that they cannot simply "cash out" and abandon the project. This mechanism can also be used to stabilize the token's value by preventing a sudden influx of tokens into the market, which could otherwise lead to price volatility.

What Are Token Unlocks?

Token unlocks refer to the scheduled release of previously restricted cryptocurrency tokens into the circulating supply, as outlined in a project's initial vesting plan. Unlike mining or staking rewards that introduce new tokens, unlocks typically involve distributing tokens that already exist but have been inaccessible to their holders for a predetermined period. These locked tokens are commonly allocated to core project stakeholders, including team members, early investors, advisors, and ecosystem development funds. The fundamental purpose of implementing lock-up periods is to align incentives among all participants by preventing immediate mass sell-offs that could crash token prices shortly after launch.

This mechanism helps maintain price stability during a project's vulnerable early stages while demonstrating long-term commitment from founders and early backers.

Possible Outcomes of Token Unlocks

Token unlocks can lead to various market outcomes, largely depending on how the market perceives the unlock and the broader economic context. Here’s how token unlocks can influence prices:

Price Decline: If a large volume of tokens is unlocked and released into the market, and holders decide to sell off their tokens, the sudden increase in supply can lead to a decrease in the token's price. This is especially true if the newly unlocked tokens represent a significant percentage of the circulating supply, creating a supply shock.

Price Increase or Stability: In some cases, a token unlock can lead to price stability or even a price increase. If the token unlock is associated with positive news, such as the achievement of significant project milestones or strategic partnerships, the market may react positively, and demand could outpace the new supply. In addition, if the unlocked tokens are expected and already factored into the price (a concept known as being "priced in"), the impact might be neutral, or the price could even rise if the overall market sentiment is bullish.

Understanding these potential outcomes helps investors anticipate market movements and strategize accordingly.

How Token Unlocks Impact Market Liquidity and Volatility

Token unlocks inherently alter market dynamics by introducing new supply into existing circulation, creating potential imbalances between buying and selling pressure. The magnitude of impact largely depends on the unlock size relative to circulating supply, with events exceeding 5% of circulating tokens typically triggering more pronounced price reactions. This relationship between added supply and price pressure follows conventional economic principles when new tokens enter circulation without corresponding demand. Downward price movement often results as recipients seek to liquidate positions. The ZRO unlock event exemplifies this dynamic, with its 7.29% circulation expansion creating conditions ripe for increased volatility as markets absorb the additional tokens.

Market psychology significantly amplifies the mechanical supply impact of token unlocks. As unlock events approach, anticipation alone can drive preemptive selling from nervous investors hoping to front-run expected price declines. This phenomenon creates a self-reinforcing cycle where fear of impending supply overwhelms fundamental valuation metrics. Historical data reveal that tokens typically underperform in the seven days preceding and following major unlock events, suggesting that market anticipation often creates a more significant impact than actual supply expansion. However, countervailing forces can sometimes emerge—if a project demonstrates strong development progress or announces positive news coinciding with the unlock, underlying demand might partially or fully offset selling pressure. The 2025 TRUMP token case exemplifies this counter-narrative, where price surged over 60% following a major unlock due to accompanying announcements about exclusive holder events, demonstrating that fundamental strength can sometimes overcome typical unlock dynamics.

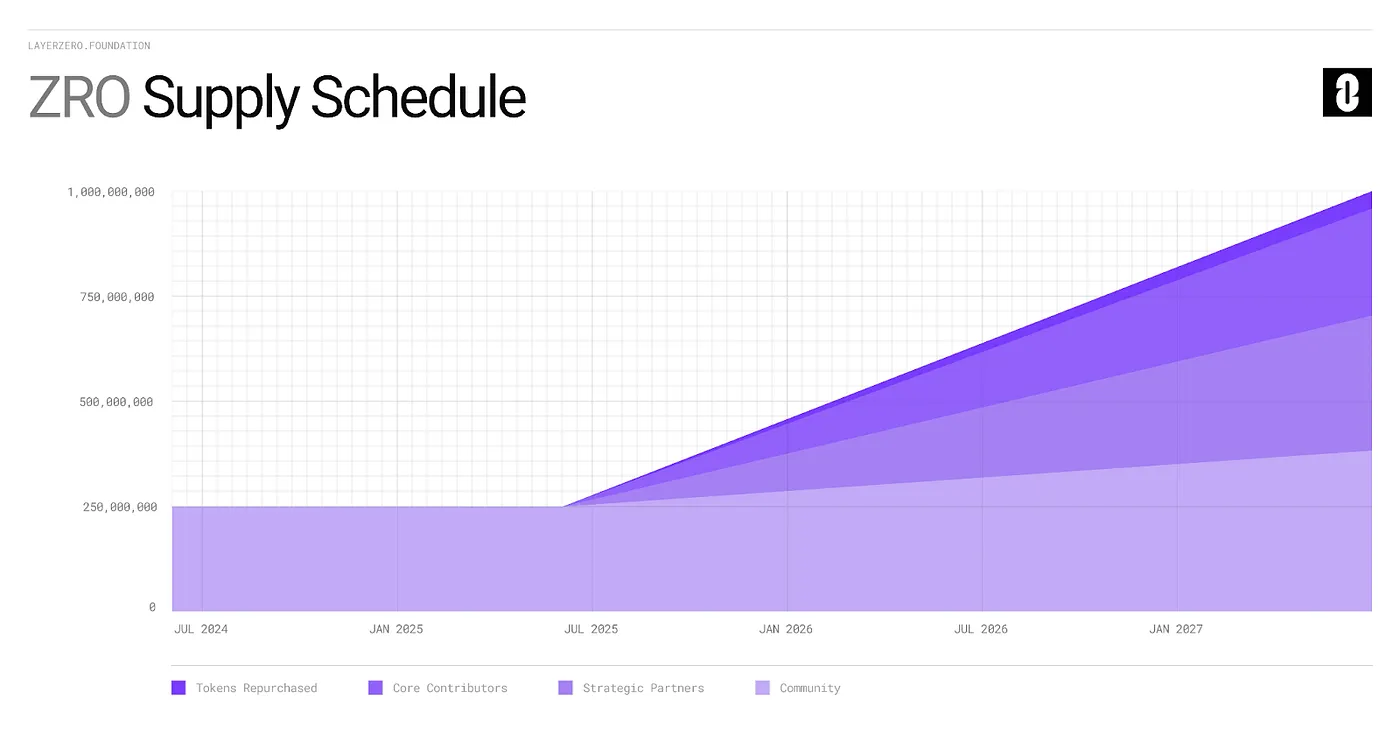

LayerZero (ZRO) Tokenomics and Unlock Schedule

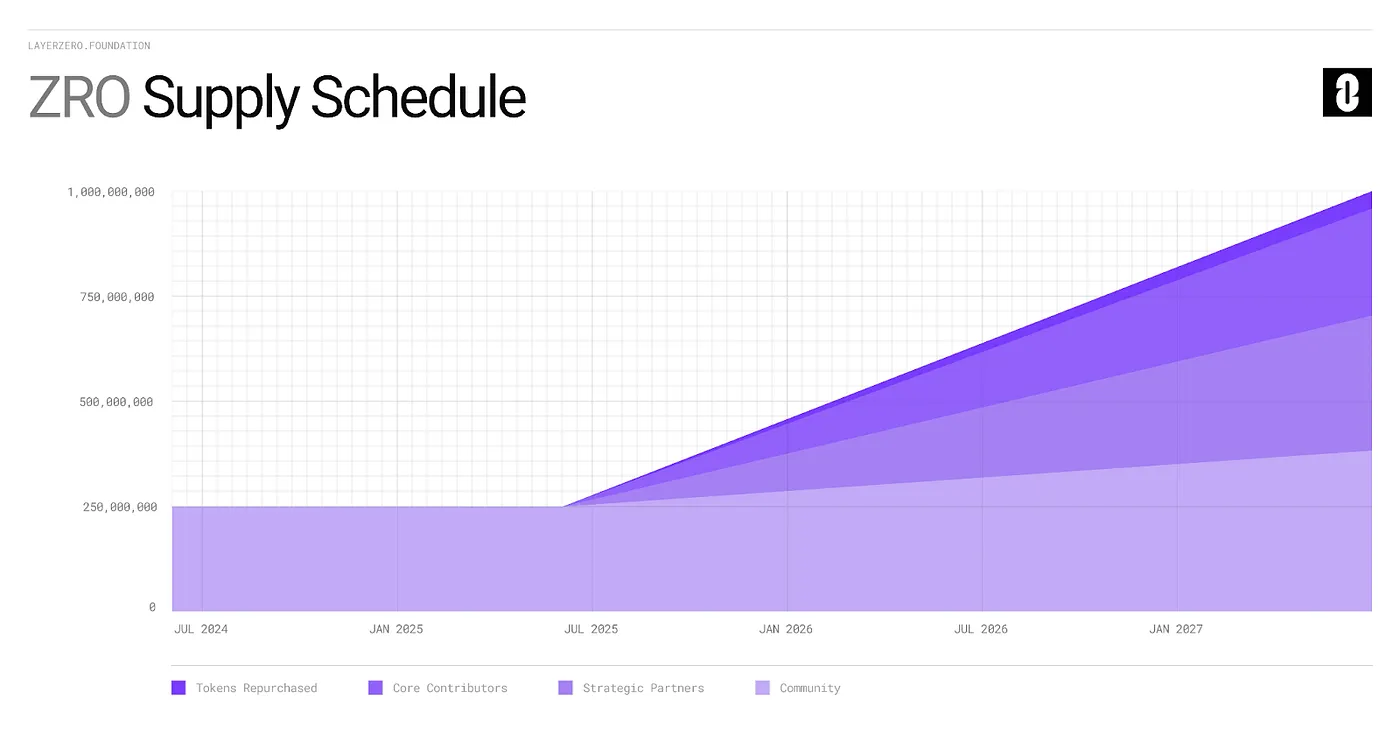

The ZRO supply is fixed at 1 billion tokens.

The allocation breakdown is as follows:

-

38.3% to LayerZero Community, which includes distributions to users, developers, and community members

-

32.2% to Strategic Partners with 3-year unlock, which includes investors and advisors

-

25.5% to Core Contributors with 3-year vesting, which includes current and future team members

-

4.0% Tokens Repurchased, which is pledged to the Community

The market absorption capacity for ZRO's unlock will depend heavily on both internal and external factors. Internally, the distribution breakdown among recipient categories will significantly influence eventual market impact—tokens allocated to venture capital investors historically carry a higher immediate selling probability than those designated for ecosystem development or community rewards. Externally, broader market conditions during the unlock period will play a decisive role in determining price outcomes. If the cryptocurrency sector experiences bullish momentum during the November unlock window, ZRO might demonstrate resilience despite the supply expansion. Conversely, if market sentiment sours, the added selling pressure from unlocked tokens could amplify downward momentum. This delicate interplay between project-specific fundamentals and macro conditions makes the ZRO unlock a critical observation point for understanding how high-profile infrastructure projects navigate scheduled supply expansions amid evolving market conditions.

Historical Trends and Case Studies of Token Unlocks

Historical analysis of token unlock events reveals consistent patterns that can inform current market expectations. Messari's comprehensive study of 619 unlock events identified that those involving circulation increases exceeding 5% typically generate significant adverse price impact, while smaller unlocks often pass with minimal market reaction. The research further established that tokens tend to underperform during the seven-day windows preceding and following unlock events, suggesting that anticipation frequently creates a more pronounced impact than the actual supply expansion. This pattern reflects market efficiency in pricing known future events, though the efficiency remains imperfect enough to create observable price dislocations around major unlock dates.

The

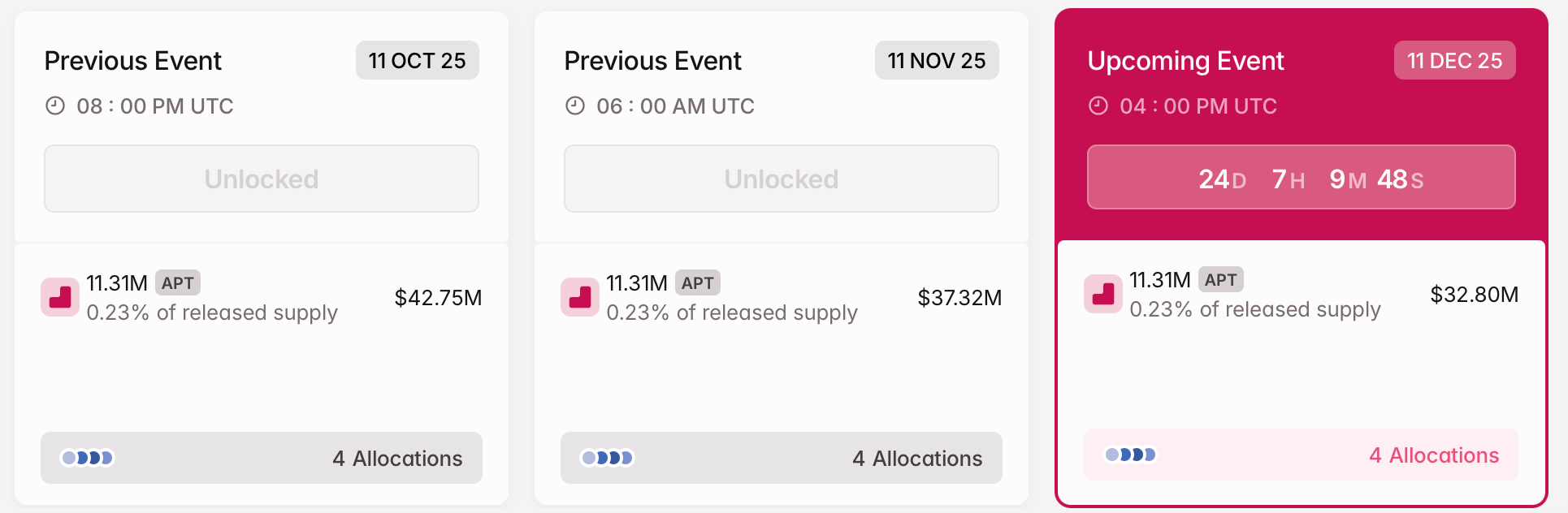

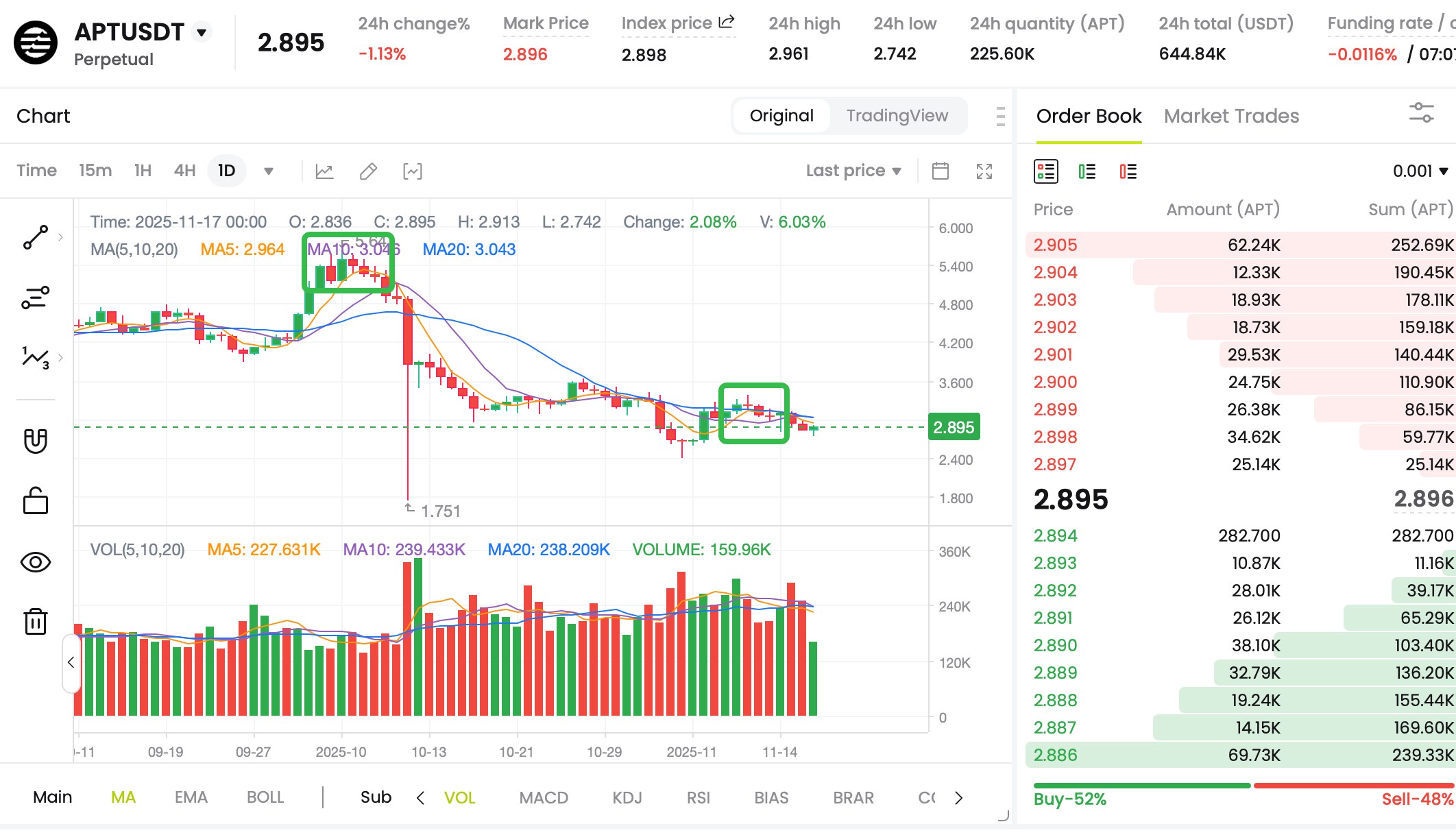

APT (Aptos) token provides an instructive case study in predictable unlock dynamics. Across three consecutive unlock events, APT demonstrated a consistent pattern where prices would establish a local bottom before the event, rally into the unlock date, and subsequently decline post-unlock.

APT unlocks schedule. Source: Tokenomist.ai

APT price chart. Source: CoinCatch

This pattern suggests sophisticated traders might engineer temporary price pumps to create favorable selling conditions before the actual supply expansion hits markets.However, this established pattern broke during APT's third unlock when Bitcoin experienced a significant downturn following ETF-related news, demonstrating that macro cryptocurrency trends can override token-specific technical patterns.

The contrasting

TRUMP token scenario in

April 2025 further complicates the narrative. Despite a massive unlock representing 20% of circulating supply, the token rallied over 60% following announcements about exclusive events for top holders. These case studies collectively demonstrate that while historical patterns provide valuable guidance, outlier outcomes driven by unique project developments remain possible, necessitating comprehensive analysis beyond simple unlock size calculations.

TRUMP price chart. Source: CoinCatch

Linear vs. Concentrated Unlock Schedules: Key Differences

Token projects typically employ two primary approaches to scheduled releases: linear unlocking and concentrated cliff-style distributions. Linear unlock models gradually release tokens over defined periods through small, frequent distributions that create relatively predictable selling pressure. This method provides constant liquidity infusion that markets can efficiently absorb, minimizing dramatic price disruptions but creating persistent overhead resistance. Concentrated unlocks, alternatively, feature extended lock-up periods followed by substantial single-event releases that can dramatically increase circulating supply within short timeframes.

The strategic implications of these divergent approaches extend throughout project ecosystems. Linear models promote price stability through predictable supply expansion but may discourage long-term investors who prefer a clear demarcation between fully locked and fully liquid tokens. Concentrated unlocks maintain cleaner capital structures between distribution events, but risk overwhelming market capacity during major releases. Most projects implement hybrid approaches incorporating both cliff and linear components, initially locking tokens for specified periods before transitioning to gradual releases. The optimal structure depends heavily on project-specific factors, including market capitalization, daily trading volume, and community composition. Projects with robust liquidity and strong retail participation typically weather concentrated unlocks more effectively than those with thin order books and significant venture capital backing. Understanding a project's selected unlock model provides crucial insight into its tokenomic philosophy and risk management priorities when evaluating investment potential around scheduled distribution events.

Market Sentiment and Trading Strategies During Unlock Events

Market sentiment surrounding token unlock events typically follows predictable patterns driven by anticipation psychology and position management necessities. As unlock dates approach, social media sentiment frequently turns negative regardless of project fundamentals, creating potential buying opportunities for contrarian investors. This sentiment deterioration stems from collective anxiety about potential selling pressure from early investors and team members gaining access to liquid tokens. The ZRO unlock has already generated substantial discussion across trading forums, with many participants expressing cautious expectations despite LayerZero's strong technological positioning in the cross-chain interoperability space.

Sophisticated market participants employ several strategic frameworks to navigate and unlock events profitably. Pre-unlock positioning often involves reducing exposure to affected assets while establishing hedges through options or correlated assets. Some traders implement pairs trading strategies, going long on projects with clear unlock timelines while shorting those with approaching distributions. Post-unlock, strategic investors monitor price action for signs of exhaustion selling, potentially entering positions once the supply overhang appears fully absorbed. Risk management remains paramount during these volatile periods—implementing stop-loss orders and position sizing appropriate for expected volatility helps preserve capital during uncertain transitions. The most successful approaches combine technical analysis with fundamental assessment of whether the unlock represents a temporary obstacle or a symptom of deeper structural issues. Projects demonstrating robust development activity, growing user bases, and clear value propositions often recover from initial unlock-related selling, while those with weakening fundamentals may never regain previous valuations following major distribution events.

Long-Term Implications of Unlocks on Project Development

Scheduled token unlocks exert profound influence on project development trajectories beyond immediate market impacts. Well-structured unlock schedules provide ongoing funding for ecosystem development while ensuring team members retain skin in the game through extended vesting periods. This long-term alignment often separates successful projects from those that fade following initial hype—development teams with significant locked token allocations maintain a stronger incentive to build enduring value rather than pursue short-term price pumps. The ZRO unlock will test LayerZero's commitment to this principle, as market observers will closely monitor whether team members retain or quickly liquidate their newly accessible tokens.

The distribution target for unlocked tokens significantly influences their long-term developmental impact. Tokens allocated to ecosystem funds and community incentives typically generate more sustainable value than those distributed to early investors seeking quick returns. Projects that transparently communicate unlock purposes and strategic rationales typically experience smoother market reactions than those treating scheduled releases as routine events. Over multiple unlock cycles, successful projects demonstrate an ability to absorb supply expansions without corresponding price deterioration, signaling healthy demand growth matching scheduled distribution. This absorption capacity represents a crucial maturity milestone, transitioning from token distribution mechanics to fundamental value creation as the primary price driver. The evolving relationship between scheduled unlocks and project development reflects cryptocurrency markets' gradual maturation toward traditional market efficiency while retaining unique characteristics stemming from blockchain-based transparency and programmability.

Conclusion

Token unlock events represent complex market phenomena where scheduled supply expansions intersect with trader psychology and project fundamentals. The upcoming ZRO distribution exemplifies these dynamics, with its 7.29% circulation increase testing market absorption capacity while providing valuable insights into cross-chain infrastructure sentiment. Historical evidence confirms that unlocks exceeding 5% of the circulating supply typically trigger underperformance during the surrounding weeks, though material project developments can sometimes override this pattern. Successful navigation of these events requires understanding differences between linear and concentrated distribution models while recognizing that recipient identity often influences market impact more than unlock size alone.

The long-term implications of token unlocks extend far beyond immediate price volatility, acting as crucial tests of project sustainability and community confidence. Well-structured distribution schedules support developmental roadmaps by ensuring ongoing team commitment and ecosystem funding, while poorly designed models create persistent overhangs that stifle price appreciation. As cryptocurrency markets mature, the evolving relationship between scheduled unlocks and price action will increasingly reflect fundamental value rather than mechanical supply impacts. For ZRO and similar projects facing significant unlocks, transparent communication and demonstrable progress remain the most effective antidotes to negative market reactions, potentially transforming perceived risks into validation of an enduring value proposition.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.