The financial world witnessed a historic milestone on October 28-29, 2025, as Nvidia’s market capitalization surged to nearly $5 trillion, cementing its status as a titan of the artificial intelligence (AI) revolution. This achievement coincides with a notable shift in investor sentiment: Bitcoin, once the undisputed champion of asset returns, now trails major U.S. equities like Nvidia year-to-date. Against this backdrop, a new narrative is emerging: traditional finance and crypto converge through innovations like

tokenized stocks

. This article explores Nvidia’s meteoric rise, its symbiotic relationship with crypto markets, and how tokenization bridges the gap between these two worlds.

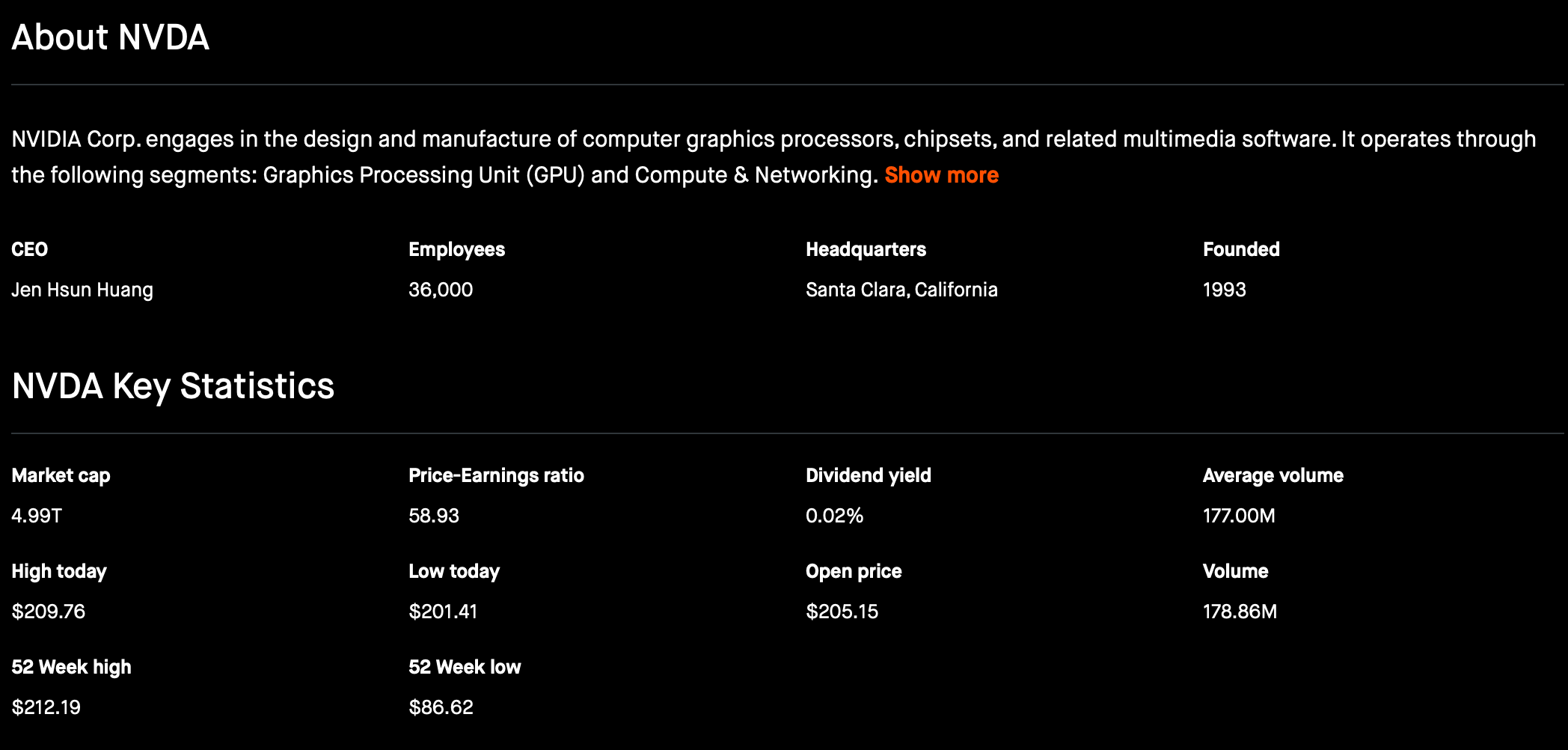

Nvidia Market Cap on October 30th. Source: Robinhood

Nvidia’s Ascent: The $5 Trillion AI Juggernaut

Nvidia’s leap toward a $5 trillion valuation was fueled by unprecedented demand for its AI processors and strategic government partnerships. The company announced $500 billion in new bookings for its AI chips and secured a contract to build seven supercomputers for the U.S. Department of Energy, including a flagship system powered by 100,000 Blackwell AI processors. These developments propelled its stock to a record high of $197.85, marking a 47% year-to-date gain and a 109% surge from its April 2025 low.

The company’s growth reflects the accelerating integration of AI across sectors, from cloud computing to defense. CEO Jensen Huang emphasized the role of supportive U.S. policies and Nvidia’s centrality to global AI development. Notably, Nvidia’s revenue from crypto mining remains a small but strategic segment, positioning it as a "pick-and-shovel" play for crypto exposure without over-reliance on volatile digital assets. This diversification has attracted investors seeking to capitalize on both AI and crypto trends while mitigating risks specific to the cryptocurrency market.

Bitcoin vs. U.S. Equities: A Shifting Dynamic

While Nvidia soared, Bitcoin’s performance lagged behind major U.S. equities in 2025. Despite its reputation as "digital gold" and its 220% annualized returns over the past decade, Bitcoin’s momentum has cooled relative to tech giants. For instance, the S&P 500 and Nasdaq 100 outperformed Bitcoin during key periods, with Nvidia alone contributing 39 points to the Dow Jones Industrial Average on October 28.

This shift underscores a broader trend: institutional investors are increasingly allocating capital to AI-driven equities as a proxy for technological growth. Bitcoin’s volatility, though reduced in 2025, remains a concern for risk-averse institutions. However, Bitcoin’s core value proposition persists—its fixed supply of 21 million coins and decentralized nature make it a hedge against currency debasement, particularly in hyperinflation-prone economies like Turkey and Argentina.

Tokenized Stocks: Bridging TradFi and Crypto

Tokenized stocks have emerged as a critical innovation, blurring the lines between traditional finance (TradFi) and crypto. These digital assets represent ownership in real-world stocks (e.g., Nvidia) and are traded on blockchain networks, enabling 24/7 settlement, fractional ownership, and integration with DeFi protocols. Two dominant models have gained traction:

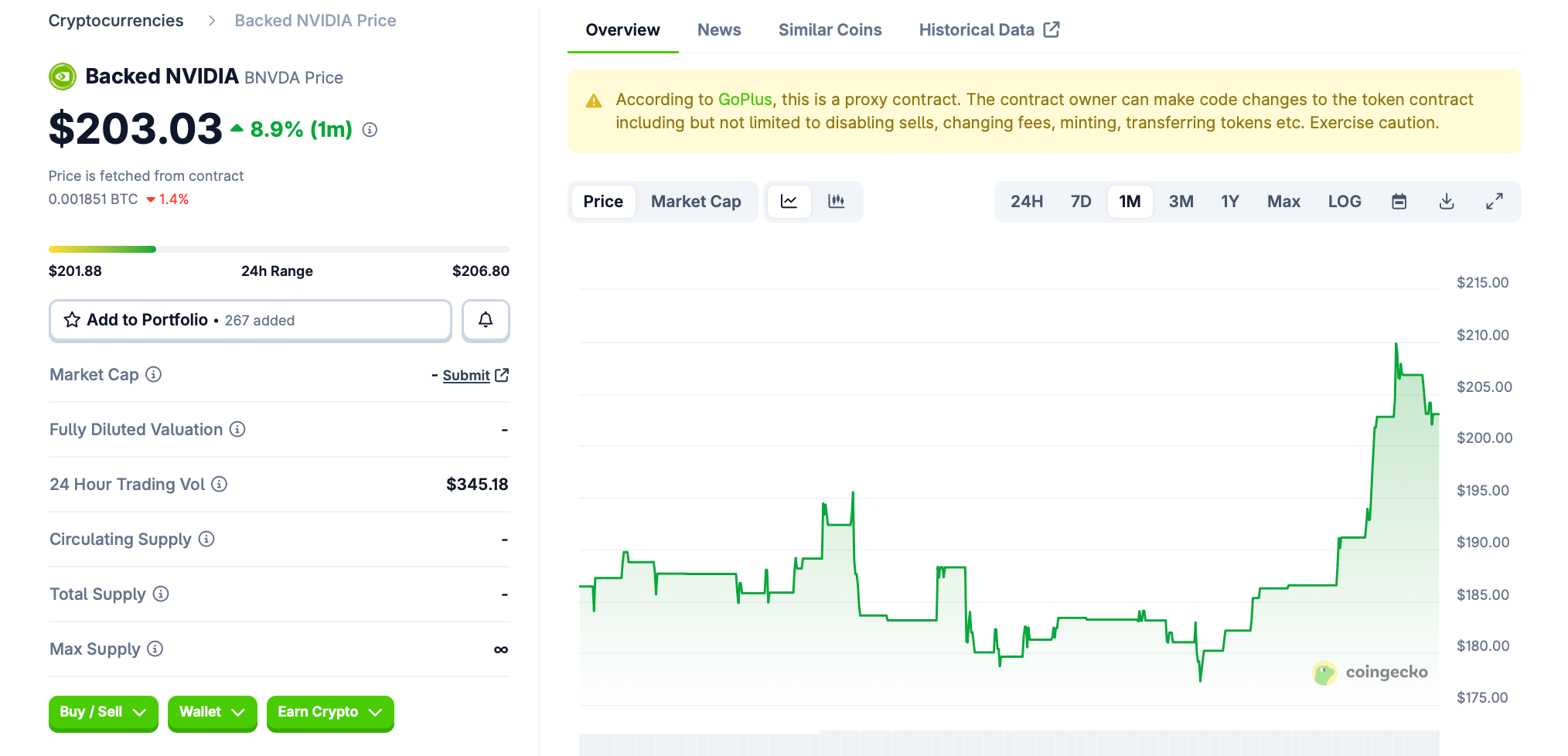

Asset-Backed Tokens: Platforms like Backed Finance and Ondo Finance issue tokens (e.g., bNVDA) that are 1:1 backed by stocks held in regulated custodians. These tokens grant economic exposure to the underlying assets but not voting rights.

bNVDA price chart. Source: CoinGecko

Derivative-Based Tokens: Brokers like Robinhood create MiFID II-compliant derivatives that track stock prices. These are recorded on blockchains (e.g., Arbitrum) but operate within closed ecosystems, limiting their DeFi interoperability.

Tokenization addresses longstanding barriers in global finance. For example, users in emerging markets can now access U.S. equities without navigating complex brokerage requirements. Similarly, developers can build innovative products around tokenized stocks, such as lending protocols that use NVDA tokens as collateral.

Nvidia’s Role in the Crypto Ecosystem

Nvidia’s influence extends beyond traditional markets into the heart of the crypto economy. Its GPUs are critical for mining proof-of-work cryptocurrencies like Bitcoin and supporting AI-driven blockchain projects. In 2025, partnerships with crypto-native firms highlighted this synergy:

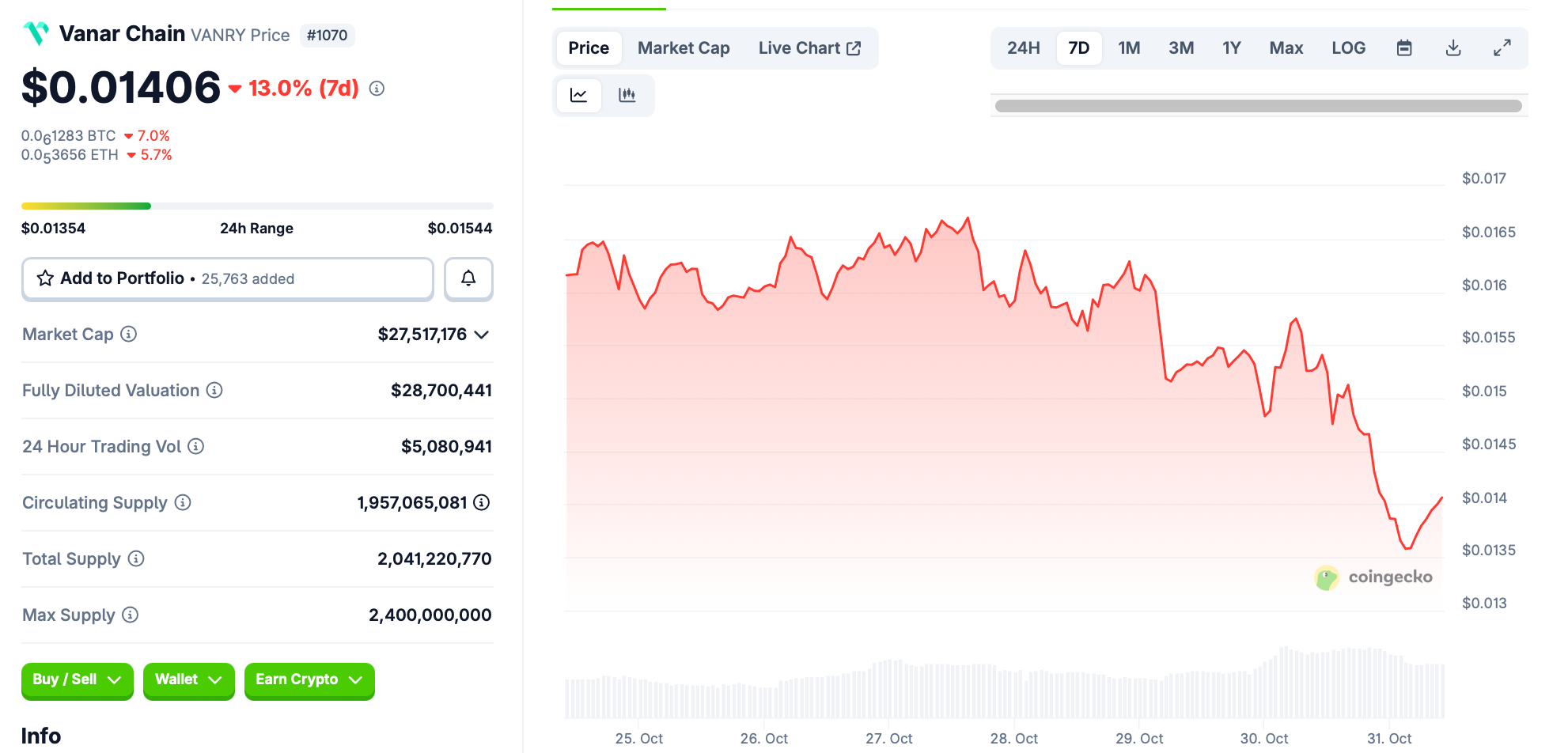

Vanar Chain: Nvidia integrated its CUDA, Tensor, and Omniverse tools with Vanar’s Layer-1 blockchain, empowering developers to create AI-powered dApps. The collaboration triggered a 42% price surge for Vanar’s native token, VANRY.

VANRY price chart. Source: CoinGecko

Nscale: Nvidia invested $683 million in this UK-based AI infrastructure firm, a spinoff of crypto miner Arkon Energy. The initiative aims to expand Britain’s GPU capacity to 60,000 units by 2026, reinforcing Nvidia’s role in both AI and crypto infrastructure.

Nscale Featured Nvidia. Source: NSCALE official sites

These ventures demonstrate Nvidia’s unique position as an enabler of crypto and AI convergence. However, the company’s quantum computing research also poses future challenges to cryptocurrencies—particularly if quantum advances threaten Bitcoin’s cryptographic security.

Market Implications and Future Outlook

The rise of tokenized stocks and AI-centric equities like Nvidia signals a broader transformation in finance. For crypto investors, tokenization offers a gateway to TradFi assets without sacrificing the benefits of blockchain—transparency, efficiency, and programmability. For TradFi participants, it provides exposure to crypto innovations without direct asset ownership.

Regulatory clarity, particularly under the U.S. Crypto Act and Europe’s MiCA framework, will be pivotal for scaling tokenization. Projects like Injective Protocol are already building specialized blockchains for tokenized assets, while Ondo Finance is channeling $250 million into RWA development.

However, challenges remain. Liquidity fragmentation and oracle reliability (e.g., pricing discrepancies during market closures) could hinder adoption. Moreover, centralized issuers like Robinhood prioritize user experience over DeFi composability, limiting the open ecosystem’s growth.

Conclusion

Nvidia’s $5 trillion milestone is more than a stock market story—it is a testament to AI’s transformative power and itsdeepening ties with the crypto industry. As Bitcoin cedes short-term momentum to U.S. equities, tokenized stocks emerge as a unifying force, democratizing access to global markets while leveraging blockchain’s efficiency. For investors, Nvidia represents a dual opportunity: a high-growth AI investment and a strategic gateway to the future of digital assets. The convergence of these trends will likely redefine portfolio strategies in the years ahead, blurring the boundaries between silicon and sovereignty.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.