In the rapidly evolving world of decentralized finance (DeFi),

Wrapped Ether (WETH)

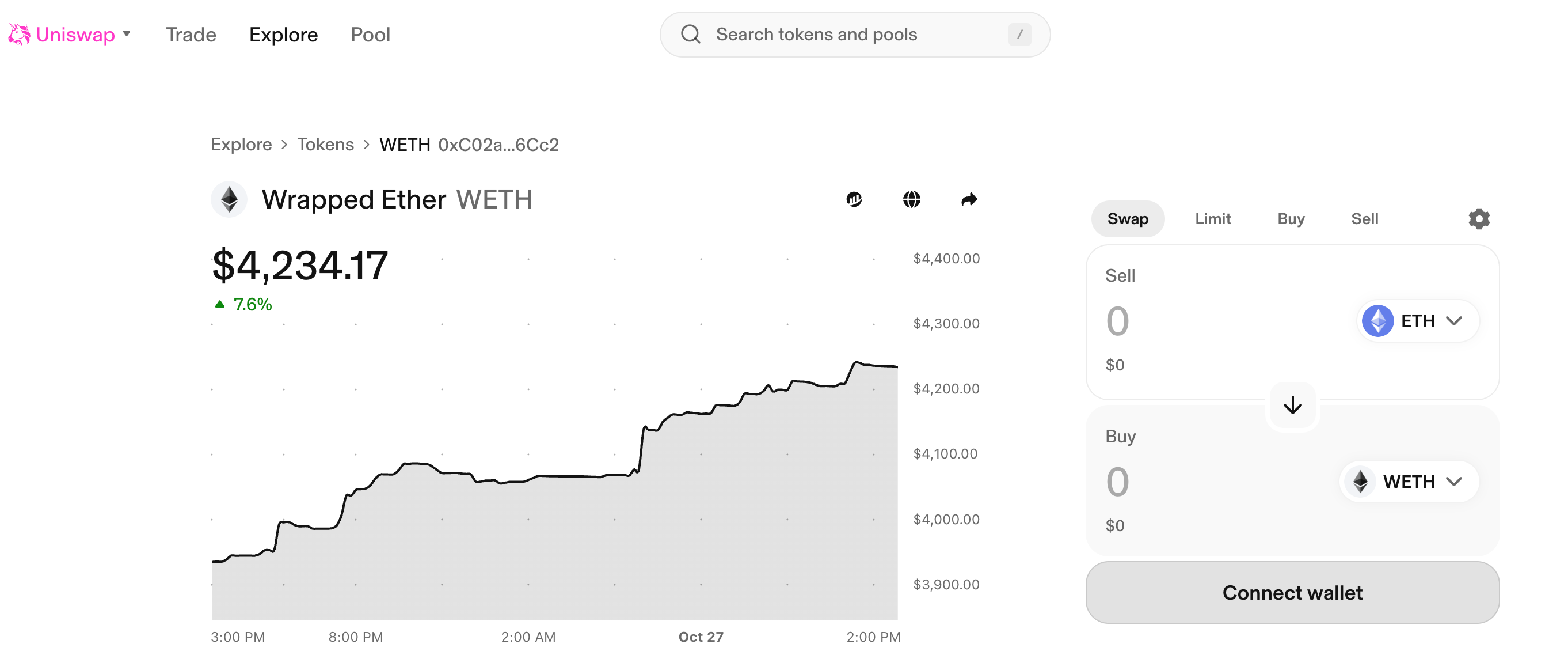

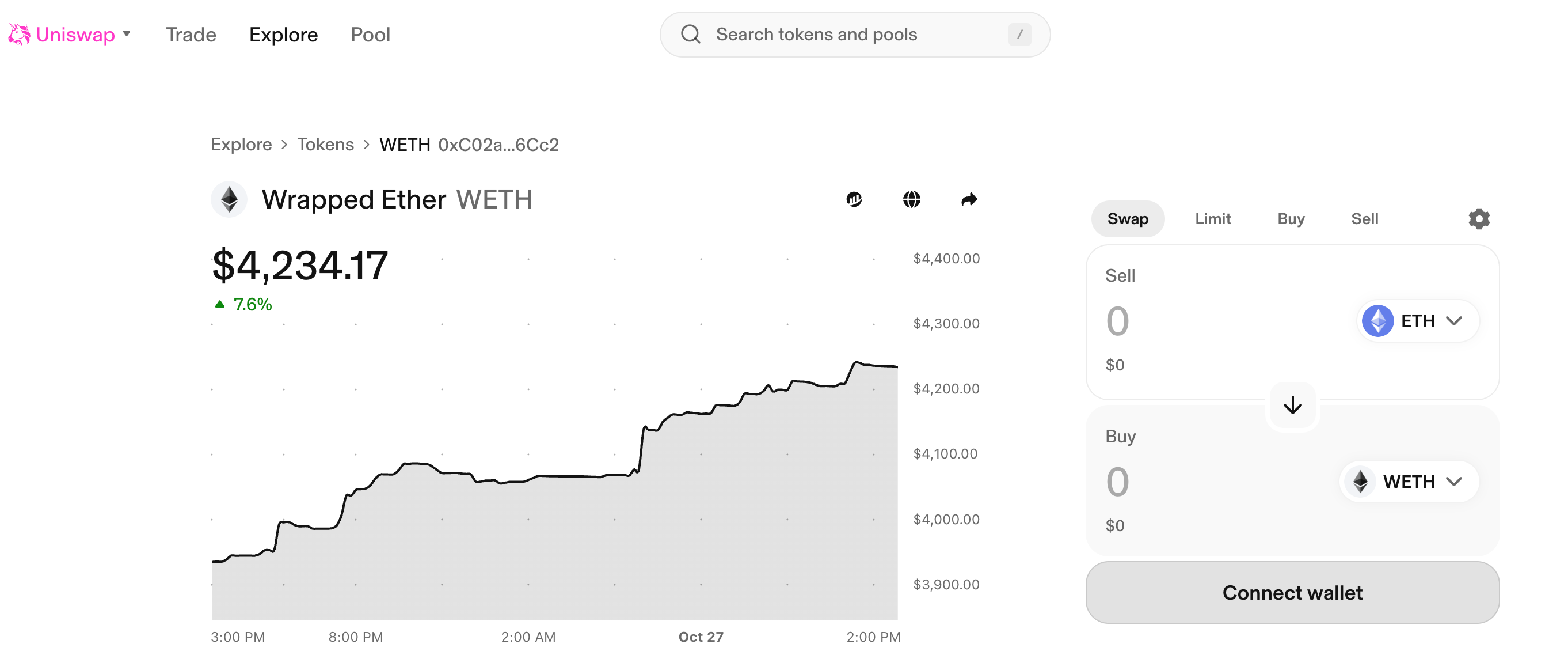

has emerged as a foundational component of the Ethereum ecosystem. As of October 2025, WETH's market capitalization stands at approximately

$13 billion

, with a circulating supply of 3.4 million tokens . Its value mirrors ETH 1:1, trading around $3,838, reflecting its critical role in enabling seamless interoperability across DeFi protocols . Unlike native ETH, which operates as Ethereum's core currency but lacks ERC-20 compatibility, WETH serves as a standardized bridge, empowering users to participate in decentralized exchanges (DEXs), lending platforms, and cross-chain solutions. This article explores WETH's technical underpinnings, its evolving utility in DeFi and beyond, and the emerging trends shaping its future.

What Is WETH and Why Does It Exist?

WETH is an

ERC-20 token that represents Ether in a standardized format, enabling seamless integration with Ethereum-based applications. Unlike native ETH, which does not natively comply with the ERC-20 token standard, WETH ensures compatibility with smart contracts and DeFi protocols. This wrapper functionality addresses a critical gap: while ETH is ideal for transactional purposes like paying gas fees, its non-standardized nature limits its utility in complex decentralized applications.

The process of converting ETH to WETH is straightforward. Users

deposit ETH into an audited smart contract, which mints an equivalent amount of WETH. This conversion is reversible, allowing holders to unwrap WETH back into ETH at any time. By wrapping ETH, users unlock the ability to trade, lend, or stake their assets across the DeFi landscape, transforming static holdings into dynamic, yield-generating resources. The emergence of WETH underscores Ethereum's broader shift toward

interoperability and composability, where assets can fluidly move between protocols without friction.

WETH vs. ETH: Key Differences and Practical Implications

While WETH and ETH share a 1:1 value peg, their functional distinctions shape how investors and developers interact with them. ETH operates as Ethereum's

native currency, governing transactions, gas fees, and network security. In contrast, WETH functions as a

utility token, optimized for DeFi applications requiring ERC-20 compliance. For example, on platforms like Uniswap or Aave, ETH must first be converted to WETH to trade against other tokens or serve as collateral.

This technical divergence carries practical implications. WETH eliminates the need for redundant liquidity pools or complex workarounds when integrating ETH into smart contracts. Its standardization also reduces slippage in trades and simplifies user experiences in decentralized applications (dApps). However, wrapping and unwrapping incur gas fees, making frequent conversions costly during network congestion. Despite this, WETH's versatility has cemented its role as the

backbone of Ethereum's DeFi economy, with millions of users relying on it daily for liquidity provisioning and yield farming.

Expanding Use Cases: DeFi, Cross-Chain Solutions, and Beyond

WETH's utility extends far beyond basic token swaps. In

decentralized exchanges, it serves as a base trading pair for thousands of ERC-20 tokens, streamlining liquidity provision and price discovery. On platforms like Uniswap V3, WETH-dominated pools enable efficient arbitrage and minimize impermanent loss for liquidity providers. Similarly, in lending protocols such as Aave, users collateralize WETH to borrow stablecoins or other assets, leveraging their ETH holdings without selling them.

The rise of

cross-chain interoperability has further amplified WETH's importance. Projects like Hedera Hashgraph have integrated WETH to bridge their ecosystems with Ethereum, allowing users to migrate value across blockchains. This cross-chain functionality positions WETH as a critical vehicle for expanding Ethereum's influence beyond its native environment. Meanwhile, novel derivatives like

privacy-focused cWETH (Confidential Wrapped Ethereum) demonstrate ongoing innovation. Proposed in 2025, cWETH aims to conceal transaction details using zk-SNARKs, addressing privacy concerns without compromising compliance.

WETH also underpins

liquid staking derivatives like wstETH (wrapped stETH), which combine staking rewards with DeFi utility . These layered assets enable users to earn validation yields while deploying capital elsewhere, which is a testament to WETH's role in driving capital efficiency.

Market Dynamics and Emerging Trends

WETH's market activity closely tracks Ethereum's price movements, though its circulation is influenced by broader DeFi trends. As of late October 2025, the token's trading volume and liquidity remain robust, reflecting sustained demand from institutions and retail participants. Notably, the growth of

liquid staking tokens (LSTs) like Lido's stETH has created synergistic opportunities for WETH. When stETH is wrapped as wstETH, it becomes ERC-20 compatible, often trading at a premium due to its accumulated staking rewards.

The emergence of

Wrapped eETH (WEETH) introduces another dimension to the wrapped asset landscape. Launched by

Ether.Fi, WEETH represents liquid-staked ETH and has surged to a market cap exceeding $110 billion by September 2025. Unlike WETH, which merely standardizes ETH, WEETH accrues value through validation rewards, highlighting how wrapping mechanisms are evolving to embed additional functionality.

Regulatory developments also shape WETH's trajectory. The dismissal of SEC lawsuits against major crypto entities in 2025, coupled with proposals like the GENIUS Act, has bolstered investor confidence in wrapped assets . However, risks persist, including potential regulatory scrutiny of cross-chain transfers and privacy-enhancing variants like cWETH.

Risks and Challenges for Users

Despite its widespread adoption, WETH is not without risks.

Smart contract vulnerabilities pose the most significant threat, as flaws in wrapping protocols could lead to fund losses. While reputable projects like WETH undergo rigorous audits, newer or unaudited wrappers may expose users to exploits. Additionally,

liquidity fragmentation across chains can result in slippage during large conversions, particularly on lesser-known platforms.

Market volatility represents another concern. Although WETH is pegged to ETH, external factors like network congestion or DeFi protocol failures can cause temporary de-pegging. For example, during the May 2022 market downturn, leveraged positions collateralized by stETH (a WETH-related asset) triggered cascading liquidations, exacerbating price deviations. Users must also consider

cross-chain bridge risks, as interoperability solutions occasionally suffer from security breaches or operational failures.

To mitigate these challenges, experts recommend using well-established platforms, verifying contract addresses, and monitoring gas fees before wrapping or unwrapping. As the ecosystem matures, insurance protocols and decentralized governance mechanisms are increasingly addressing these vulnerabilities.

Future Outlook and Strategic Importance

WETH's future is intertwined with Ethereum's broader evolution. The upcoming

Pectra upgrade and growing Layer-2 adoption are expected to reduce gas costs and enhance wrapping efficiency, further solidifying WETH's utility. Moreover, the proliferation of

AI-agent economies could fuel demand for automated WETH transactions, as machines require standardized tokens for micropayments and decentralized coordination.

The rise of

institutional DeFi also bodes well for WETH. With traditional finance entities exploring tokenized assets, WETH could serve as a cornerstone for derivatives, ETFs, and structured products. Notably, BlackRock's $110 million ETH acquisition in 2025 signals growing institutional comfort with Ethereum-based assets, potentially accelerating WETH's integration into regulated financial systems .

However, competition from alternative wrapping solutions and central bank digital currencies (CBDCs) may challenge WETH's dominance. Projects like Confidential WETH (cWETH) aim to address privacy limitations, while cross-chain protocols seek to minimize wrapping dependencies entirely. Despite this, WETH's first-mover advantage and deep liquidity suggest it will remain integral to Ethereum's ecosystem for the foreseeable future.

Conclusion

WETH exemplifies the crypto industry's capacity for innovation, transforming a foundational asset like ETH into a versatile tool for DeFi, cross-chain interoperability, and emerging technologies. Its 1:1 peg to ETH ensures stability, while its ERC-20 compliance unlocks endless composability. As Ethereum advances, WETH will continue to bridge traditional finance with decentralized systems, enabling users to maximize the utility of their holdings. For newcomers and veterans alike, understanding WETH is not optional, and it is essential for navigating the future of digital assets.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.