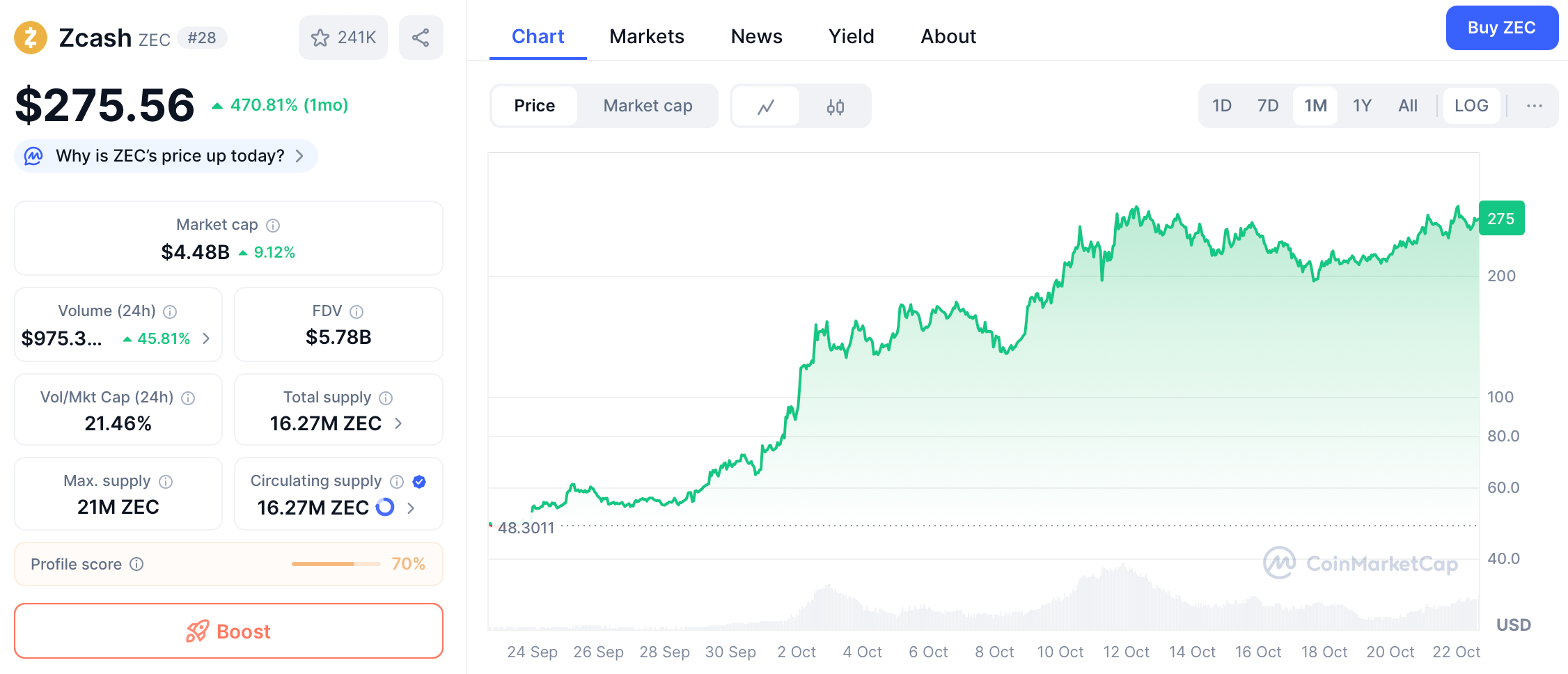

Zcash (ZEC) is a leading privacy-focused cryptocurrency that balances anonymity with regulatory compliance. Since its launch in 2016, Zcash has distinguished itself through advanced cryptographic technology that allows users to control their financial privacy . The cryptocurrency has recently experienced a significant resurgence, with its price tripling within two weeks in Q3 2025 and reaching $270, coupled with substantial growth in its shielded pools. This renewed interest comes at a pivotal time when digital privacy concerns are growing among users worldwide. As Zcash continues to evolve with technological upgrades and expanding ecosystem integration, it positions itself not just as cryptocurrency but as a fundamental tool for preserving financial privacy in the digital age.

What is Zcash?

Zcash is a decentralized cryptocurrency that launched in 2016 as a fork of Bitcoin, with integrated zero-knowledge proof technology to enable selective transaction privacy. Unlike Bitcoin, where all transactions are transparent and traceable on the public blockchain, Zcash offers users the flexibility to choose between transparent transactions (similar to Bitcoin) and shielded transactions that conceal the sender, receiver, and amount. This dual approach allows Zcash to maintain compatibility with regulatory requirements while still offering robust privacy options.

The project was founded by Zooko Wilcox and developed by the Electric Coin Company (ECC), with backing from prominent cryptocurrency investors including Roger Ver, Erik Voorhees, and Barry Silbert. Zcash employs a Proof-of-Work (PoW) consensus mechanism using the Equihash algorithm, which is compatible with Bitcoin's SHA-256 but offers faster transaction times of approximately 2.5 minutes per block compared to Bitcoin's 10 minutes.

The Principles of ZCash

ZCash is built on foundational principles that prioritize fairness, openness, privacy, user autonomy, and sustainable development. Fairness manifests in its accessibility—anyone with internet can participate without gatekeepers, democratizing financial privacy. Openness is evident in its transparent codebase, audited regularly to foster trust and collaboration among developers worldwide.

Privacy forms bedrock, achieved through zero-knowledge proofs like zk-SNARKs, which verify transactions without revealing underlying data. This cryptographic magic allows ZCash to maintain a secure ledger while protecting personal information, a principle increasingly vital as data breaches plague centralized systems. User control is another cornerstone; in ZCash's decentralized setup, individuals own their keys and funds, free from intermediary interference like banks or governments.

Self-funded development ensures longevity, with a portion of mining rewards allocated to the Electric Coin Company and ZCash Foundation for ongoing improvements. This model supports innovation without relying on external venture capital, aligning incentives with the community's long-term health. These principles not only differentiate ZCash from transparent chains but also position it as an ethical alternative to crypto, where privacy is treated as a human right rather than an afterthought. In 2025, amid rising concerns over digital surveillance, these ideals resonate more than ever, driving adoption in regions with strict financial controls.

The Technology Behind Zcash

Zero-Knowledge Proofs (zk-SNARKs)

At the core of Zcash's privacy features is zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge), an advanced cryptographic technology that allows one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. In practical terms, this means Zcash can verify transactions without disclosing the addresses of the sender and receiver or the transaction amount, while still maintaining the integrity of the blockchain through mathematical proof of validity.

Dual Transaction Model

Zcash supports two types of addresses: transparent addresses (t-addresses) that function similarly to Bitcoin addresses, and shielded addresses (z-addresses or u-addresses) that utilize zk-SNARKs to conceal transaction details. This flexible approach allows users to choose the appropriate level of privacy for each transaction based on their specific needs, whether they require transparency for auditing or compliance purposes, or privacy for confidential business transactions or personal financial security.

Recent Technological Upgrades

Zcash recently completed its NU7 quantum upgrade, making it one of the first cryptocurrencies to integrate quantum-resistant cryptography into its core protocol. This upgrade enhances Zcash's security against potential future threats from quantum computing. Additionally, the implementation of Zcash Shielded Assets (ZSAs) now supports private transfers of stablecoins and NFTs, while Memo Bundles expand the capacity for encrypted metadata.

Why Zcash is Gaining Attention

Resurgent Market Performance

Zcash demonstrated impressive price performance in 2025, surging 37.15% in just 24 hours on October 10, 2025, and outperforming the broader cryptocurrency market. This rally is part of a broader trend that has seen ZEC triple in price within two weeks during Q3 2025, peaking at $188. The cryptocurrency has maintained strong support above $250, with some analysts predicting a potential rise to $300 or even $500 if current bullish factors persist.

Growing Institutional Adoption

Institutional interest in Zcash has grown significantly, largely driven by Grayscale's launch of the Zcash Trust (ZCSH) in Q3 2025. This development opened doors for traditional investors to gain exposure to ZEC through regulated financial products. Additionally, partnerships with platforms like Maya Protocol and NEAR have improved ZEC's interoperability, while the launch of Zashi CrossPay in September 2025 enabled shielded payments across more than 20 blockchains.

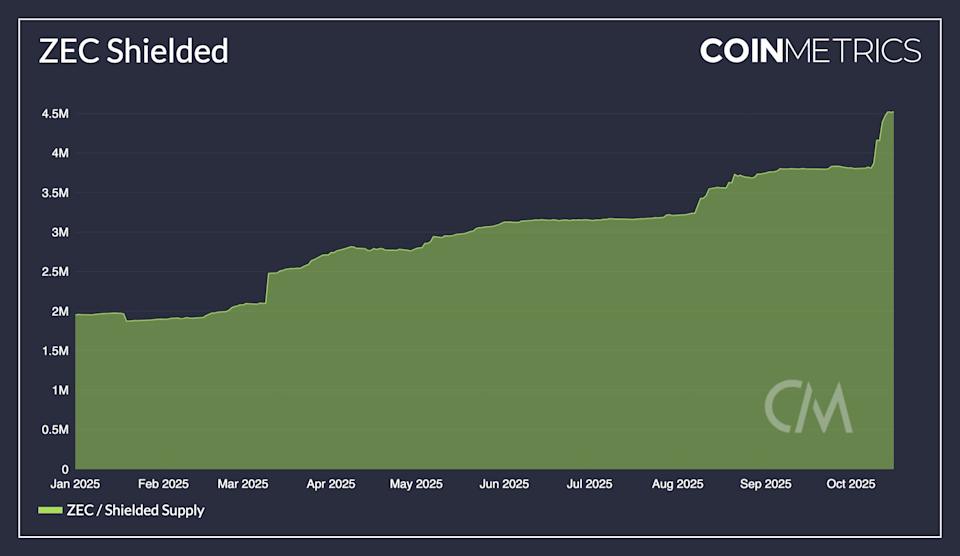

Record-Breaking Shielded Pool Growth

A key indicator of Zcash's renewed relevance is the record growth of its shielded pools. Recently, the network's shielded pool surpassed 4.5 million ZEC, representing approximately 27.5% of the circulating supply. In just three weeks, nearly 1 million ZEC were moved into shielded pools, coinciding with a fivefold price increase. This trend is particularly significant because, as Josh Swihart, CEO of Electric Coin Co., noted: "Those who shield their ZEC don't sell". This behavior reduces available liquid supply, potentially creating upward price pressure as demand increases.

ZEC Token Economics

Fixed Supply and Halving Mechanism

Similar to Bitcoin, Zcash has a fixed maximum supply of 21 million coins, creating natural scarcity within its ecosystem . The cryptocurrency implements a halving mechanism approximately every four years, which systemically reduces mining rewards by 50% . This controlled reduction ensures a predictable emission rate while gradually lowering inflation over time.

The current block reward stands at 1.5625 ZEC, which is added to the blockchain every 75 seconds when a new block is mined . This represents an 87.5% reduction from the initial reward of 12.5 ZEC, significantly decreasing the rate of new ZEC entering circulation .

Allocation Framework

Zcash has established a carefully designed allocation framework to ensure sustainable development and long-term value creation. The upcoming 2025 ZEC token distribution employs a balanced approach where 50% is allocated to the team, 30% to investors, and 20% reserved for community initiatives.

This distribution strategy reflects the evolution of token economic design, gradually moving from traditional time-based unlocking schedules to milestone-based frameworks. In this model, token unlocks are triggered by meaningful project achievements rather than simple calendar dates.

Deflationary Mechanisms

Zcash implements token burning as a sophisticated deflationary approach to cryptocurrency management, effectively reducing circulating supply to maintain scarcity and potentially enhance value . The Network Sustainability Mechanism (NSM) enables this critical function while preserving the 21 million hard cap. By systematically removing tokens from circulation, Zcash creates deliberate scarcity that can positively influence market dynamics.

Use Cases and Features

Privacy-Focused Transactions

The primary use case for ZEC is as a privacy-enhancing digital currency. Users can conduct completely private transactions where the sender, receiver, and amount are cryptographically shielded. This makes ZEC particularly valuable for individuals and organizations that require financial privacy for legitimate reasons, such as protecting trade secrets, safeguarding competitive business information, or simply maintaining personal financial security in an increasingly transparent digital world.

Compliance-Friendly Features

Unlike some privacy-focused cryptocurrencies that enforce anonymity universally, Zcash offers optional privacy features that can actually enhance regulatory compliance. The platform includes "view keys" that allow users to selectively disclose transaction details for auditing or compliance purposes . This compliance-friendly approach has helped Zcash maintain listings on major regulated exchanges like Coinbase, while some other privacy coins have faced delistings.

Cross-Chain interoperability and DeFi Integration

With the introduction of wrapped ZEC (wZEC), Zcash has expanded its utility into the decentralized finance (DeFi) ecosystem. wZEC enables ZEC holders to participate in various DeFi applications on Ethereum and other blockchains while maintaining the option for privacy. The recent Zashi CrossPay launch further enhances this interoperability, enabling shielded payments across more than 20 blockchains and integrating ZEC into DeFi ecosystems like THORSwap for private cross-chain trading.

Everyday Transactions

Zcash offers faster transaction times and lower fees compared to Bitcoin, typically costing just a few cents. These advantages make ZEC suitable for everyday payment scenarios including retail transactions, long-term value storage, and cross-border transfers, particularly when privacy is desirable.

Is ZEC a Good Investment?

Bullish Factors

Several factors suggest potential upside for ZEC as an investment:

Limited Supply Growing Demand: With a fixed supply of 21 million coins and a significant portion locked in shielded pools (over 4.5 million ZEC), the available liquid supply continues to shrink, potentially creating upward price pressure as demand increases.

Institutional Adoption: The creation of Grayscale's Zcash Trust and other institutional products creates new demand channels from traditional investors.

Privacy Technology Leadership: Zcash's advanced zk-SNARKs technology and continuous upgrades (like recent quantum-resistant cryptography) position it as a leader in the privacy cryptocurrency space.

Historical Performance After Halvings: Following the 2020 halving, ZEC saw a 170% price rise, and similar dynamics may unfold after the most recent halving events.

Risks and Challenges

Despite promising developments, ZEC faces significant challenges:

Regulatory Uncertainty: The European Union's Anti-Money Laundering Regulation (AMLR) is set to enforce a full ban on privacy coins by July 2027, which could significantly impact ZEC's utility in key markets.

Competition: While Zcash pioneered zk-SNARKs technology, other privacy-focused cryptocurrencies and privacy solutions on major platforms continue to emerge, increasing competition.

Market Volatility: Like all cryptocurrencies, ZEC is subject to significant price volatility, as evidenced by its dramatic price swings in 2025.

Analysts have mixed outlooks for ZEC, with some setting price targets of $308.46 in the near term, while market predictions suggest ZEC could reach $99.75 to $113.38 by 2030. The Fear & Greed Index reading of 34 (Fear) as of October 2025 suggests potential undervaluation.

Recent News and Developments

Price Surge and Market Performance

Zcash has recently shown a significant price increase, driven by strong buyer dominance in both spot and futures markets. Cumulative Volume Delta data from CryptoQuant shows a substantial increase in buyer dominance over recent days, with retail traders increasing their accumulation and adding to the growing momentum. This convergence of bullish factors has positioned ZEC to potentially challenge the critical $300 resistance level.

Shielded Pool Milestones

October 2025 marked a significant milestone for Zcash, with the network's shielded pool surpassing 4.5 million ZEC. This represents approximately 27.5% of the circulating supply being held in private addresses. An additional 959 ZEC were shielded in a single day, setting a new all-time high for shielded coins. This trend indicates that instead of taking short-term profits during price increases, holders are choosing to shield their coins for long-term privacy, demonstrating conviction rather than speculation.

Regulatory Developments

The EU's proposed privacy coin ban by 2027 continues to cast a shadow over Zcash's long-term utility in European markets. However, Zcash's optional privacy model may offer more regulatory flexibility compared to privacy coins with mandatory anonymity. In contrast to the EU's stance, the United States has taken a more nuanced approach, with FinCEN implementing a $500 transaction reporting rule that adds compliance burdens but doesn't prohibit privacy coins entirely.

Ecosystem Expansion

The Zcash ecosystem continues to expand through various partnerships and technological developments. Integration with NEAR Protocol and the growing availability of Zashi wallet have provided retail traders with wider access to ZEC. Data also indicates significant whale activity, with one large investor swapping up to 50 BTC per day for ZEC coins. These developments, combined with ZEC's positioning as one of the few privacy assets to maintain positive momentum during recent market corrections, highlight its unique position in the cryptocurrency landscape.

Conclusion

Zcash stands at a pivotal moment in its development, balancing its core mission of providing financial privacy with the practical realities of an increasingly regulated global cryptocurrency landscape. Its recent price resurgence and technological advancements demonstrate the continuing relevance of privacy-focused cryptocurrencies in the digital age.

The project's unique value proposition lies in its flexible approach to privacy—offering both transparent and shielded transactions—which may prove crucial for navigating regulatory challenges while still serving users who require financial privacy. With record growth in shielded pools, significant institutional adoption through products like Grayscale's Zcash Trust, and continuous technological upgrades including quantum-resistant cryptography, Zcash has positioned itself as a leader in the privacy coin segment.

However, investors should remain cognizant of the significant regulatory headwinds, particularly the EU's proposed 2027 ban on privacy coins, which could impact ZEC's utility in major markets. The cryptocurrency's future success will likely depend on its ability to balance privacy features with compliance requirements, continue technological innovation, and expand its use cases through DeFi integration and cross-chain interoperability.

For risk-tolerant investors interested in the privacy segment of the cryptocurrency market, ZEC represents a compelling opportunity with strong technological fundamentals and growing adoption. As digital privacy concerns continue to mount in our increasingly surveilled world, Zcash's value proposition as a tool for preserving financial sovereignty may become increasingly relevant to a broader user base.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.