On October 22, the crypto market experienced a volatile correction, with major cryptocurrencies generally under pressure. BTC price shows no change over a day, remaining within its key support range; ETH fell 0.92%, showing a weak trend. In contrast to sentiment, there are positive signs at the capital level. The open interest of Bitcoin futures has rebounded to over $32 billion

since the low on October 11, indicating that traders and funds are gradually returning to the market.

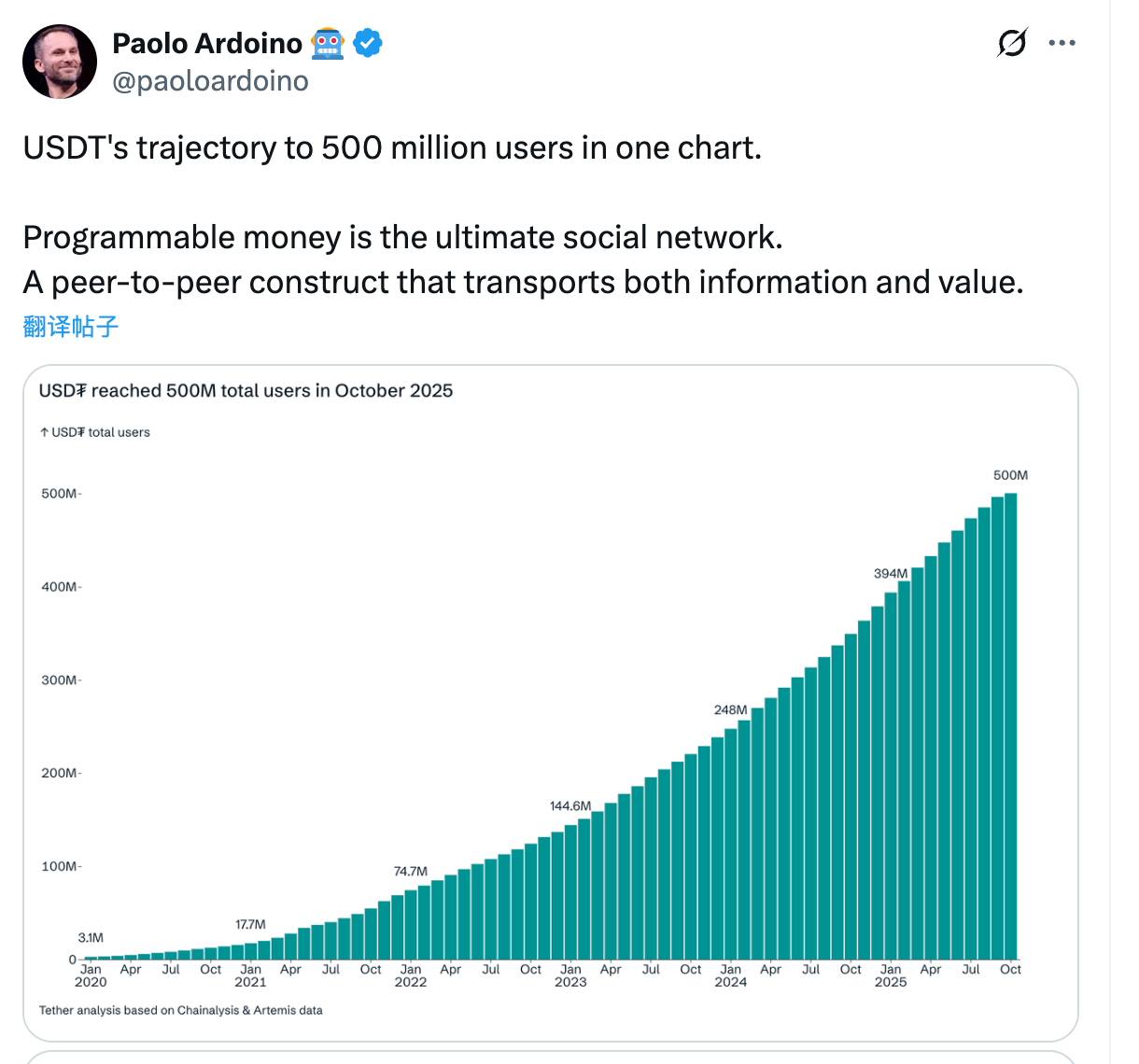

Meanwhile, Tether, the issuer of the world’s largest stablecoin by market capitalization, USDT , announced that it has reached 500 million verified users worldwide. Solana DEX aggregator Jupiter announces the launch of a beta version of its new prediction market. Ark Labs has launched Arkade in public beta — introducing what it describes as Bitcoin's most advanced native Layer 2 since the Lightning Network's debut nearly a decade ago.

Crypto Market Overview

BTC (+0.00% | Current Price: $107,760.13)

Bitcoin hit a high of

$114,000 on October 22. This rebound coincided with the positive turn of the 4-hour open interest and cumulative volume differential for Bitcoin, indicating that

the futures market was behind this rally .

Key technical levels : Traders are focusing on the support level of

$107,000 and the resistance range of

$114,000 to $115,000. On October 21st, Bitcoin ETFs experienced a net inflow of $477.2 million. BlackRock IBIT experienced an inflow of $210.9 million, while Fidelity FBTC observed an inflow of $34.1 million.

ETH (-0.92% | Current Price: $3,844.87)

Ethereum prices are struggling below

$4,000. Public disagreements between core developer Péter Szilágyi and the Ethereum Foundation and Vitalik Buterin have added to market uncertainty. US spot Ethereum ETFs continue to face outflows, with net outflows reaching

$145.99 million yesterday , reflecting institutional caution in the short term. Technically, Ethereum is in a state

of consolidation, with key support at

$3,850 and resistance near

$4,250. The market awaits a strong signal to determine its future direction. On October 21st, ETH ETFs experienced a total net inflow of $141.7 million, including an inflow of $42.5 million from BlackRock ETHA and an inflow of 54.1 million from Fidelity FETH.

ETF

ProShares has officially applied to list its "ProShares CoinDesk Crypto 20 ETF" on the New York Stock Exchange. The fund will track the top 20 digital assets by market capitalization, providing investors with a more convenient and diversified investment tool.

Altcoins

On October 22, 2025, the cryptocurrency market presented a complex landscape of bull-bear oscillations. The

fear and greed index is currently standing at 29, which is in the "fear" zone. While overall investor sentiment leaned toward extreme panic, significant market divergence emerged: some altcoins performed buoyantly, and Ethereum remained relatively under pressure. This surge was primarily driven by the accumulation of large whales. On-chain data showed that 30 newly created wallets withdrew over $116 million worth of LINK from exchanges, marking the first significant accumulation since the

market liquidation event on October 10.

Macro Data

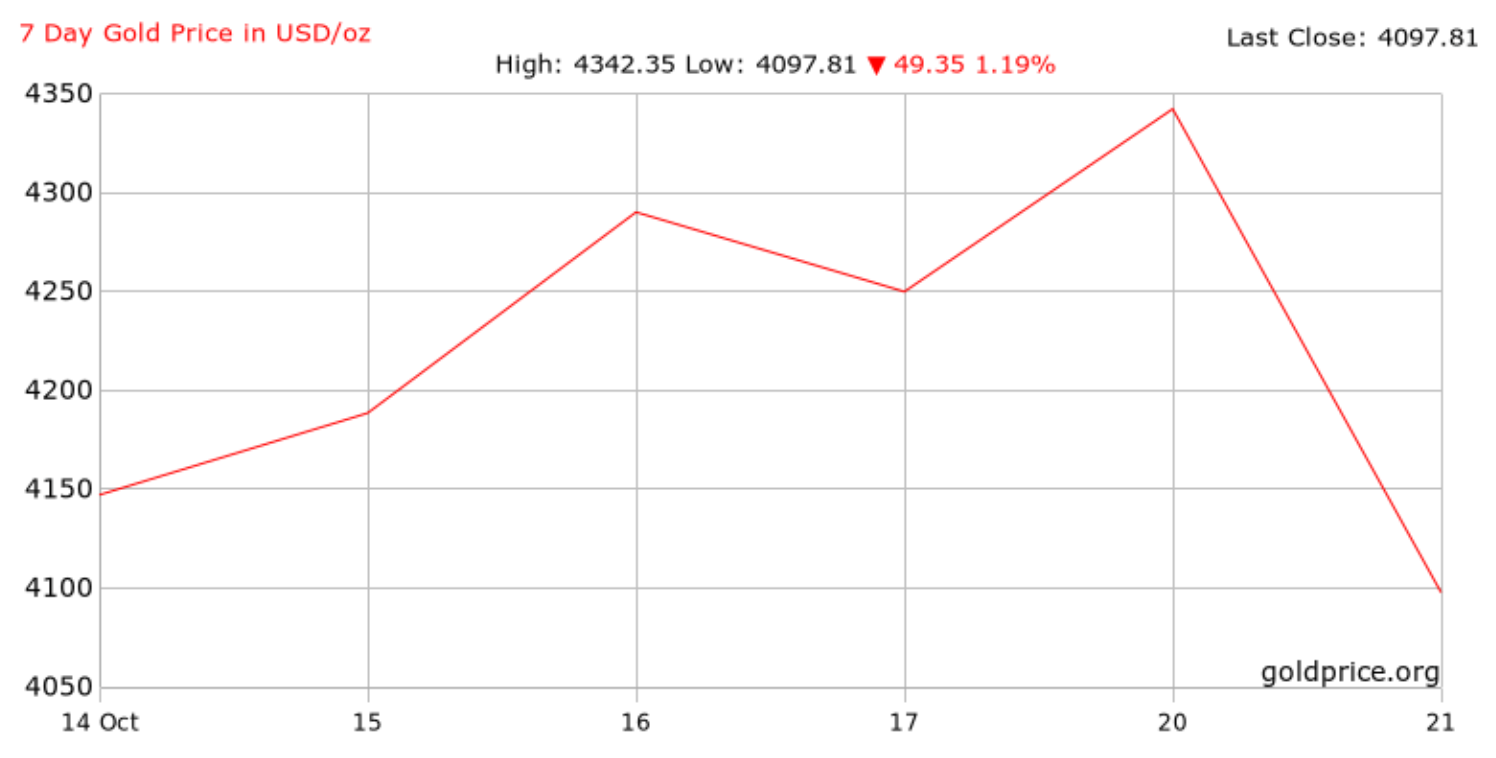

Broader macroeconomic concerns, such as inflation and recession fears, have spilled over to both traditional and crypto markets. Gold prices saw a significant dip following a record-breaking rally, partly due to profit-taking and optimism around easing trade tensions.

On October 21st, the S&P 500 was at 6,735.35 points; the Dow Jones Industrial Average increased 0.47% to 46,924.74 points, and the Nasdaq Composite dropped 0.16% to 22,953.67 points.

Trending Tokens

NIL Nillion (+18.95%, Circulating Market Cap: $84.92 Million)

NIL is trading at $0.3295, up approximately 18.95% in the past 24 hours. Nillion is the blind computer – a private computation and storage network for AI and data. The network uses PETs (Privacy-Enhancing Technologies) to enable computation and storage of data while maintaining privacy, making possible use cases like private personalized AI, encrypted databases, and privacy-preserving applications. NIL broke above a descending trendline on the daily chart, exiting a multi-month wedge pattern. The asset reclaimed $0.2936 support and tested $0.3145 resistance, with volume up 12.59% ($32.18M) vs. the prior day. Breakouts from consolidation often signal trend reversals. The move above the 50-day SMA ($0.2918) and rising RSI (47.15) suggest short-term momentum. However, Fibonacci retracement shows stiff resistance at $0.336 (23.6% level).

FF Falcon Finance (+8.75%, Circulating Market Cap: $346.65 Million)

FF is trading at $0.1481, up approximately 8.75% in the past 24 hours. Falcon Finance is building a universal collateral infrastructure that turns any liquid asset, including digital assets, currency-backed tokens, and tokenized real-world assets, into USD-pegged onchain liquidity. $FF is the protocol's native token and it serves as the gateway to governance, staking rewards, community incentives, and exclusive access to unique products and features. On October 16, Falcon Finance publicly unveiled its Transparency Dashboard, detailing its yield-generation methodologies: 61% employing options-based strategies, 21% utilizing funding rate arbitrage, and 18% applying statistical arbitrage techniques. The protocol maintains $2.25 billion in reserves, supported by a 105% reserves-to-liabilities backing ratio. A key trust enhancement is full transparency of strategic approaches, which mitigates the prevalent "black box" perception within DeFi and attracts risk-averse capital. The protocol's yield offering of an 8.65% APY for USDf stakers surpasses competing platforms such as Ethena’s USDe (7.2%), thereby incentivizing demand for the FF governance token.

LUNC Terra Classic (+6.4%, Circulating Market Cap: $247.62 Million)

LUNC is trading at $0.00004500, up approximately 6.4% in the past 24 hours. Terra is a blockchain protocol that uses fiat-pegged

stablecoins to power price-stable global payments systems. According to its white paper, Terra combines the price stability and wide adoption of fiat currencies with the censorship-resistance of

Bitcoin (BTC) and offers fast and affordable settlements. LUNC formed an inverse head-and-shoulders pattern on the 4-hour chart, with a neckline at $0.00006440. A breakout could target $0.00007350 (+63% from current $0.000045). MACD’s histogram turned positive, and RSI (14-day) at 43.99 avoids overbought risks. Traders are positioning for a potential breakout, though LUNC must hold above $0.0000417 (7-day SMA) to maintain momentum. Failure to breach $0.00006440 may trigger profit-taking.

Market News

Tether Reaches 500M Verified Users as Stablecoin Market Nears $316B

On Tuesday, October 21, Tether, the issuer of the world’s largest stablecoin by market capitalization, USDT , announced that it has reached 500 million verified users worldwide. The Paolo Ardoino-led company shared the milestone with its 546,000 followers on X, calling for celebrations.

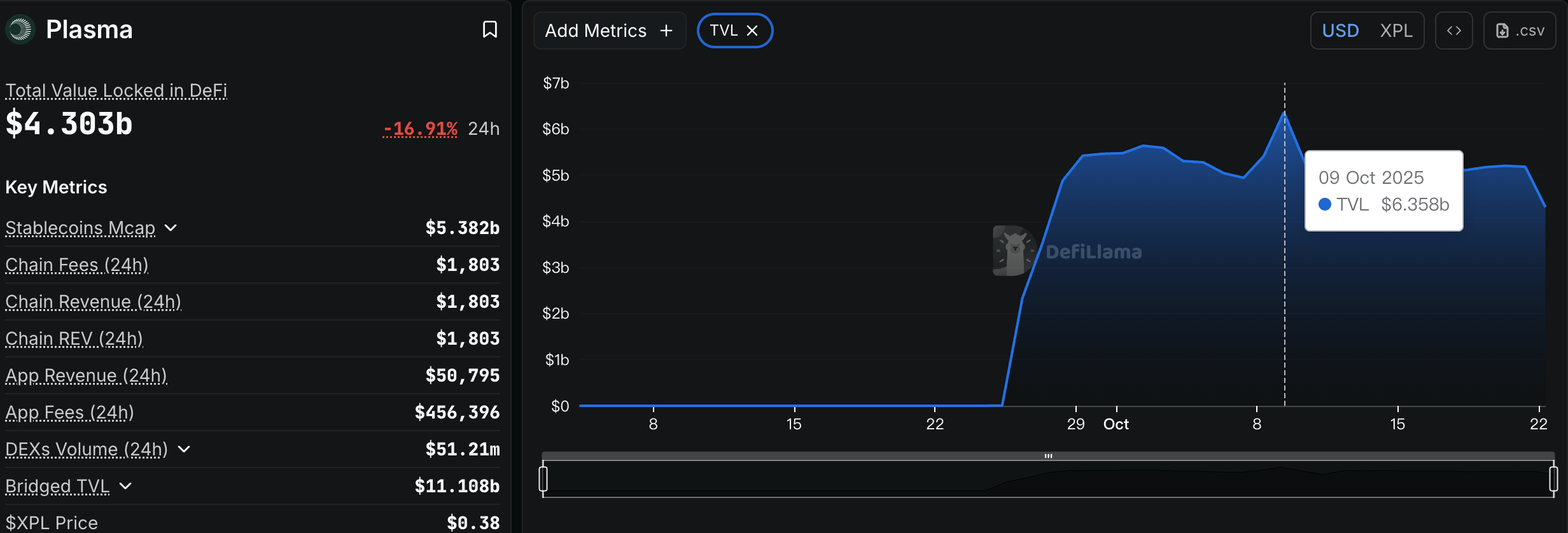

Founded in 2014 as Realcoin by Brock Pierce, Reeve Collins, and Craig Sellars, Tether has now emerged as the most widely used digital dollar in global trade. The firm also revealed plans to release a documentary film shot in Kenya, showcasing how USDT has transformed cross-border transactions and its difference-making impact on underserved markets. Holding over $127 billion in US securities at the close of Q2 2025, the company recently launched the Plasma (XPL) blockchain, designed to financialize its treasury holdings and further deepen US adoption in the emerging asset tokenization sectors.

According to DeFiLlama data, Plasma attracted over $6 billion in total value locked (TVL) within a week of its launch, reflecting positive market response.

Rival stablecoin issuer Circle (USDC) reported 87 million unique wallet addresses globally as of Q1 2025, according to data from Coinlaw. Tether’s 500 million verified user count means it now commands an 82% larger active user base compared to USDC. However, the gap narrows in terms of market capitalization. Tether’s $182 billion market value exceeds USDC’s $76.7 billion by only 58%, suggesting that despite Tether’s wider adoption, its users hold smaller average

Jupiter Launches Beta Version of New Prediction Market

Solana DEX aggregator Jupiter announces the launch of a beta version of its new prediction market supported by Kalshi. The first test market involves the Mexico Grand Prix.

In a recent post, the Solana decentralized exchange Jupiter announced that it has launched the beta version of its first prediction market. For the platform’s first test market, users can vote on F1 racers they believe have the highest chance of winning the Mexico Grand Prix.

The market’s liquidity is powered by Kalshi, the American regulated prediction market that has been operating since 2021. For now, the platform is still in its beta version and has limited features, but users can start betting on their favorite F1 drivers with starting limits pinned at a maximum of 100,000 for global contracts and 1,000 for position contracts.

Ark Labs Launches Arkade Public Beta, Introducing a New Native Layer 2 Built Directly on Bitcoin

After two years of development, Ark Labs, backed by investors including Draper Associates, Axiom, and Fulgur Ventures, has launched Arkade in public beta — introducing what it describes as Bitcoin's most advanced native Layer 2 since the Lightning Network's debut nearly a decade ago.

Built on the Ark Protocol specification, originally proposed in 2023, Arkade's launch delivers the first mainnet implementation of that vision. It virtualizes Bitcoin's transaction layer through Virtual Transaction Outputs (VTXOs) — offchain representations of Bitcoin's native Unspent Transaction Outputs (UTXOs). Importantly, Arkade achieves this without requiring a change to Bitcoin's consensus rules, operating entirely within its existing security framework. In Bitcoin, coins aren't stored in accounts but as UTXOs — individual amounts of bitcoin created by previous transactions. Each UTXO is fully spent when used, with any remaining value returned as new outputs, forming the basis of how ownership is recorded and moves across the network.

By virtualizing these outputs offchain, Arkade allows users to move, lend, or trade assets instantly while leveraging Bitcoin's security model and the ability to unilaterally exit onchain. Each VTXO represents a user's offchain claim derived from an onchain UTXO, coordinated through Ark Service Providers (ASPs). Analogous to Lightning Service Providers — which help users route payments on the Lightning Network — ASPs coordinate the creation and settlement of thousands of offchain transactions by batching them into periodic single Bitcoin transactions onchain, dramatically reducing costs. Crucially, ASPs never take custody of user funds — every VTXO is backed by a presigned Bitcoin transaction — ensuring users retain custody and can unilaterally reclaim their assets onchain at any time, even if an ASP goes offline or acts maliciously.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.