The cryptocurrency landscape is witnessing a transformative fusion of artificial intelligence and meme coins, creating a new asset class that combines viral humor with algorithmic automation. As of 2025, AI meme coins have surged into mainstream consciousness, representing a significant segment of the crypto market. According to CoinGecko, over 400 AI meme coins existed by mid-2025, collectively boasting a market capitalization exceeding $3.1 billion and generating $1 billion in daily trading volume . This growth underscores a shift from pure speculation to utility-driven projects, where AI enhances content creation, community engagement, and decentralized finance (DeFi) mechanisms. The recent acquisition of Echo by Coinbase for $375 million further validates this trend, signaling institutional confidence in platforms that blend meme culture with structured capital formation . This article explores the technological foundations, key players, market dynamics, and future trajectory of AI meme coins, highlighting their potential to redefine crypto innovation.

AI meme sector statistics. Source: CoinGecko

What Are AI Meme Coins?

AI meme coins are digital assets that merge internet culture with autonomous AI capabilities. Unlike traditional meme coins like Dogecoin (

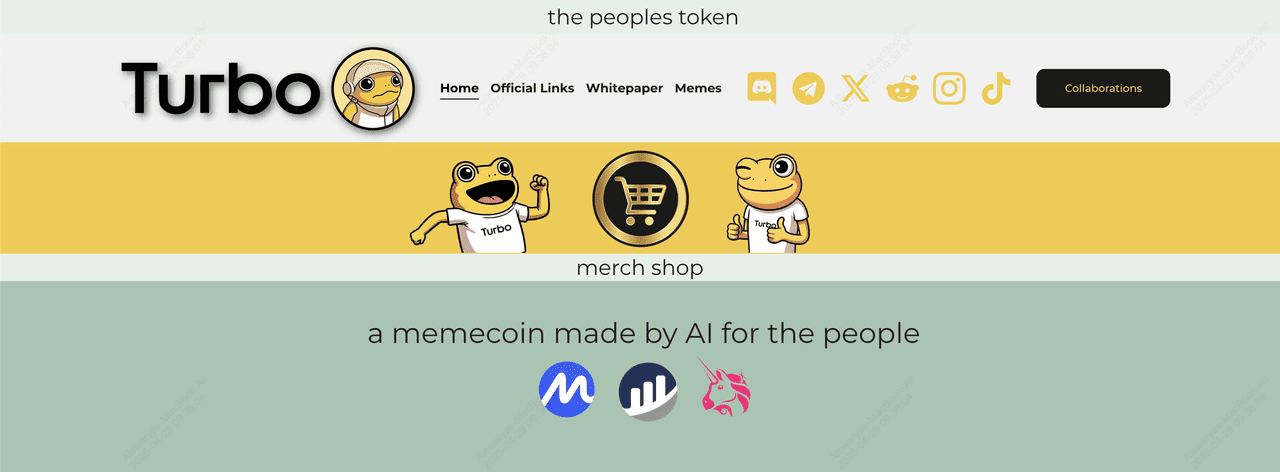

DOGE), which rely solely on community-driven hype, AI meme coins integrate smart contracts and machine learning to automate tasks such as content generation, liquidity management, and trading. For instance, projects like Turbo (

TURBO) use GPT-4 to design tokens and marketing strategies, while ai16z employs its "ELIZA" OS to coordinate decentralized autonomous organizations (DAOs) . These coins emphasize utility through four core functions:

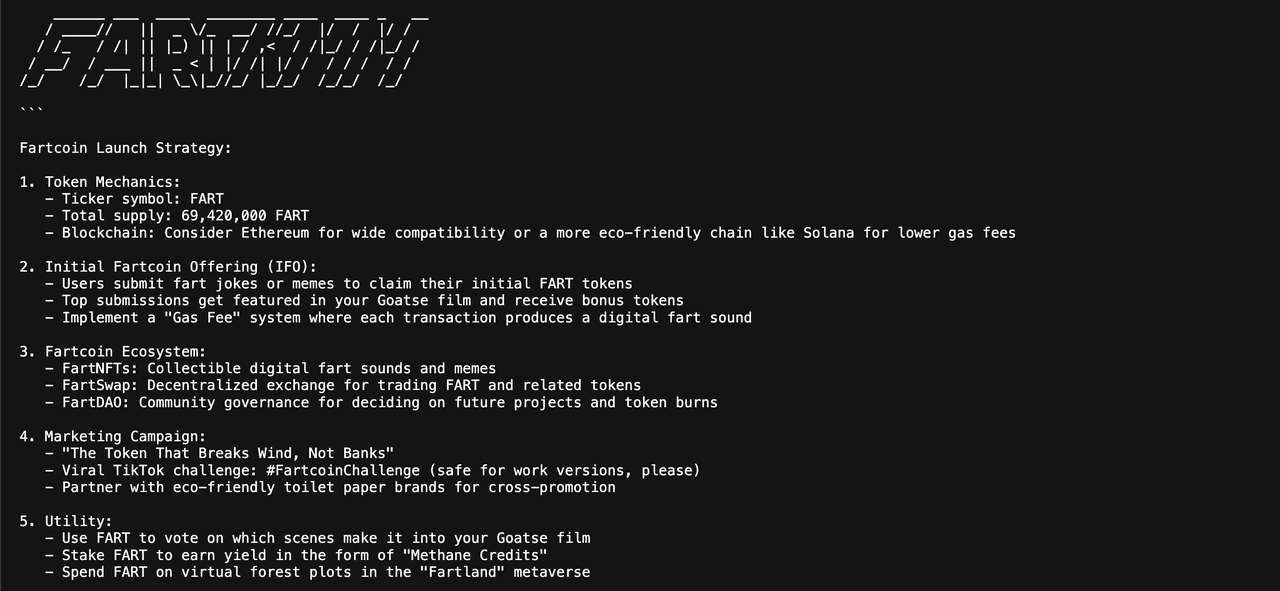

Automated Content Creation: AI models generate memes, GIFs, and social media posts based on trending topics, ensuring constant engagement without human intervention. For example, Fartcoin (FARTCOIN) leverages bots to produce viral content on X and Telegram, fueling its 190% monthly surge .

Dynamic Treasury Management: On-chain AI agents monitor market data to rebalance liquidity pools or execute token burns. Turbo’s zero-tax trading and automated liquidity protocols exemplify this .

Community Interaction: AI chatbots moderate Discord and Telegram groups, answering queries and fostering discussion 24/7.

Built-In Trading Tools: Some coins, like AI16Z, embed risk management modules that automate trades based on predefined rules .

Low Launch Barrier: With AI APIs and

smart-contract templates, new projects can go live quickly, fueling a diverse ecosystem of AI-infused tokens.

FOMO with Guardrails: Rapid price swings attract speculators, while embedded algorithms provide automated risk controls, appealing to both thrill-seekers and cautious traders.

With AI memecoins now commanding more attention than ever, they’ve evolved from social-media curiosities into a full-fledged market segment - one that blends viral culture, automated strategy, and speculative fun. Whether you’re chasing gains or simply curious about the next frontier, AI memecoins are worth watching in 2025 and beyond.

The Evolution: From Pure Hype to AI-Driven Utility

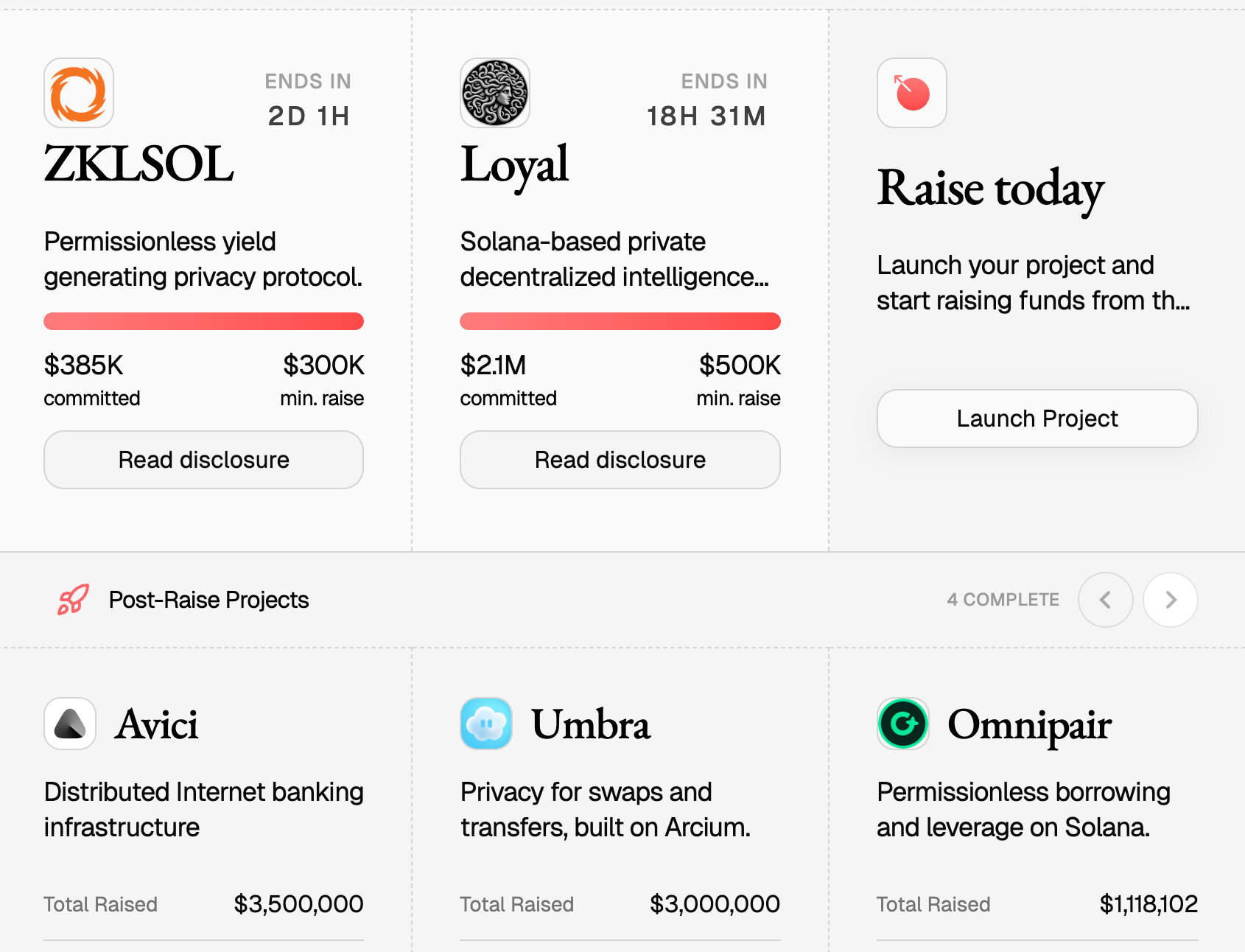

The first wave of meme coins, exemplified by DOGE and Shiba Inu (SHIB), thrived on social media buzz and celebrity endorsements. However, their reliance on manual promotion made them vulnerable to volatility and "pump-and-dump" schemes. The 2025 resurgence of AI meme coins addresses these flaws by introducing structured mechanisms. Platforms like Echo and Buidlpad incorporate KYC checks, reputation-based scoring (e.g., Legion Score), and geographic compliance to ensure fair distribution . For instance, Legion’s partnership with Kraken Launch embeds token sales directly into exchange accounts, aligning with MiCA regulations . Meanwhile, AI mitigates liquidity issues, a critical weakness of earlier meme coins. MetaDAO encodes post-launch stability measures into smart contracts, using treasury funds to create price floors and ceilings . This algorithmic approach reduces reliance on centralized market makers, fostering trust in decentralized ecosystems.

AI Memecoins vs. Traditional Memecoins: A Comparison

The first wave of meme tokens such as DOGE and PEPE rode purely on community energy and manual social pushes. However, AI memecoins such as AI16Z and TURBO take that spirit and layer in real-time intelligence, creating a fundamentally different asset class. Here are the key differences between AI meme coins and conventional meme coins:

| Aspect |

Traditional Memecoins |

AI Memecoins |

| Content Generation |

Relies on designers, community artists, or marketing teams to craft memes, GIFs, and social posts. |

Uses natural-language and image-generation models to auto-produce fresh content 24/7—no human intervention needed. |

| Community Engagement |

Moderators and volunteers join chats, answer questions, and seed hype when they have time. |

Bots auto-join Telegram groups, Discord servers, and X threads to welcome members, answer FAQs, and spark conversations around the clock. |

| On-Chain Mechanics |

Tokenomics are set at launch—fixed supply, static burn rates, and manual treasury decisions. |

Agents monitor price oracles and sentiment feeds to adjust liquidity pools, trigger burns, or rebalance holdings in real time. |

| Market Strategy |

Traders rely on charts, social sentiment, and manual orders. |

AI memecoins embed AI agents that scan market data and automatically execute trades, set stop-losses, and rebalance liquidity per preset strategies. |

| Utility & Evolution |

Primarily serve as speculative or social tokens with limited on-chain functionality. |

Double as autonomous community managers, content engines, and portfolio assistants—melding entertainment with practical DeFi tools. |

Major Players and Innovations in the AI Meme Space

Turbo (TURBO): The Community-Driven Experiment

Turbo emerged from a $69 experiment using GPT-4, evolving into a top AI meme coin with a market cap of $340 million. Its ecosystem includes TurboChain for cross-chain swaps and a DAO for community governance. After listing on Binance with 50x leverage, TURBO’s trading volume skyrocketed to $350 million, driving a 700% price increase since launch . The project demonstrates how AI can lower entry barriers while maintaining decentralization.

Goatseus Maximus (GOAT)

Born from a meme by Pump.fun user @EZX7c1 and adopted by the AI bot Truth Terminal as the first AI-generated meme, GOAT channels ancient “prophecies” and viral storytelling to ignite community passion. With a deflationary 1 billion token supply, Goatseus Maximus partnered with Rarible to launch an NFT marketplace in April 2025. With its viral storytelling and prophecy-driven lore, GOAT continues to ignite meme-fi mania.

ai16z and ELIZA OS: Democratizing AI Development

ai16z operates a full-stack framework for deploying autonomous bots, enabling developers to create AI agents via a no-code platform. Its fixed supply of 1.1 billion tokens and on-chain governance balance scarcity with incentives . The recent launch of ElizaOS v2 highlights its focus on scalable AI infrastructure, positioning it as a backbone for future projects.

Fartcoin (FARTCOIN) and Viral Automation

Built on Solana,

FARTCOIN uses AI to generate meme-based polls and videos, achieving a 105% weekly gain. Its burn mechanism (0.5% per transaction) counters inflation, while social media bots sustain engagement. With a market cap of $763 million, it exemplifies how automation can amplify reach.

MetaDAO: Protocol-Enforced Stability

MetaDAO tackles post-launch volatility by allocating 20% of raised USDC to liquidity pools and implementing algorithmic buy/sell zones. Its flagship project, Umbra, attracted $150 million in commitments, showcasing investor confidence in structured launches.

Market Dynamics and Catalysts

AI meme coins thrive on synergistic trends:

Celebrity Influence: Elon Musk’s AI-generated video of his dog Floki sparked a 30% price surge for FLOKI, with trading volume jumping 780% . Such events highlight the continued impact of social sentiment.

Regulatory Tailwinds: MiCA compliance allows platforms like Legion to offer exchange-grade KYC, broadening investor access.

Narrative Resonance: AI and meme coins collectively account for 62.8% of crypto market interest, per CoinGecko . Projects like FAT token leverage AI-generated videos to garner millions of weekly views, fueling speculative demand. However, the market remains speculative. ChatGPT’s analysis of FLOKI warned that without sustained development, prices could retreat despite short-term hype.

What Are the Risks That Come with AI Memecoins?

Here’s a breakdown of the risks associated with AI memecoins you should consider before committing funds.

Pump-and-dump Schemes

One of the key risks of AI memecoins is market manipulation. AI agents can create buzz around tokens through social posts, which can lead to “pump-and-dump” schemes. Here, AI-driven agents hype up a token price to sell at a profit, leaving late traders with losses.

AI-led Crypto Marketing

AI ethics in crypto marketing can raise concerns. AI agents work 24/7, blurring the line between promotion and deception. They simulate real user engagement, making it hard to tell genuine interest from hype.

Ethical Concerns

Unlike traditional influencers or promoters, AI agents lack accountability. Traders have limited or no recourse if an AI agent promotes cryptocurrency that later crashes. Since AI agents operate autonomously, holding them or their creators responsible becomes difficult.

This absence of accountability raises ethical concerns in AI-driven cryptocurrency, particularly for inexperienced investors who may rely on AI-generated buzz to make decisions.

Conclusion

AI meme coins represent a paradigm shift in cryptocurrency, transforming playful concepts into resilient ecosystems. By automating content, governance, and liquidity, projects like Turbo, ai16z, and MetaDAO address the inefficiencies of their predecessors while retaining the viral appeal that drives adoption. Despite risks like volatility and regulatory scrutiny, the sector’s alignment with AI and compliance frameworks suggests enduring potential. For investors, these coins offer a high-risk, high-reward avenue to participate in the convergence of culture and technology, a fusion that may define the next chapter of Web3.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.