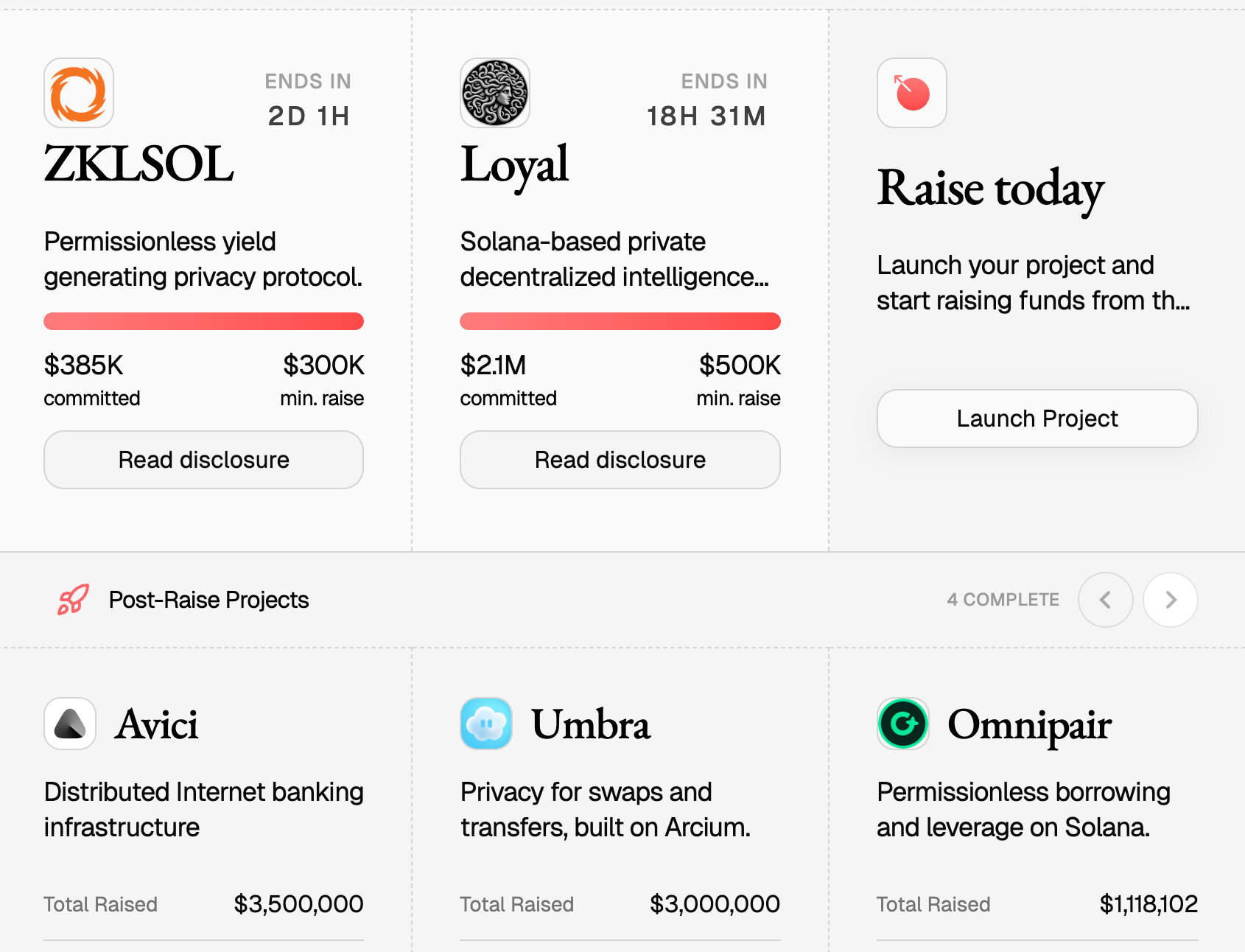

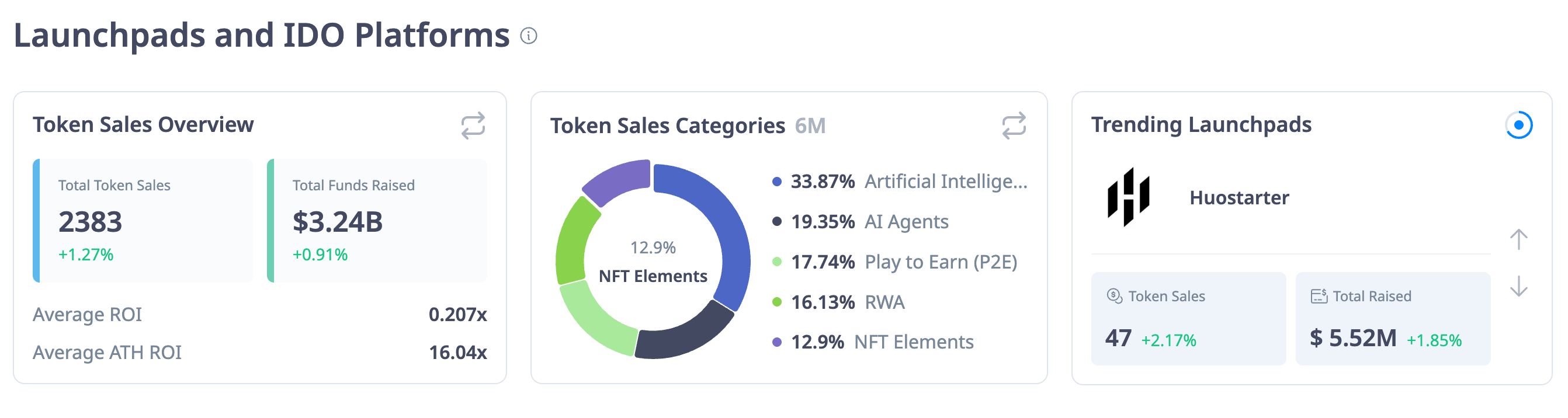

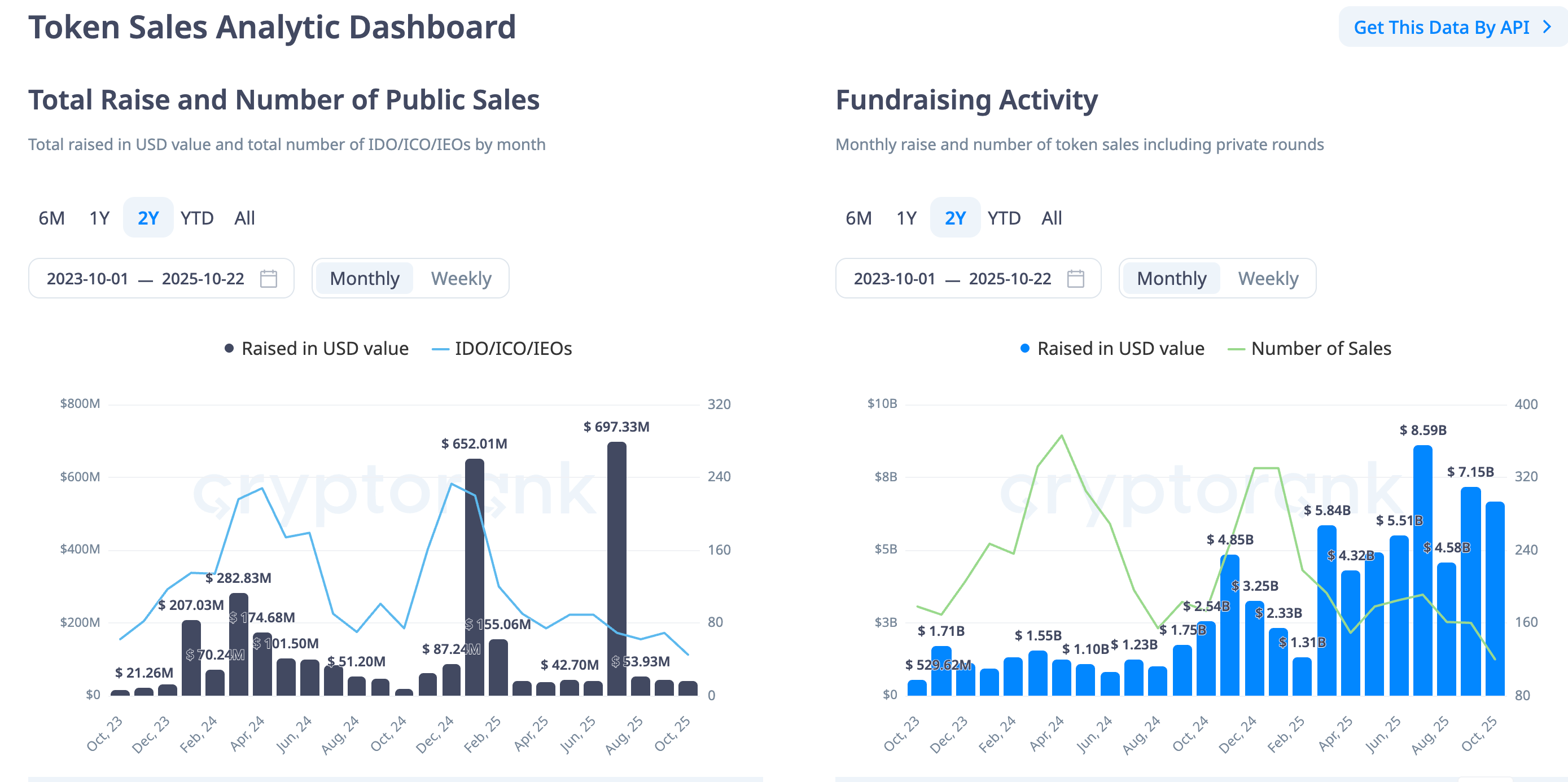

The term Initial Coin Offering (ICO) once evoked memories of the 2017 frenzy—a period characterized by revolutionary potential but plagued by rampant speculation, regulatory ambiguity, and frequent malfeasance. However, after years of dormancy, ICOs are experiencing a powerful resurgence in 2025. This revival is not a mere repetition of past cycles; it represents a fundamental transformation into a more sophisticated, structured, and compliant model for on-chain capital formation. The chaotic "gas wars" and anonymous fundraising events have been replaced by a new generation of launch platforms that systematically prioritize regulatory compliance, equitable distribution, and sophisticated post-listing liquidity management. This evolution is largely driven by pioneering platforms like Echo, Legion, MetaDAO, and Buidlpad, which have successfully embedded mechanisms such as identity verification (KYC), reputation-based scoring, and automated market-making directly into their architectural core. The recent acquisition of Echo by Coinbase for approximately $375 million underscores significant institutional belief in this emerging paradigm, signaling a major shift toward regulated, community-driven token sales . This article explores the key drivers, leading platforms, and persistent risks defining the modern ICO landscape.

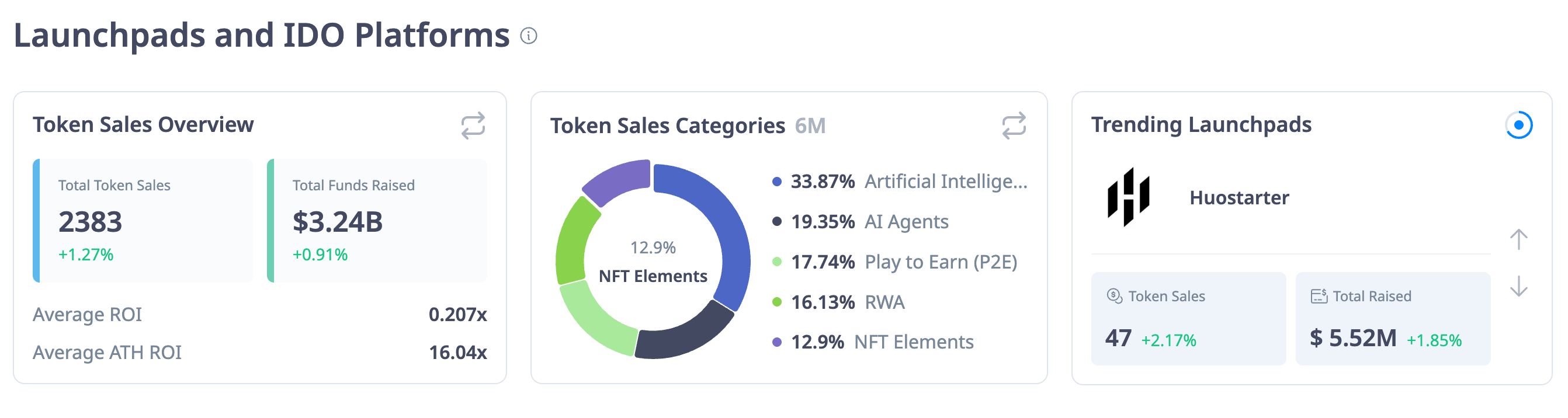

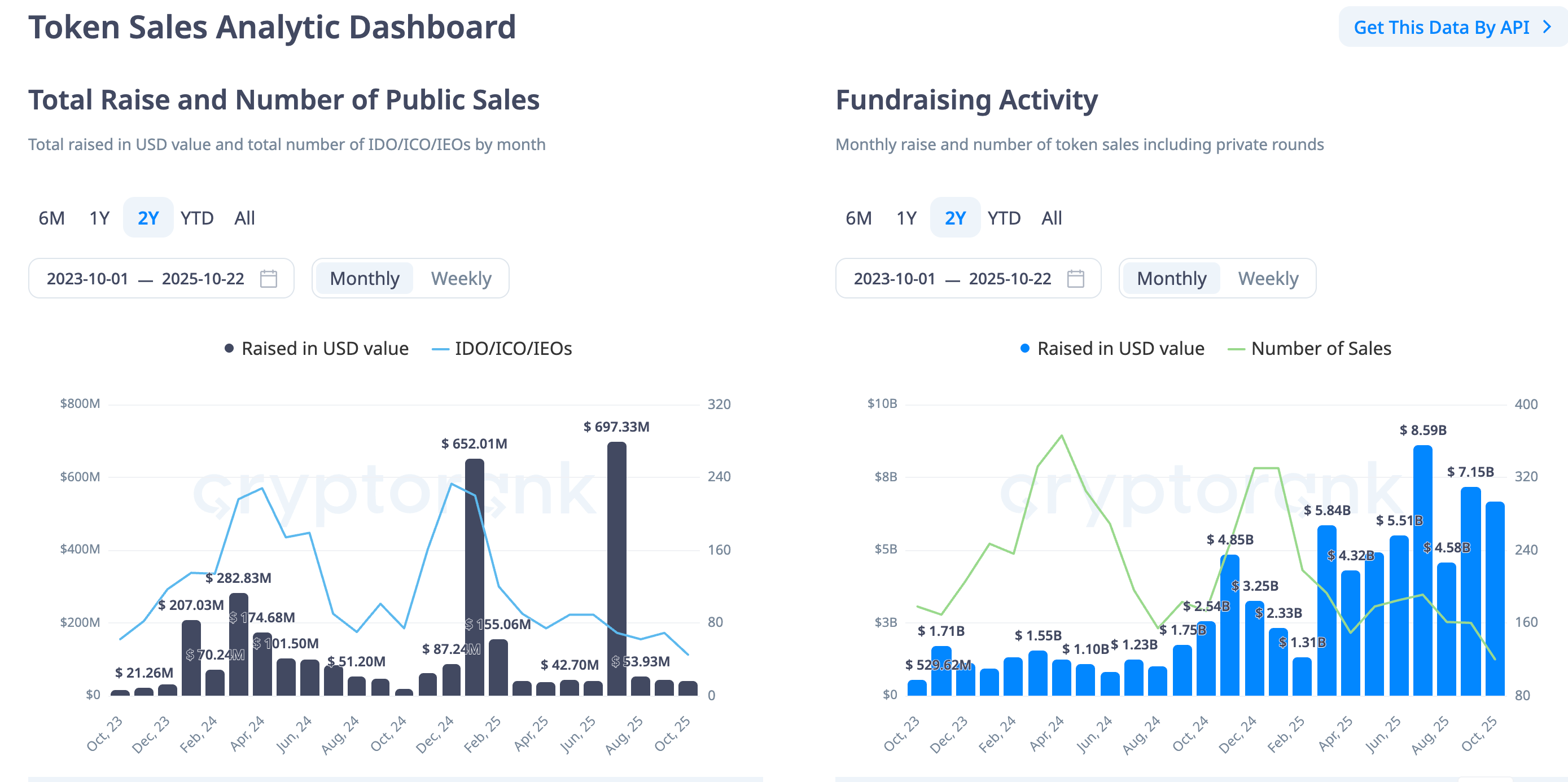

Launchpad platforms' overview, number of public sales and fundraise activities. Source: CryptoRank

What Is an Initial Coin Offering (ICO)?

An initial coin offering (ICO) is the cryptocurrency industry’s equivalent of an initial public offering (IPO). A company seeking to raise money to create a new blockchain app or service with a cryptocurrency can launch an ICO as a way to raise funds.

Interested investors can buy into an initial coin offering to receive a new cryptocurrency issued by the company. This token may have some utility related to the product or service that the company is offering or represent a stake in the company or project.

Echo: Self-Custody and Flexible Compliance

Introduction of Echo

Founded by the prominent crypto personality Cobie, Echo has rapidly emerged as a breakout token launch infrastructure in 2025, largely due to the success of its flagship product, Sonar. Unlike traditional centralized launchpads or exchange-based IEOs (Initial Exchange Offerings), Echo functions primarily as underlying infrastructure rather than a closed market. It provides projects with the flexibility to choose their preferred sale format—whether fixed-price, auction, or vault/credit mode—and allows them to set customizable KYC, credentialing, and geographic restrictions through its Echo Passport system. A significant differentiator is its support for multiple blockchains, including Solana, Base, Hyperliquid, and Cardano, enabling truly cross-chain token sales.

Echo's value proposition was spectacularly demonstrated by the Plasma ICO in July 2025. The project sold 10% of its token supply at a price of $0.05, attracting over $50 million in commitments and achieving a peak return on investment (ROI) of 33.78x for its earliest backers. Another successful sale, $LAB, also generated a formidable 6.22x return upon listing . However, Echo's model emphasizes flexibility over standardization. The platform does not enforce a uniform post-listing liquidity framework, meaning liquidity provision (LP), market maker requirements, and vesting schedules are entirely determined by the issuing project. This hands-off approach grants projects significant freedom but also places the onus on investors to conduct thorough due diligence regarding a project's own liquidity plans.

Coinbase Acquires Echo

Coinbase's acquisition of Echo for $375 million marks the exchange's eighth acquisition this year, reflecting its aggressive expansion strategy under what it views as favorable U.S. regulatory developments. According to industry reports, the transaction was finalized on October 20-21, 2025, and includes customary purchase price adjustments. Unlike many acquisitions that lead to complete integration, Echo will continue to operate as an independent platform maintaining its existing brand, while its revolutionary Sonar product for public token sales will be integrated into Coinbase's ecosystem. This balanced approach allows Coinbase to leverage Echo's specialized expertise while gradually incorporating its most valuable features.

The philosophical alignment between both companies is notable. As Coinbase stated, "By joining forces, we're making it easier for companies to raise funds and grow, and giving the community early access to unique investment opportunities". This vision resonates with Echo's founding principle of "democratizing early-stage investing, so that more people can support the next generation of breakthrough companies". Founded by Cobie, a respected crypto veteran and advocate for community-driven investing, Echo has pioneered tools that make fundraising more inclusive, transparent, and efficient.

The MegaETH Phenomenon

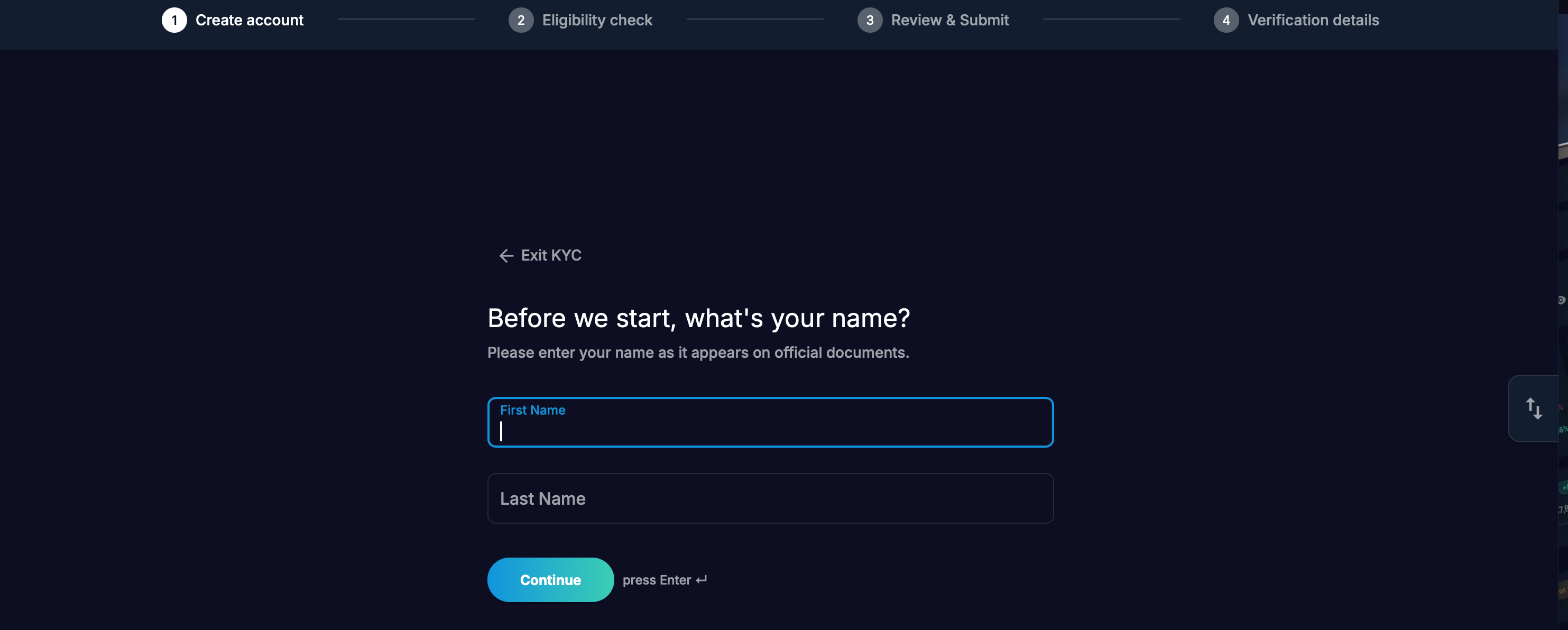

The compelling case for Echo's value proposition is perfectly illustrated by MegaETH, the latest hotly anticipated project to utilize Echo's platform for its token sale. As an Ethereum L2 project generating significant buzz, MegaETH has opened registration and KYC verification exclusively through the Echo/Sonar platform, with its registration period running from October 15 to October 27, 2025.

The immense interest in MegaETH stems largely from investors hoping to replicate the spectacular returns seen with Plasma, which earlier demonstrated Echo's capacity to identify and support breakthrough projects. The participation process for MegaETH showcases Echo's sophisticated approach to community building: potential investors are encouraged to link social media accounts with "rich interactions" and upload "up to 3 of their own wallets with rich on-chain interaction history" to increase their chances of receiving allocations during oversubscription. This mechanism ensures that dedicated community members receive priority access.

The KYC process for MegaETH, while thoroughly, is designed for efficiency. If information is complete and accurate, verification can be "approved instantly," though manual reviews may take 1-3 days. This balance between regulatory compliance and user experience represents a significant advancement in ICO accessibility, potentially creating what industry observers have described as a "'compliant ICO' market".

Legion: Reputation-Based Allocation and Exchange Integration

In contrast to Echo's founder-centric flexibility,

Legion champions a highly structured, reputation-gated access model for token sales. Its core innovation is the Legion Score, a dynamic metric ranging from 0 to 1000 points that aggregates a user's on-chain behavior, technical contributions (such as GitHub activity), social interactions, and peer endorsements . This system was fully integrated into Kraken Launch in September 2025, enabling seamless token sales directly within verified Kraken accounts while adhering to the European MiCA regulatory standards.

The mechanics of a Legion-driven sale are designed to reward long-term contributors over fleeting speculators. Projects typically reserve 20-40% of their total token allocation for users with high Legion Scores, with the remaining portion made available on a first-come, first-served (FCFS) or lottery basis. This fundamentally reorients the allocation paradigm, moving away from rewarding the fastest bots—a hallmark of the 2017 era—and instead prioritizing builders, active community members, and proven contributors. While this system marks a significant upgrade in fairness, it is not without its critiques. Some users have noted that the Legion Score's algorithm may still overvalue social media influence, potentially allowing large accounts to secure an advantage over genuine but less visible builders. Despite these concerns, the integration with Kraken provides a formidable advantage: exchange-grade KYC/AML checks and immediate, deep liquidity on the first day of trading.

MetaDAO: Protocol-Enforced Liquidity Mechanisms

MetaDAO distinguishes itself in the launchpad landscape by taking a radically different approach: it hard-codes post-sale market policies directly into its protocol logic. Following a successful token sale, all raised USDC is deposited into a market-managed treasury. The protocol then automatically injects 20% of these funds alongside 5 million project tokens into a Solana-based DEX liquidity pool . Furthermore, the treasury is programmed to act as a stabilizing force, creating a soft price band by systematically buying tokens when the price falls below the ICO price and selling when it rises above that threshold.

This mechanism profoundly impacts early market behavior. In a typical ICO, thin liquidity or coordinated selling by insiders can lead to catastrophic price dumps shortly after listing. MetaDAO's policy band ensures that early trading activity is largely contained within a predictable range, limiting downside volatility while also capping extreme speculative pumps. A prime example of its effectiveness is the Solana privacy protocol Umbra, which attracted over 10,000 participants and generated more than $150 million in total commitments during its sale. It is crucial to understand that this is a mechanistic, not a promised, outcome. If genuine market demand is insufficient, the treasury's funds will eventually be depleted. Nevertheless, from the first day of trading, the protocol's algorithmic actions provide a foundational layer of price stability that was previously nonexistent.

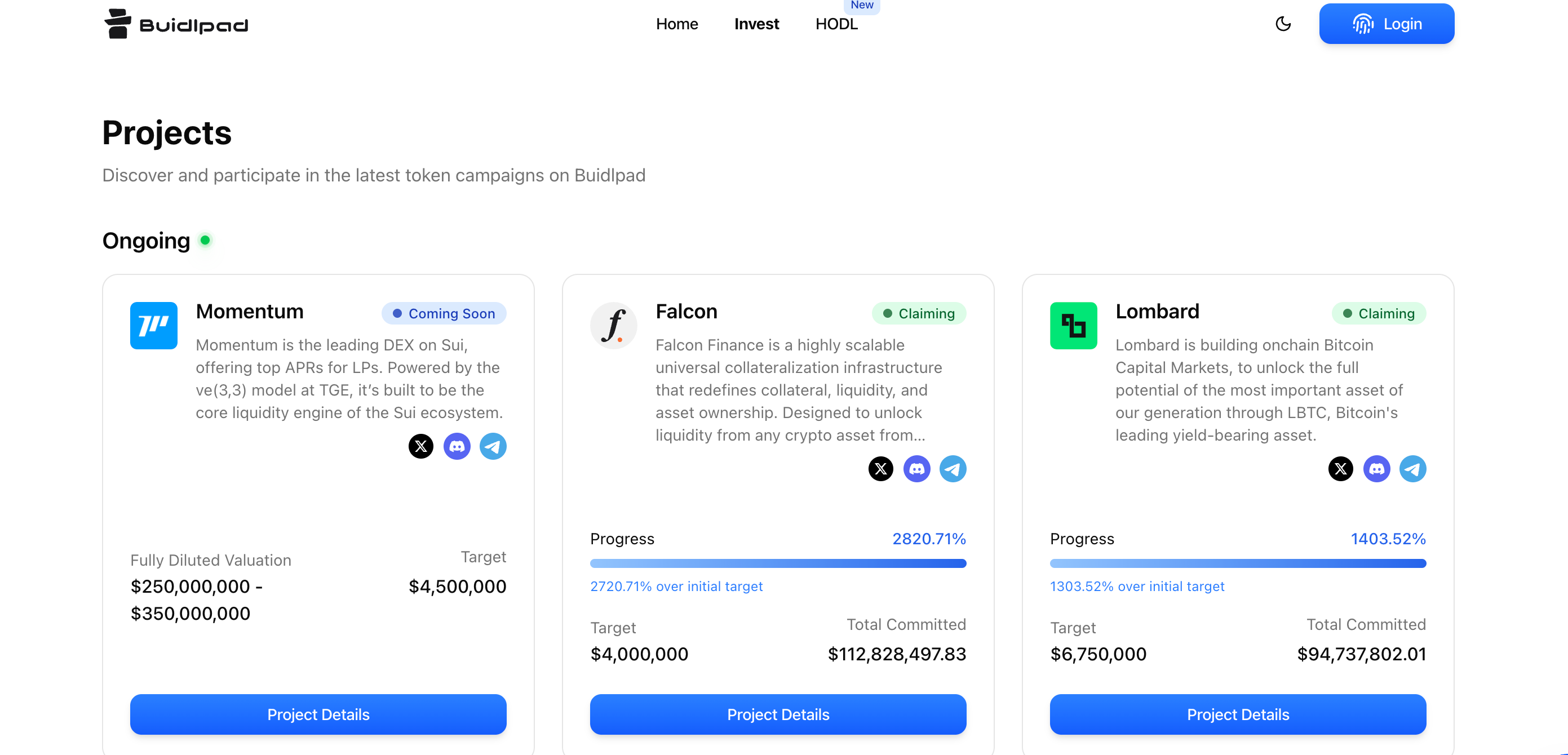

Buidlpad: KYC-Focused and Community-Centric Access

Buidlpad, launched by Erick Zhang, a former Binance research head and Launchpad lead, focuses on a straightforward yet powerful mission: providing a clear and streamlined path for KYC-verified community investors to participate in token sales . Its operational model is notably simple, involving a clean two-step sequence: users first complete KYC registration and subscription, after which they can commit funds during a defined purchase window . To ensure fairness, the platform implements strict anti-sybil policies, effectively excluding bots and farming operations from community sales .

The platform's milestone moment came with the Falcon Finance ($FF) sale in September 2025. The project aimed to raise $4 million but received a staggering $112.8 million in commitments, resulting in a 28x oversubscription rate . In such scenarios of excess demand, Buidlpad's process automatically refunds any excess funds to participants, ensuring a transparent and fair allocation process . The platform's simplicity is its greatest strength, offering structured, compliant access without complex scoring systems or prediction vaults. However, similar to Echo, the responsibility for post-listing liquidity planning on Buidlpad remains entirely with the issuing project, which can sometimes lead to fragmented trading volume across multiple chains.

Navigating Risks and Opportunities in the New ICO Landscape

Despite the significant advancements in infrastructure and regulation, the modern ICO market remains a high-risk, high-reward environment that demands cautious and informed participation.

Persistent Market Risks: The allure of high returns is tempered by a stark reality: analysis of the 2025 crypto presale market indicates that over 80% of presales fail within a year . High oversubscription, as witnessed with Falcon Finance and Plasma, does not guarantee long-term project success or sustained token performance. If a project fails to deliver utility and drive adoption, its high initial Fully Diluted Valuation (FDV) often corrects sharply in the secondary market .

Technical and Governance Vulnerabilities: While mechanisms like Legion's reputation score aim for fairer distribution, the weighting of the score can be opaque and potentially manipulated by those with large social media followings . Similarly, while MetaDAO's treasury provides a reliable price floor, this mechanism can be exhausted if there is no genuine, organic market demand for the token .

Regulatory Evolution and Clarity: The regulatory environment, though improved, remains a dynamic factor. Frameworks like the European Union's MiCA regulation provide a more structured path for compliant participation, and platforms have integrated these requirements into their core functionality . However, regulatory enforcement is still adapting to the pace of technological innovation, and rules can vary significantly across different jurisdictions, creating a complex global compliance landscape .

Conclusion

The resurgence of ICOs in 2025 marks a pivotal moment in the maturation of the cryptocurrency industry. The model has evolved from a wild west of fundraising into a structured, transparent, and increasingly regulated market segment. Driven by platforms like Echo, Legion, MetaDAO, and Buidlpad, the new ICO paradigm emphasizes fair access, regulatory compliance, and sophisticated market management. Validated by major institutional moves like Coinbase's acquisition of Echo, this structured approach is paving the way for the next phase of crypto fundraising, potentially encompassing tokenized securities and real-world assets (RWAs) .

For investors, this new era presents a significantly improved, though not risk-free, opportunity to engage with early-stage projects. Success in this landscape requires a strategic approach: understanding specific sale mechanisms, meticulously tracking eligibility windows, conducting independent due diligence on project fundamentals, and managing position sizes with the clear understanding that oversubscription does not equate to guaranteed long-term success. The transformed ICO, now a vehicle for structured capital formation, demonstrates the growing resilience and sophistication of the digital asset ecosystem.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.