The blockchain world is defined by innovation but plagued by fragmentation. With countless blockchains operating in isolation, developers face immense challenges in building applications that can seamlessly operate across multiple networks. This lack of interoperability has been a significant barrier to the mass adoption of Web3. Enso aims to fundamentally simplify cross-chain development, positioning itself as a critical infrastructure that could unlock the next wave of decentralized applications. By providing a unified layer for blockchain interaction, Enso has the potential to dissolve the barriers between isolated networks, empowering developers to focus on innovation rather than complex integrations. This article delves into the intricacies of the Enso project, exploring its technology, tokenomics, and potential impact on the future of Web3.

What is Enso (ENSO)?

Enso is a unified blockchain network designed to solve the core problem of interoperability in the Web3 space. Founded in 2021 by Connor Howe, an Ethereum developer since 2016, Enso acts as a standardized gateway, allowing developers to read and write data to any blockchain through a single, simplified API. Its primary mission is to eliminate the technical hurdles and "integration gymnastics" that developers face when trying to build applications that span multiple blockchains. In practical terms, Enso serves as a foundational layer that abstracts away the complexity of direct integrations with individual chains. By acting as a universal adapter, it enables the creation of composable applications that can leverage the unique strengths and liquidity of over 1,000 different blockchains and smart contracts without requiring custom code for each one. This vision of a seamlessly connected blockchain ecosystem has already garnered support from major investment firms like Polychain Capital and Multicoin Capital, and has been trusted by 145 projects to settle over $17 billion in on-chain transactions.

The Technology Behind Enso: How It Works

At the heart of Enso's technical framework is its innovative "

Shortcut" system. Shortcuts are programmable, composable units that package complex protocol interactions into reusable logic. This system allows developers to execute sophisticated on-chain actions—such as cross-chain token swaps, decentralized finance (DeFi) routing, and automated treasury management—with minimal technical overhead. The platform functions as a broad infrastructure layer, not just a simple bridge. It is built to integrate with multiple ecosystems, including Ethereum Virtual Machine (EVM), Solana Virtual Machine (SVM), and others. A key component of Enso's architecture is its

validation system. Network validators are required to simulate and verify the correctness of Shortcuts, staking ENSO tokens as collateral to ensure honest participation. Validators who perform incorrect validation face slashing penalties, a mechanism that aligns their economic incentives with the security and integrity of the entire network. This technical design, which emphasizes standardization and security, drastically reduces development time and infrastructure complexity, enabling applications to scale more efficiently across the fragmented blockchain landscape.

Why Enso Matters: The Value Proposition

Enso's value proposition lies in its potential to catalyze a developer boom in Web3 by significantly lowering the barriers to building complex, multi-chain applications. The platform's standardized interface can reduce development time by up to 80%, according to the project. This efficiency is crucial for the growth of the ecosystem, especially when considering the significant developer shortage in Web3, which has only about 23,000 developers compared to 47 million in traditional software. By simplifying the technical challenges, Enso allows developers to redirect their energy from overcoming integration obstacles to creating innovative features that define the next generation of dApps, such as cross-chain neobanks and AI agents that can execute transactions across entire ecosystems. Furthermore, as the blockchain space continues to evolve into a multi-chain reality, infrastructures like Enso that provide secure and efficient cross-chain communication become indispensable. They enhance capital efficiency by connecting isolated liquidity pools and ensure that the user experience is smooth and intuitive, which is vital for driving mainstream adoption of decentralized technologies.

ENSO Tokenomics: Distribution and Utility

The ENSO token is the economic core of the Enso network, with a carefully designed tokenomic structure. The genesis supply is

100 million ENSO, with a maximum supply of approximately

127.3 million ENSO. This increase is due to an initial annual inflation rate of 8%, which gradually decays monthly to 0.35468% by year 10, after which inflation ceases.

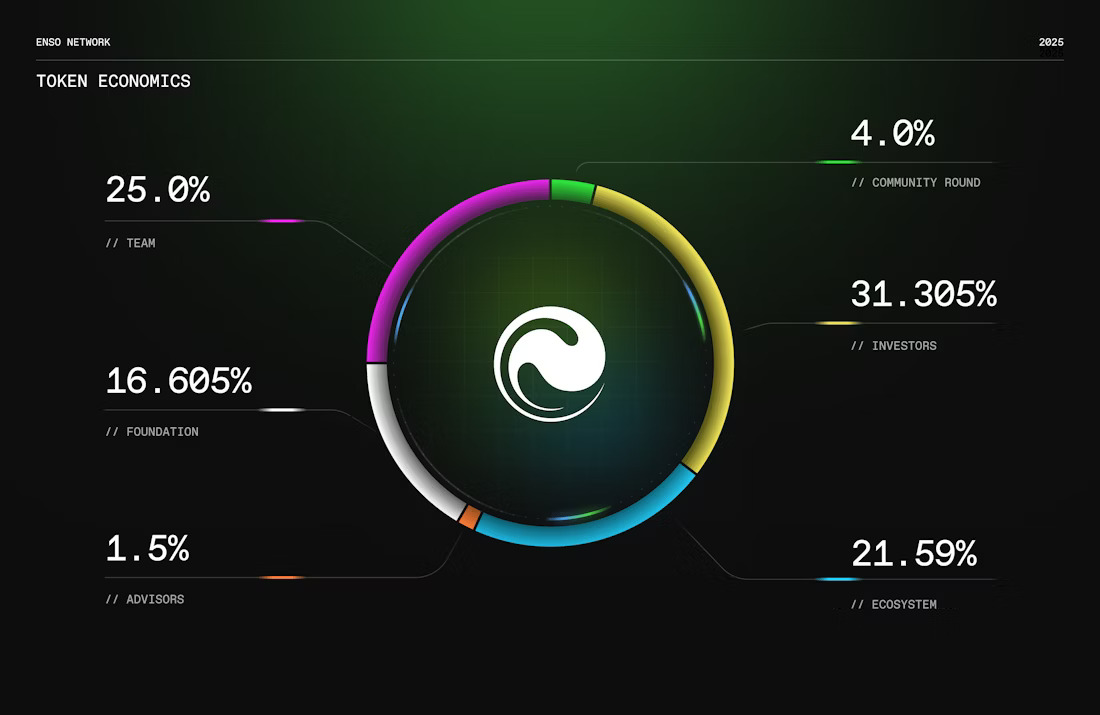

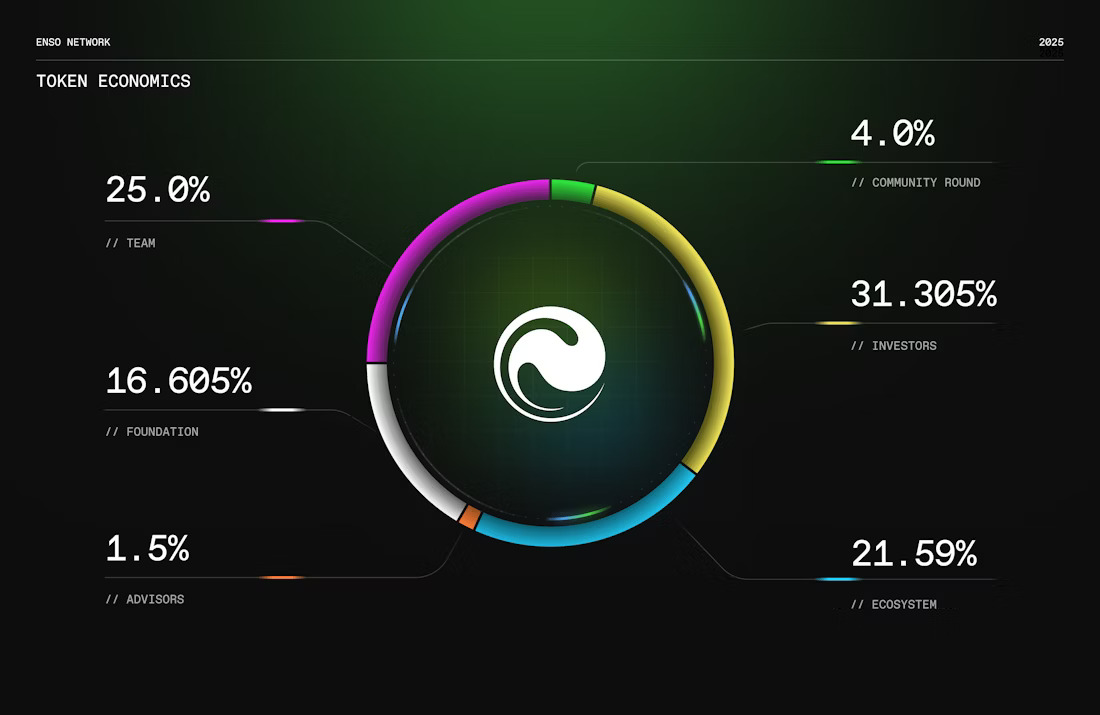

The initial distribution is as follows:

Investors (31.3%), Team (25%), Foundation (23.2%), Ecosystem Treasury (15%), CoinList Public Sale (4%), and Advisors (1.5%). Upon its Binance listing, the circulating supply was 20.59 million ENSO, representing 20.59% of the genesis supply. The token serves several key functions within the ecosystem. Primarily, it is used for

network governance, allowing holders to participate in voting on protocol upgrades and treasury management decisions. Secondly, it supports

staking, where users can stake their tokens to help secure the network. For validators, staking ENSO is mandatory, and it acts as collateral that can be slashed in case of malicious behavior. It is important to note that the tokenomics reveal a significant allocation to investors and the team, a factor that potential holders should consider, as these tokens are typically subject to lock-up periods followed by gradual release, which can influence market dynamics.

Use Cases and Features

Enso's platform enables a wide array of use cases that demonstrate its practical utility in the blockchain space. A primary application is in the

DeFi sector, where it functions as a powerful liquidity layer and strategy automation tool.Users can leverage Enso's "no-code" strategy builder to create and automate complex, multi-protocol investment strategies across different chains without writing a single line of code. This capability positions Enso as a "Zapier for DeFi," significantly lowering the technical barrier for sophisticated on-chain operations. Beyond DeFi, Enso's infrastructure is capable of powering

cross-chain applications in various domains. For instance, it can facilitate the operations of a cross-chain neobank or enable AI agents to manage and move assets across different blockchain ecosystems autonomously. The core features that enable these use cases include its universal API for accessing over 1,000 chains, its composable Shortcuts that can be combined to build complex workflows, and its cross-chain automation engine that allows for managing assets and executing strategies from a single, unified interface. These features collectively make Enso a versatile and powerful tool for developers and end-users alike.

Investment Perspective: Is ENSO a Good Buy?

Evaluating ENSO as a potential investment requires a balanced consideration of its promising technology against its token economic structure. On the positive side, Enso is tackling a critical and growing problem in crypto—interoperability—with a product that has already demonstrated traction by processing billions of dollars in transactions. It's backing by renowned venture capital firms like Polychain, which adds a layer of credibility and resource support. Furthermore, the initial circulating supply is relatively low, which could lead to price volatility driven by supply and demand imbalances in the early stages. However, there are notable risks. The tokenomics are skewed towards investors and the team, who collectively control over 56% of the genesis supply. This concentration means that when lock-up periods expire, the market could experience sustained selling pressure from these insiders. The project also operates in a highly competitive landscape, competing with established players like Yearn Finance, and must continually prove its product-market fit. Market analysts have presented various price scenarios, with a baseline prediction hovering around the

$1.5 - $2.2 range, contingent on the project's ability to meet its development milestones and achieve wider adoption. Therefore, while the technological vision is strong, the investment thesis is complicated by the token distribution, suggesting that a cautious, well-researched approach is necessary.

Recent Developments and News

The most significant recent event for Enso was the coordinated launch of its

mainnet and the listing of the ENSO token on October 14, 2025. A major highlight was its inclusion as the

52nd project on Binance's HODLer Airdrops program. This program distributed 1.75 million ENSO (1.75% of the genesis supply) to eligible Binance users who had staked their BNB. Simultaneously, Binance listed ENSO for spot and perpetual contract trading, offering pairs against USDT, USDC, BNB, FDUSD, and TRY, with leverage of up to 75x on its futures contract. Following the listing, the Enso team activated the token's

staking functionality, allowing users to participate in network security and earn rewards. The mainnet activation is particularly noteworthy as it transitions the project from theory to practice, enabling developers to immediately start building and deploying on the live network. These events have generated substantial discussion within the crypto community about the future of interoperability and have placed Enso at the forefront of this critical technological frontier.

Conclusion

Enso enters the blockchain arena at a critical time. The success of its mainnet and the market's reception of the ENSO token represent a real-world test for its ambitious vision of a unified, interoperable blockchain ecosystem. The project's technical foundation, evidenced by its innovative Shortcut system and growing adoption, is undoubtedly strong and addresses a genuine pain point for developers. However, its long-term success is not guaranteed. The project must navigate the challenges of a competitive market, prove sustained product-market fit, and manage the potential selling pressure from its initial token allocation. Enso represents the ongoing evolution of infrastructure from single-chain to multi-chain and cross-chain paradigms for the broader crypto industry. If it succeeds in making cross-chain development as simple as building on a single network, it could play a foundational role in the next chapter of Web3, helping to onboard the next million developers and users. As with any emerging technology, the path forward will require careful execution, but Enso has positioned itself as a project with the potential to fundamentally reshape how we interact with the blockchain universe.

References:

Enso. (n.d.).

Enso Network Token Overview. Enso Documentation. https://docs.enso.build/pages/network/token

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.