The cryptocurrency market witnessed a significant turbulence around October 11, 2025, leading to massive liquidations across various trading platforms. This event not only shook traders but also ignited a public feud between major exchanges, highlighting a critical yet often overlooked mechanism in derivative trading:

Auto-Deleveraging (ADL)

.

This debate, primarily between decentralized exchange Hyperliquid and centralized giant Binance, underscores a fundamental philosophical divide in risk management approaches within the crypto industry. While ADL acts as the last line of defense for an exchange's solvency, its implementation varies drastically, raising questions about transparency, fairness, and the very nature of decentralized versus centralized finance.

What Is Auto-Deleveraging (ADL)?

Auto-deleveraging is a risk management mechanism applied when a position is closed with a negative equity. If a liquidated position can't be closed at a price higher than the bankruptcy price and the insurance fund is insufficient to cover the negative equity, CoinCatch's ADL system steps in. It automatically deleverages the position of the trader with the highest ranking at the bankruptcy price of the liquidated order.

Example:

Assume Smith has a long position of 10,000 contracts in BTCUSDT at a price of $20,000. Let's assume the liquidation price is set at $19,700 and a bankruptcy price at $19,500.

The mark price falls to $19,000 dramatically and the position gets liquidated. If Smith’s position is closed by the liquidation engine at $19,000, which is even lower than his bankruptcy price, his realized loss is more than the initial margin.

If Smith is trading with a traditional securities broker, he will be chased for excessive loss. However, CoinCatch deploys capital from the insurance fund to cover such losses and Smith is not held liable. In cases where the insurance fund is empty (or insufficient), the ADL mechanism is employed.

How Does the Auto-deleveraging Mechanism Work?

The ADL system identifies and prioritizes traders with the highest rankings for deleveraging. These rankings are determined by their highest profits and the leverage they employ effectively.

Subsequently, the system pairs the chosen profitable positions with liquidation orders. The trader responsible for covering the loss incurs a Maker fee, and the trader whose loss is covered receives a Maker fee rebate. Traders encountering an ADL will be notified via email or SMS and will see all their active orders closed.

Example:

There are 3 short positions on the exchange

Traders Short position Ranking (PNL + Leverage) Precentile

| Trader |

Positions Held |

ADL Ranking |

| A |

10,000 |

1 |

| B |

7,000 |

2 |

| C |

3,000 |

3 |

To match Smith’s 10,000 liquidated long contracts, Trader A, who is ranked the highest in the ADL ranking system will have all the 10,000 short position contracts closed out at Smith’s bankruptcy price of $19,500. After that, his ranking will no longer be at the top percentile.

If there were a loss of 20,000 contracts, then Trader A's 10,000 contracts, followed by B's 7,000 contracts, and C's 3,000 contracts together would be selected, and will get auto-deleveraged at $19,500 in the price plunge. They would receive a notification that all their active orders are closed. They are then free to re-enter the market at their convenience.

The ADL system acts as a last resort, as most exchanges typically have an insurance fund that must be depleted before the ADL mechanism takes over.

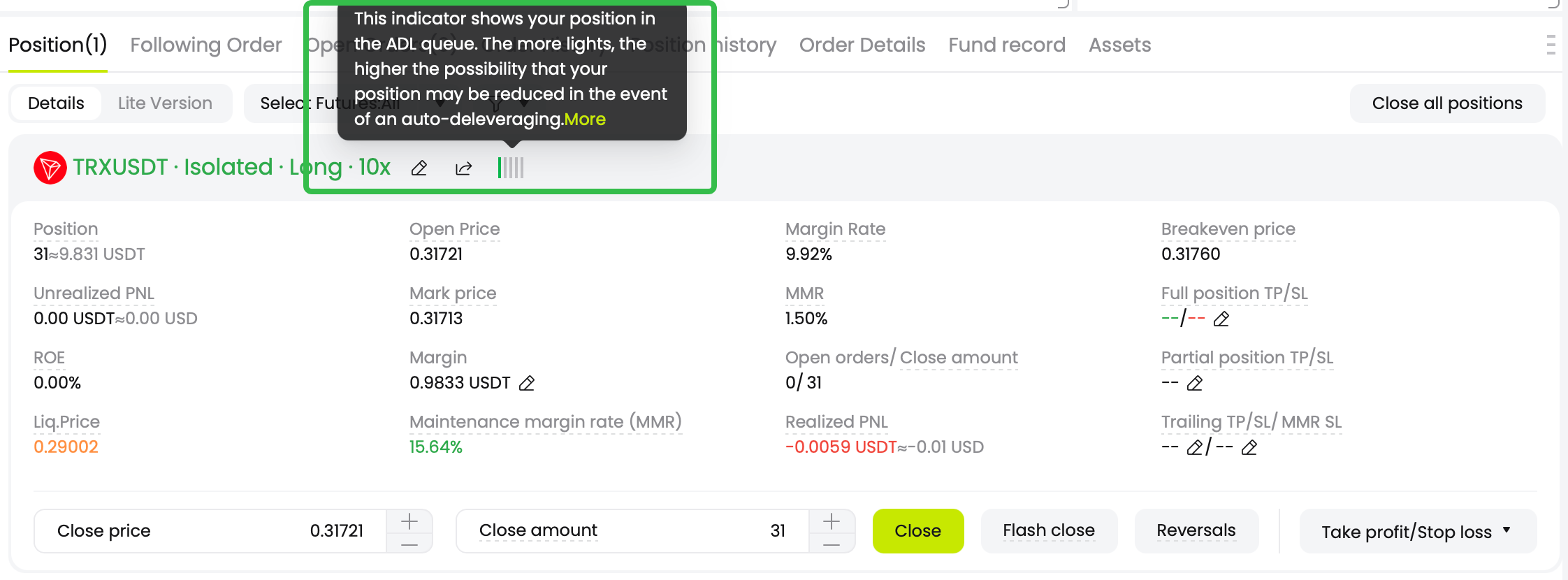

Warning indicator of ADL on CoinCatch.

ADL in Action: A Tale of Two Exchanges

The recent market crash brought the differences in ADL implementation between Hyperliquid and Binance into sharp focus, representing the broader contrast between decentralized and centralized exchange philosophies.

Hyperliquid's ADL: Engineered for Rarity and Transparency

Hyperliquid designed its ADL mechanism to be an extremely rare event. The incident on October 11, 2025, was notable as it was the platform's first activation of a full liquidation mode ADL in over two years of operation.

Its multi-layered safety net triggers only after other defenses fail. When a position falls below the maintenance margin, the system first attempts a standard liquidation on the order book. If depth is insufficient, the position is transferred to the Hyperliquid Liquidity Provider Pool (HLP). ADL is triggered only when the HLP's value turns negative.

A key feature of Hyperliquid's system is its

transparency and decentralized execution. All ADL processes are run automatically via smart contracts on its L1 blockchain, making every step verifiable on-chain and auditable through a block explorer, leaving no room for black-box operations. The platform also does not charge any liquidation fees, and 97% of its trading fees are used to buy back HLP and HYPE tokens, creating a community-aligned ecosystem.

Binance's ADL: A Centralized and Semi-Transparent Approach

Binance's ADL functions as the final safety valve for its USDT-margined futures, activating after its insurance fund is depleted. The trigger is dynamic, depending on the specific contract and market conditions, but essentially occurs when the insurance fund can no longer cover the bankruptcy losses.

Binance uses an

ADL Score to determine the queue for deleveraging. For profitable positions, the score is calculated as

P&L Percentage × Effective Leverage

. A trader with 50% profit and 20x leverage would have a score of 1000, making them a higher priority for forced closure than a trader with 20% profit and 10x leverage (score of 200).

Unlike Hyperliquid's on-chain approach, Binance relies on a

centralized risk control engine and internal servers for execution. While the platform publishes its ranking formula, the specific execution process is not fully visible to outsiders, making it a semi-transparent "black box". However, Binance provides a comprehensive notification system, sending app pushes, emails, and SMS when ADL occurs, and offers a five-level indicator within its trading interface to warn users of their ADL risk level beforehand.

The Great Debate: Transparency vs. Opaqueness in Liquidation

The differing ADL mechanisms sparked a public confrontation, putting the industry's risk management practices under scrutiny.

The Hyperliquid Accusation

Hyperliquid founder Jeff Yan directly accused some centralized exchanges of significantly underreporting user liquidation events. He claimed that on platforms like Binance, "even with thousands of liquidation orders within the same second, they only report one," suggesting that the underreported amount could "easily reach 100 times". This statement struck a nerve, challenging the reporting integrity of major centralized exchanges.

The Centralized Exchange Rebuttal

While not directly quoting Yan, a statement from Binance's founder Changpeng Zhao (CZ) seemed to respond to the broader criticism. He emphasized that while "others try to ignore, hide, deflect responsibility, or attack competitors," key participants in his ecosystem had "come out of pocket with hundreds of millions of dollars to protect users," pointing to "different value systems". This highlighted a centralized platform's claim of taking ultimate financial responsibility to shield its user base.

The Road Ahead for ADL and Risk Management

The recent ADL event and the ensuing debate signal a maturation phase for the crypto derivatives market. Traders are becoming increasingly sophisticated, demanding not just leverage but also clarity on what happens when trades go catastrophically wrong.

Transparency is emerging as a non-negotiable virtue for decentralized platforms like Hyperliquid, which tout their on-chain, verifiable processes as a superior model. In contrast, the

efficiency and user protection claims of centralized giants like Binance continue to attract a massive user base, even amidst concerns about their opaque operations.

The industry's split into two camps, as evidenced by industry figures like Andre Cronje siding with Binance and Solana's Mert supporting Hyperliquid, indicates that this is not just a technical debate but a fundamental ideological one. The future of risk management in crypto will likely involve continued evolution and refinement of both models, driven by user preference for either the transparent, code-is-law approach of DeFi or the managed, custodial experience of CeFi.

Conclusion

Auto-Deleveraging, as the "last line of defense," is a crucial, if unpleasant, component of the leveraged trading ecosystem. Its existence is a reminder of the inherent risks in derivative markets. The dramatic events of October 2025 have brilliantly illuminated the stark contrast between the

transparent, chain-enforced ADL of decentralized exchanges like Hyperliquid and the

centralized, semi-opaque ADL of established players like Binance.

For traders, this serves as a critical lesson: understanding an exchange liquidation waterfall and ADL mechanism is as important as analyzing the market itself. As the industry continues to grapple with these complex risk management challenges, the pursuit of a fair, transparent, and resilient system remains the ultimate goal, ensuring that the ecosystem can withstand even the most violent storms.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.