On September 24, BTC is at $112,561, with limited rebound momentum and a weak overall trend; ETH rebounded to $4,178, but is still suppressed by the medium-term and short-term moving averages; the market is generally sideways, and investors are cautiously watching the market. Meanwhile, Spot Ethereum ETF volumes have reached 15% of the total ETH spot market volume. Stablecoin giant Tether is looking to raise between $15 billion and $20 billion for about a 3% stake in the company through a private placement. Binance founder Changpeng Zhao (CZ) confirmed that $200,000 has been frozen at HTX following an SFUND bridge exploit.

Crypto Market Overview

BTC (-0.37% | Current Price: $112,561.26)

Bitcoin fell 0.37% to $112,561 over the past 24h. It briefly dipped below the

$112,500 support level earlier today, potentially exposing it to further downside risk towards

$110,000. Cautious remarks from Federal Reserve Chair Jerome Powell regarding interest rate cuts, coupled with anticipation for the upcoming US Personal Consumption Expenditures (PCE) index (a key inflation gauge), are contributing to the cautious market sentiment. A significant liquidation event earlier this week, estimated at $1.5 billion, triggered forced selling across derivative markets and intensified bearish sentiment. The Relative Strength Index (RSI) is below the neutral 50.0 mark, indicating stronger bearish momentum. The cryptocurrency market is displaying mixed signals, with overall investor confidence still not very strong, particularly among long-term holders. The Fear & Greed Index is currently at 39, indicating fear in the market. On September 23rd, BTC ETFs saw a net outflow of $130.8 million, including $75.6 million outflow from Fidelity's FBTC.

ETH (-0.8% | Current Price: $4,178.77)

Ethereum fell 0.8% over 24h, aligning with broader crypto weakness (-0.56%) and extending a 7-day decline of 8.24%. A $1.8B crypto long liquidation event on September 23 hit ETH hardest, with over $500M in ETH positions closed (Bitget). This coincided with ETH testing $4,150 support, triggering margin calls, which means extreme altcoin leverage (ETH/BTC ratio hit yearly lows) amplified selling. Traders rushed to exit positions as ETH’s 24h funding rate turned negative (-0.006%), signaling bearish sentiment.

ETH broke below the $4,350 pivot and 100-hour SMA, activating sell signals. Fibonacci levels suggest $4,092.40 as next support. Breakdown the data: RSI 39.19 (14-day): Approaching oversold but not yet signaling reversal; MACD histogram -46.42: Bearish momentum confirmed; Traders now eye the 200-day SMA ($2,900) as critical long-term support. ETH ETFs saw $140.8M outflows on September 23 , reversing prior institutional accumulation trends. While ETFs still hold 6.3M ETH, short-term outflows mirror BTC’s 4-day ETF outflow streak. Market-wide fear (CMC Fear & Greed Index: 39) likely drove profit-taking.

Altcoins

The Fear and Greed Index is now at 39, indicating that market sentiment is biased to the downside. The current Altcoins Season Index of 70 indicates that altcoins have entered a critical window before accelerating their upward trend . Despite buoyant market sentiment and continued capital inflows, investors should be wary of regulatory risks, market divergence, and the ripple effects of Bitcoin's volatility. Investment strategies should focus on cost-effective assets, avoid blindly chasing rising prices, and closely monitor changes in macroeconomic and industry policies. Traders should be aware that funds may be seeking localized opportunities. For example, the strongest performing sectors today, CeFi and SocialFi, may be driven by specific positive news.

Macro Data

This Friday, the US PCE inflation data will be released. This is the core indicator that the Federal Reserve closely monitors. The results of the data will directly affect market expectations of the Fed's future policies, triggering a new round of volatility. Federal Reserve Chairman Powell has struck a cautious tone in recent remarks. Despite cutting interest rates last week, he hinted that subsequent cuts will be very cautious. This hawkish stance on rate cuts has raised market concerns that liquidity won't return quickly. Gold is currently trading at $3,774.91, up 0.92%. On September 24, the S&P 500 declined by 0.55% to 6,656.92 points; the Dow Jones Industrial Average decreased by 0.19% to 46,292.78 points, and the Nasdaq Composite decreased by 0.95% to 22,573.47 points.

Trending Tokens

SIGN Sign (+24.22%, Circulating Market Cap: $133.79 Million)

SIGN is trading at $0.09913, up approximately 24.22% in the past 24 hours. Sign is building global infrastructure for credential verification and token distribution with two products: 1) Sign Protocol: An omni-chain attestation protocol that powers digital public infrastructure for governments and functions as a foundational layer for decentralized apps. 2) TokenTable: A smart contract-based platform for token distribution, including airdrops, vesting, and unlocks. Sign’s Orange Dynasty SuperApp entered final testing phases with 30% of SIGN’s total supply allocated to user rewards. The app combines Web3 identity verification with social features, driving engagement through its "Oranges" points system (Sign Protocol docs). While the app could increase utility demand, 411M SIGN tokens sit on exchanges – the highest ever – suggesting holders might sell into rallies. Success hinges on converting speculative interest into actual product usage post-launch.

FLOCK FLock.io (+24.05%, Circulating Market Cap: $75.33 Million)

FLOCK is trading at $0.3300, up approximately 24.05% in the past 24 hours. FLock.io is the first decentralised AI training platform, combining Federated Learning and blockchain technology to revolutionise AI model development. By enabling secure, privacy-preserving model training without centralising data, FLock empowers communities to collaboratively create, train, and own AI models. Its ecosystem includes AI Arena for competitive model training, FL Alliance for privacy-preserving collaboration, and an AI Marketplace for deploying and refining models. FLOCK trades at $0.332, above its 30-day SMA ($0.322) but below the 7-day SMA ($0.328). The RSI (48.07) shows neutral momentum, while the MACD histogram (-0.0105) hints at short-term bearish pressure. Bulls defended the $0.30–$0.32 support zone during the weekly dip. A sustained break above the 7-day SMA ($0.328) could target the 50% Fibonacci retracement level at $0.456.

GMX GMX (+18.91%, Circulating Market Cap: $178.56 Million)

GMX is trading at $17.40, up approximately 18.91% in the past 24 hours. GMX is a leading decentralized exchange (DEX) for trading perpetual swaps with up to 100X leverage on popular cryptocurrencies like

BTC,

ETH and more. The platform launched in September 2021 on the Ethereum Layer-2 blockchain Arbitrum. To date, GMX has a total trading volume of over $277B and 728K total users, making it the leading derivatives DEX on Arbitrum and Avalanche. GMX broke above its 23.6% Fibonacci retracement level ($16.46) and pivot point ($16.07), with RSI14 at 61.89 signaling growing momentum. The move above $16.48 (24h high) triggered algorithmic buying, amplified by a 459% spike in trading volume. MACD histogram at +0.117 confirms bullish divergence.

Market News

Ethereum ETFs Now Account for 15% of Spot Market Volume, Up from 3% at Launch

Spot Ethereum ETF volumes have reached 15% of the total ETH spot market volume, marking a significant increase from the 3% share observed in November 2024, about three months after the ETFs debuted.

This steady climb reflects growing institutional and retail preference for regulated exposure to Ethereum rather than direct token ownership, eliminating custody and security concerns associated with self-managed wallets. The ETF structure enables traditional investors to gain ETH exposure through familiar brokerage accounts, significantly expanding the addressable market beyond crypto-native participants.

The shift toward ETF-based exposure presents both opportunities and trade-offs for the Ethereum ecosystem. ETFs have contributed to Ethereum's strong price performance, with ETH rising over 30% year-to-date to approximately $4,500, as institutional capital flows through regulated investment vehicles. However, this growth comes at the cost of decentralization, as large amounts of ETH are concentrated in ETF provider custody rather than distributed across individual wallets participating in DeFi protocols.

Tether Looking to Raise Up to $20B, Bringing its Valuation to $500B

Stablecoin giant Tether is looking to raise between $15 billion and $20 billion for about a 3% stake in the company through a private placement, Bloomberg reported, citing two people familiar with the matter. The massive raise would bring its valuation to around $500 billion, putting it in the same league as OpenAI and SpaceX, Bloomberg reported. Tether would be issuing new equity, and Cantor Fitzgerald is acting as lead adviser.

Tether's USDT has a market cap of around $172.8 billion, making it the largest among stablecoins. Circle, which recently went public in the U.S., is the issuer of USDC, which has the second-largest market cap of $74 billion, according to CoinMarketCap data.

The report of the raise comes as Tether recently reported $4.9 billion in net profit in the second quarter and held over $162.5 billion in reserves against $157.1 billion in liabilities. It also holds about $8.9 billion in bitcoin in its reserves. Bloomberg said that the talks of the deals are in the early stages, and the final numbers of the raise could be significantly lower. According to the report, prospective investors have been given access to a data room over the past few weeks to facilitate the deal.

CZ Confirms $200K Frozen After $1.7M Seedify SFUND Bridge Exploit

Binance founder Changpeng Zhao (CZ) confirmed that $200,000 has been frozen at HTX following an SFUND bridge exploit. The hack targeted Meta Alchemist’s bridge and OFT contract, allowing attackers to mint new tokens and transfer them across multiple chains.

The majority of the stolen funds were sold on BNB Chain, where SFUND holds its largest user base. According to Meta Alchemist, the attackers currently control more than $1.2 million on BNB Chain, affecting approximately 64,000 holders.

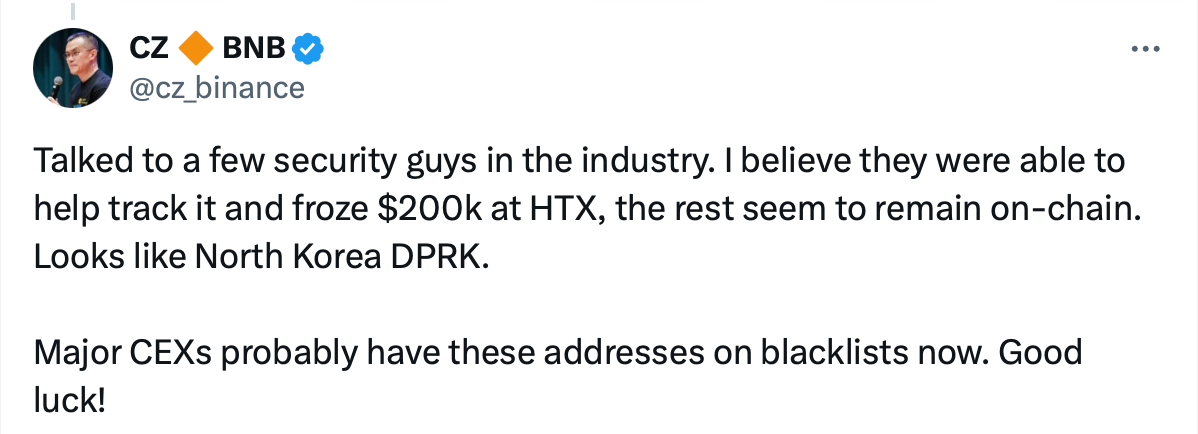

In response, CZ stated that he had spoken with security experts across the industry following the breach. He confirmed that $200,000 connected to the exploit was frozen at HTX. However, most of the stolen assets remain on-chain.

“Looks like North Korea DPRK,” CZ wrote on X, adding that major centralized exchanges had blacklisted the wallet addresses linked to the exploit. CZ’s comments suggest possible ties to North Korea, which has been implicated in several high-profile cryptocurrency thefts.

Source: cz_binance X account

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.