The decentralized finance (DeFi) landscape has witnessed remarkable innovation in recent years, particularly in the realm of derivatives trading. Among the most compelling success stories to emerge is Avantis (AVNT), a groundbreaking perpetual contracts decentralized exchange (perps DEX) that has rapidly ascended to become the largest derivatives platform on Coinbase's Base blockchain. Since its mainnet launch in February 2024, Avantis has consistently demonstrated impressive growth, processing over $18 billion in cumulative trading volume and serving more than 38,500 traders across 80+ markets. The platform's recent listing on major exchanges like Binance, Upbit, and Bithumb in September 2025 catalyzed a dramatic price surge, with its native AVNT token achieving an all-time high of $1.56 and single-day trading volumes exceeding $1.5 billion. This article explores the architectural innovations, token economics, and market position that make Avantis a potentially transformative force in the decentralized derivatives space, offering unparalleled access to both crypto and real-world assets (RWA) through a unique synthetic leverage engine.

Overview of Avantis

-

-

Ticker: $AVNT

-

Type: ERC20

-

Chain: Base

-

-

-

-

Total Supply: 100,000,000 AVNT

-

Token Contract Address (Base): 0x696F9436B67233384889472Cd7cD58A6fB5DF4f1

-

-

-

Supported DEX: Uniswap, Camelot

What Is Avantis (AVNT)?

Avantis is a decentralized derivatives protocol operating on the Base blockchain that enables users to trade perpetual contracts across a diverse range of assets using stablecoin collateral. Unlike traditional decentralized exchanges that focus primarily on cryptocurrency pairs, Avantis has established itself as a comprehensive "Universal Leverage Layer" where traders can gain exposure to not only digital assets like Bitcoin and Ethereum but also traditional financial instruments including foreign exchange pairs (forex), commodities (gold, crude oil), and U.S. stock indices. This expansive approach positions Avantis uniquely at the intersection of decentralized finance (DeFi) and real-world assets (RWA), making it the largest protocol in both derivatives trading and RWA market making on the Base ecosystem.

The platform's core innovation lies in its ability to abstract away individual order books, instead creating a synthetic trading environment where any asset with reliable price information can be listed and traded with leverage of up to 500x. This eliminates the need for separate liquidity pools for each trading pair, significantly improving capital efficiency while maintaining deep liquidity across all markets. Since its inception, Avantis has attracted over 25,000 liquidity providers who have collectively contributed more than $23 million in total value locked (TVL), facilitating the execution of over 2 million trades for tens of thousands of active traders.

Table: Avantis Key Performance Metrics (September 2025)

| Metric |

Value |

Description |

| Cumulative Trading Volume |

$18+ billion |

Total value of all trades executed on the platform since launch |

| Active Traders |

38,500+ |

Number of unique addresses that have traded on the platform |

| Total Value Locked (TVL) |

$23 million |

Amount of liquidity provided to the protocol across all vaults |

| Number of Markets |

80+ |

Supported trading pairs, including 22 RWA assets |

| Liquidity Providers |

25,000+ |

Unique addresses providing liquidity to the protocol's vaults |

How Does Avantis Work?

Architectural Foundation: The Synthetic Engine

At the heart of Avantis lies a capital-efficient synthetic engine that fundamentally reimagines how derivative trading occurs on blockchain networks. Instead of matching buyers and sellers through traditional order books, Avantis pairs each trader against a unified USDC liquidity vault that acts as the counterparty to all transactions. This vault aggregates deposits from thousands of liquidity providers, creating a massive pool of collateral that backs every position on the platform. When a trader opens a position—whether long or short—the protocol essentially creates a synthetic representation of that trade against the shared liquidity pool, eliminating the need for finding a matching counterparty while ensuring instant execution regardless of market conditions.

Risk-Transformed Liquidity Provision

Avantis introduces a sophisticated risk-tiering system that allows liquidity providers to select their preferred level of exposure and potential returns. The protocol offers two primary tranches:

Junior Vault: This pool absorbs the first 65% of losses and receives 65% of fee revenue in exchange for higher potential returns. Designed for risk-tolerant providers seeking maximized yields, the Junior Vault currently offers approximately 20% annualized returns for 180-day lockups.

Senior Vault: This more conservative option bears up to 35% of losses and receives 35% of fee revenue. It appeals to providers preferring stable, lower-risk yields while still contributing to the protocol's liquidity backbone.

Liquidity providers can further customize their participation through time-based locks (30, 90, or 180 days), with longer commitments generating proportionally higher fee shares. This design mirrors the concentrated liquidity models popularized by Uniswap V3 but adapts them specifically for perpetual contract risk management.

Innovative Trader Incentives and Alignment

Avantis incorporates several groundbreaking mechanisms that align the interests of traders and liquidity providers:

Zero Transaction Fees: Unlike traditional exchanges that charge upfront trading fees, Avantis only collects a percentage of profitable trades upon closure. This creates a unique alignment where the protocol only profits when traders succeed.

Loss Rebates: Traders who take positions opposite to imbalanced open interest (helping to stabilize platform exposure) can receive up to 20% of their losses rebated. This encourages market behaviors that reduce systemic risk.

Positive Slippage: When trader orders improve the vault's risk profile (such as closing heavily skewed positions), Avantis provides entry prices better than market rates. This "better-than-market" execution rewards traders for enhancing protocol stability.

Fundraising Info About Avantis

Avantis's development and growth have been supported by substantial institutional backing through multiple funding rounds. The project is developed and operated by Lumena Labs, a specialized development studio with team members hailing from prestigious organizations including Pantera Capital, McKinsey, Lazard, and Barclays. This blend of traditional finance expertise and blockchain-native experience has been instrumental in designing Avantis's sophisticated risk management architecture.

In September 2023, the project completed a $4 million seed round led by Pantera Capital, with participation from Founders Fund, Galaxy Digital, and the Base Ecosystem Fund. This initial funding supported the platform's development and mainnet launch in February 2024. Following a successful first year of operation with impressive traction, Avantis secured an additional $8 million in Series A funding in June 2025. This round was co-led by Pantera Capital and Peter Thiel's Founders Fund, with participation from Symbolic Capital and SALT Fund, bringing the total raised to $12 million.

These funds have been strategically allocated toward technological enhancements—including expansion into stocks, sports, and other asset categories, the development of a custom EVM-compatible chain to improve trading speed, and ecosystem growth initiatives. The continued support from major investors underscores confidence in Avantis's vision to become the universal leverage layer for both crypto and real-world assets.

Tokenomics of Avantis

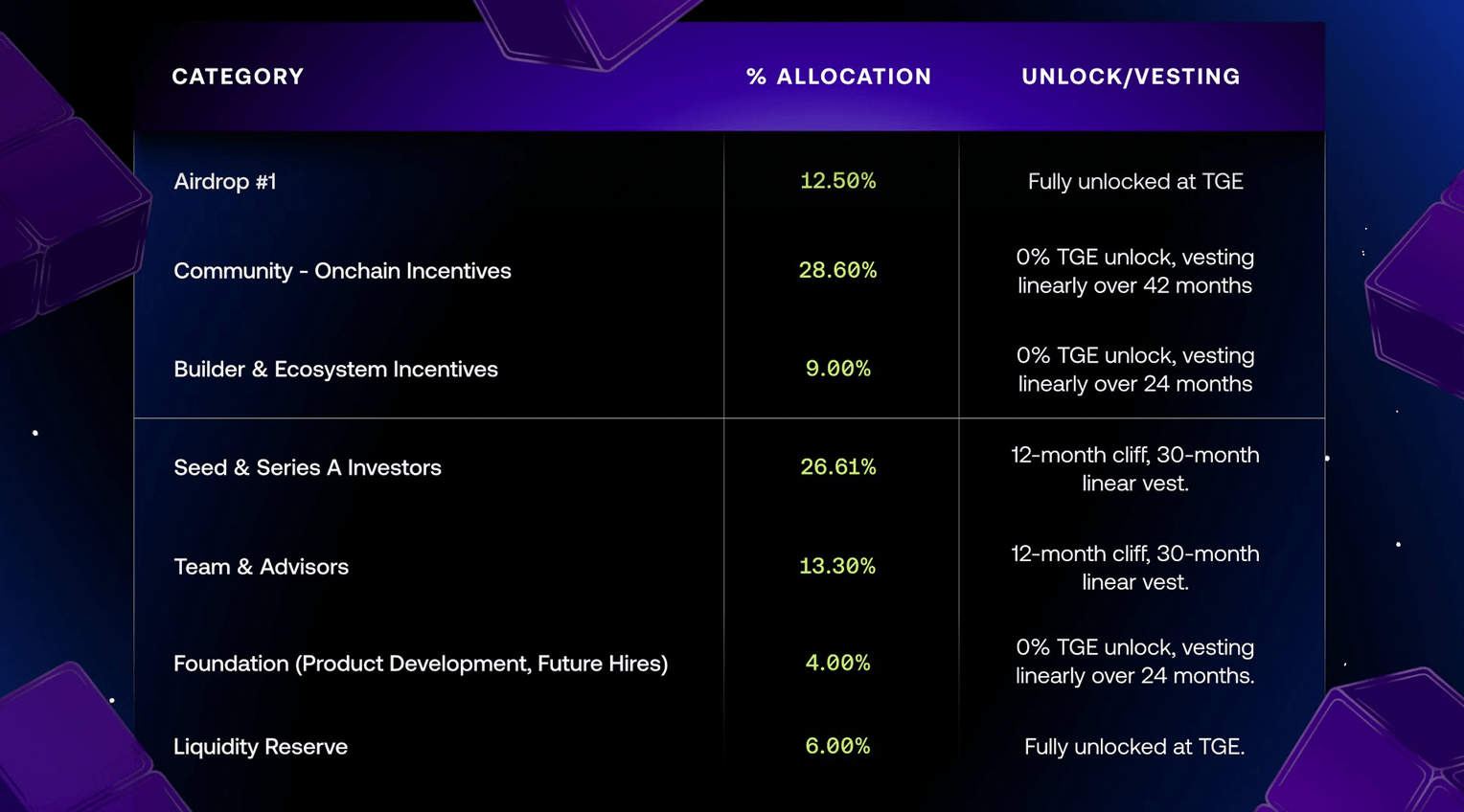

The AVNT token serves as both the governance and utility token within the Avantis ecosystem, with a fixed total supply of 1 billion tokens. The token distribution has been carefully designed to prioritize community ownership and long-term protocol development:

The AVNT token fulfills several critical functions within the ecosystem:

Security and Staking: Holders can stake AVNT in the protocol's security module to provide backstop liquidity during extreme market conditions. In return, stakers receive AVNT rewards and trading fee discounts.

Governance: Token holders gain voting rights on protocol decisions, including asset listings, fee structures, buyback programs, and cross-chain deployment strategies.

Community Incentives: More than half of the total token supply is dedicated to rewarding traders, liquidity providers, referrers, and builders who contribute to the ecosystem's growth.

The project conducted its Token Generation Event (TGE) in early September 2025, distributing 12.5% of the total supply to early protocol users through an airdrop. This significant allocation to community rewards reflects Avantis's commitment to decentralized governance and broad-based token distribution.

Is Avantis (AVNT) Worth Buying?

Evaluating Avantis as a potential investment requires considering both its innovative technology and market position alongside the inherent risks of emerging DeFi protocols. Several factors suggest strong fundamental value:

Market Leadership: Avantis has established itself as the largest derivatives platform on Base blockchain and the leading RWA trading and market-making DEX. This first-mover advantage in synthetic derivatives across both crypto and traditional assets represents a significant competitive moat.

Sustainable Token Utility: Unlike many DeFi tokens with limited utility, AVNT serves essential functions within the ecosystem—providing security through staking, enabling governance participation, and offering fee discounts to active users. This creates inherent demand drivers beyond speculative trading.

Institutional Backing: The $12 million in funding from top-tier investors like Pantera Capital and Founders Fund demonstrates serious institutional confidence in the team's vision and execution capability.

Growing Traction: With over $18 billion in cumulative trading volume and more than 38,500 traders, Avantis has demonstrated product-market fit in the rapidly expanding decentralized derivatives space.

However, potential investors must also consider several risks:

Market Volatility: As with all crypto assets, AVNT is subject to significant price volatility. The token's recent listing on major exchanges has already triggered substantial price movements, reaching an all-time high of $1.56 before experiencing some correction.

Regulatory Uncertainty: The regulatory status of synthetic asset trading and derivative products remains uncertain in many jurisdictions. Evolving regulations could impact platform operations.

Smart Contract Risk: As with all DeFi protocols, Avantis carries inherent smart contract risks that could be exploited by malicious actors.

Competitive Landscape: The DeFi derivatives space is increasingly competitive, with established players like dYdX and new entrants constantly innovating.

Despite these risks, Avantis's unique approach to synthetic derivatives, strong institutional backing, and early traction suggest it occupies a distinctive position in the evolving DeFi landscape. For investors believing in the future of decentralized derivatives and the convergence of traditional and crypto finance, AVNT represents exposure to a protocol with substantial growth potential.

Conclusion

Avantis represents a significant evolution in decentralized derivatives trading, successfully creating a unified platform for exposure to both crypto and real-world assets through its innovative synthetic engine. By replacing traditional order books with a unified liquidity vault and implementing sophisticated risk-tiering for liquidity providers, the protocol achieves unprecedented capital efficiency while maintaining deep liquidity across 80+ markets. The recent listing of its AVNT token on major exchanges including Binance, Upbit, and Bithumb—triggering a dramatic price increase and exceeding $1.5 billion in daily trading volume—demonstrates strong market recognition of its technological innovations.

What distinguishes Avantis in an increasingly crowded DeFi landscape is its pioneering work in bringing real-world assets on-chain through a derivatives framework, positioning itself at the forefront of the RWA narrative that many believe will drive the next major wave of crypto adoption. The protocol's carefully designed tokenomics, which allocate majority ownership to the community while maintaining sufficient resources for continued development, creates sustainable alignment between all ecosystem participants.

While investing in emerging DeFi protocols like Avantis carries inherent risks, its unique value proposition, institutional backing, and early traction suggest it has the potential to remain a major player in the decentralized derivatives space. As the protocol continues to expand its asset offerings, enhance its risk management framework, and potentially expand to additional blockchain networks, Avantis is well-positioned to capture growing demand for sophisticated on-chain trading products that bridge the gap between traditional and decentralized finance.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.