The convergence of artificial intelligence (AI) and blockchain technology represents one of the most transformative developments in the digital economy, and OpenLedger has emerged as a pioneering force in this space. OpenLedger is an Ethereum-compatible Layer 2 network built on OP Stack and EigenDA that aims to create a transparent, decentralized ecosystem for AI data and model development. Its native token, OPEN, debuted spectacularly on Binance on September 8, 2025, surging over 200% on its first trading day and capturing significant market attention. This performance underscores the growing investor interest in projects that address critical challenges in AI development, particularly data transparency, fair compensation for contributors, and the democratization of AI innovation. OpenLedger's vision is to "redefine the AI economy" much like Bitcoin redefined money and Ethereum redefined finance, positioning itself at the forefront of a potential multi-billion dollar market at the intersection of AI and blockchain. This article explores OpenLedger's technology, tokenomics, market performance, and future potential in the rapidly evolving decentralized AI landscape.

What Is OpenLedger?

OpenLedger is a

decentralized AI blockchain platform designed to create a transparent and equitable ecosystem for data contributors, AI model developers, and users. Unlike traditional AI development dominated by large tech companies with opaque data practices, OpenLedger introduces a

verifiable and reward-based system that ensures all contributors are fairly compensated for their inputs. At its core, OpenLedger addresses the fundamental "data problem" in AI, where high-quality training data is essential but often poorly compensated and attributed by creating a marketplace where data becomes a monetizable asset with clear provenance and ownership.

Proof of Attribution is a cryptographic mechanism that ensures data contributions are transparently linked to AI model outputs. This system maintains an immutable record of contributions, ensuring that contributors receive proper credit and rewards based on the impact of their data.

Proof of Attribution enables,

Verifiable Data Contributions: Ensures that every data point used in AI models can be traced back to its contributor.

Immutable Record Keeping: Data contributions are permanently recorded on-chain, preventing unauthorised modifications.

Reward Mechanisms: Contributors receive incentives based on the significance of their data for each inference.

Transparency and Trust: Ensures that AI-generated outputs are backed by verifiable data sources, reducing misinformation.

OpenLedger's ecosystem consists of several crucial components:

Datanets (domain-specific data repositories for high-quality data collection),

Specialized Language Models (SLMs) (focused AI models trained on specific datasets),

Model Factory (a no-code tool for AI model fine-tuning), and

OpenLoRA (a deployment engine for efficient AI model operation). These elements work together to create a comprehensive environment for decentralized AI development that challenges the centralized paradigms currently dominating the AI industry.

How Does OpenLedger Work?

OpenLedger operates through a sophisticated three-layer architecture that enables its decentralized AI economy. The

Datanet Layer serves as the data management foundation, collecting and curating high-quality data from various sources. These Datanets are community-driven networks where users can create and share datasets for training AI models, ensuring diverse and valuable data resources. The

Payable AI Models Layer functions as the AI integration component, transforming specialized AI models into systems that can measure value and distribute rewards to contributors. Finally, the

Agent Layer deploys and runs AI agents using specialized models, serving as the environment where agents operate and connecting users with the broader AI ecosystem.

The platform's core operational mechanism is the

Proof of Attribution (PoA) system, which leverages blockchain technology to track and reward data providers and model developers transparently. When a user contributes data or improves a model, PoA verifies and records this contribution on-chain, ensuring that when the data or model is used in AI training processes, the contributor receives automatic compensation based on the influence and value of their input. This creates a

self-sustaining economic flywheel where increased model usage leads to greater rewards for contributors, which in turn attracts more high-quality data and model improvements, further enhancing the ecosystem's value.

OpenLedger also incorporates innovative technical components such as the

Model Factory, which allows users to fine-tune Large Language Models (LLMs) using OpenLedger datasets through a graphical user interface without coding experience. The

OpenLoRA system enables efficient deployment of multiple AI models on a single GPU through lightweight fine-tuning, significantly reducing computational costs. For end-users, OpenLedger provides intuitive interfaces, including integration with Trust Wallet that allows approximately 200 million users to execute Web3 commands via AI-powered voice or text instructions, making decentralized AI accessible to mainstream audiences.

Overview of OPEN Tokens

What Is OPEN?

OPEN is the native utility token of the OpenLedger ecosystem, serving as the fundamental economic unit that powers all transactions and interactions within the platform. It is an

ERC-20 token with a maximum supply capped at

1 billion units, of which approximately 21.55% (215.5 million OPEN) was in circulation at launch. The token functions as both a

utility token (for transactions, payments, and access to services) and a

governance token (allowing holders to vote on protocol upgrades, parameter adjustments, and ecosystem development decisions).

Applications of OPEN

The OPEN token has multiple critical applications within the ecosystem. First, it serves as the

gas tokenfor network transactions, including paying for computation, model training, and inference services. Second, it facilitates

reward distribution through which data contributors and model developers are compensated for their contributions to the ecosystem. Third, OPEN tokens are used for

staking and governance, allowing holders to participate in key protocol decisions and earn potential rewards. Additionally, the token provides

access to premium features and advanced AI tools within the OpenLedger ecosystem, creating demand through utility. The recent integration with Trust Wallet also enables OPEN to power AI features for millions of users, expanding its use cases beyond the core platform.

OPEN Tokenomics

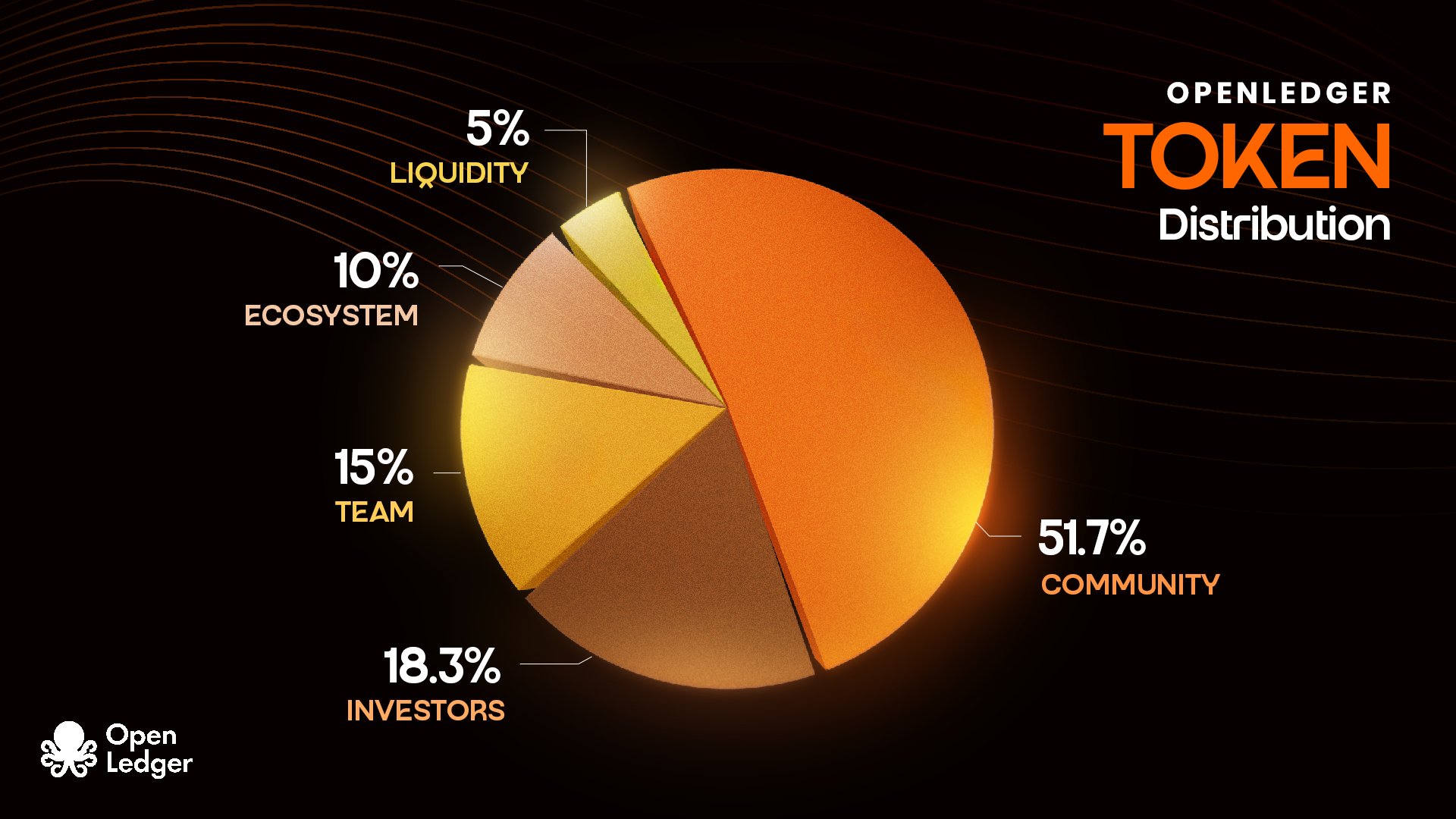

OPenLedger Tokenomics. Source: OpenLedger X Account

OpenLedger's tokenomic model is designed to balance incentives for various stakeholders while ensuring long-term sustainability. The token distribution allocates

51.7% to community rewards, 10% to the ecosystem fund, 18% to investors, 15% to the team, and 5% to liquidity provisions. A significant feature of tokenomics is the

vesting scheduledesigned to prevent market flooding: community and ecosystem allocations have a 48-month linear release, while team and investor tokens have a 12-month cliff followed by a 36-month vesting period.

The project implemented a

phased airdrop through Binance's HODLer campaign, distributing 10 million tokens (1% of total supply) at launch with another 15 million scheduled for distribution six months later. The tokenomics also incorporates

scarcity mechanisms such as supply halving events tied to user milestones, potentially creating deflationary pressure as adoption increases. With only 21.55% of tokens initially circulating and approximately 33% locked for team and early investors (subject to 12-month lock-up periods), the tokenomics are structured to minimize early selling pressure while aligning long-term incentives among all stakeholders.

Price Prediction and Market Analysis

Market Performance and Analysis

OPEN token demonstrated extraordinary market performance upon its Binance debut on September 8, 2025, surging

over 200% in its first trading day and reaching a price of approximately

$1.45. This explosive start reflected strong market interest in AI-blockchain convergence projects and the limited initial circulating supply of tokens. The token's market capitalization quickly reached

$312 million, while its fully diluted valuation (FDV) stood at approximately

$1.5 billion, indicating high growth expectations embedded in its valuation.

Market analysts attribute strong initial performance to several factors: the strategic Binance listing with multiple trading pairs (OPEN/USDT, OPEN/USDC, OPEN/BNB, OPEN/FDUSD, OPEN/TRY), the HODLer airdrop program that created immediate buying interest, and the compelling AI-blockchain narrative that aligns with current market trends. Technical analysis suggests that the $1.00 level has emerged as a crucial support zone, with maintaining this threshold being critical for future price stability. The relatively low circulating supply (21.55%) creates conditions for potential volatility, as limited availability can amplify both upward and downward price movements.

Price Prediction

Based on current market analysis and projections, OPEN's price trajectory shows potential for gradual appreciation if the platform achieves its adoption milestones. For

2025, price predictions suggest a range between $1.00-$2.00, with an average around $1.50, representing stability after the initial volatility. By

2026, if ecosystem development progresses well, prices could average near $2.00 with potential highs reaching $2.40, supported by expanded partnerships and adoption.

Looking further ahead,

2027 might see consolidation with prices stabilizing above $1.80 and potentially testing the $2.90 region. By

2028, with broader integration of blockchain-based AI infrastructure, OPEN could rise toward $3.20, sustained by platform maturity and increased utility.

2029 could witness further gains toward $3.90, potentially benefiting from broader crypto market cycles. By

2030, if OpenLedger establishes itself as a significant player in the AI economy, prices could approach $4.50, representing substantial growth from initial levels.

It's important to note that these predictions are speculative and depend on numerous factors including overall market conditions, platform adoption rates, regulatory developments, and technological execution. The significant difference between current market cap ($312M) and fully diluted valuation ($1.5B) suggests that token price may face headwinds unless the ecosystem achieves substantial growth to justify its valuation.

Conclusion

OpenLedger represents an ambitious attempt to redefine the AI economy through blockchain technology, addressing critical issues of data transparency, fair attribution, and decentralized innovation. Its core innovation: the Proof of Attribution mechanism offers a promising solution to the longstanding challenge of properly compensating data contributors and model developers in the AI ecosystem. The project's strong market debut, strategic partnerships, and comprehensive tokenomics suggest significant potential for growth and adoption.

However, OpenLedger faces substantial challenges on its path to success. The platform must achieve meaningful adoption beyond initial hype, requiring demonstration of practical utility and competitive advantages over alternative solutions. It operates in an increasingly competitive landscape where both blockchain natives and traditional tech giants are investing heavily in AI infrastructure. Additionally, regulatory uncertainties and the technical complexities of scaling a decentralized AI platform present ongoing challenges that the team must navigate.

For the broader market, OpenLedger's progress will be an important case study in the convergence of AI and blockchain technologies. Its success or failure could influence investment patterns and development approaches in this emerging sector. Investors and users should monitor key metrics such as platform adoption rates, model quality improvements, partnership announcements, and token utility expansion to assess OpenLedger's long-term viability.

While OpenLedger's vision of a transparent, equitable AI economy is compelling, its realization remains uncertain and dependent on execution quality, market conditions, and competitive dynamics. As with any emerging technology project, potential participants should approach with cautious optimism, conducting thorough research and understanding the risks involved in decentralized systems and cryptocurrency investments.

References:

OpenLedger Foundation [@OpenledgerFdn]. (September 4, 2025).

We're excited to share our latest updates on OpenLedger's Proof of Attribution mechanism! This is a game-changer for AI data traceability [Post]. X. Retrieved September 10, 2025, from

https://x.com/OpenledgerFdn/status/1963376400016048600

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.