The meme coin market has evolved from a niche internet phenomenon to a significant segment of the cryptocurrency ecosystem. By 2025, meme coins have transcended mere speculative assets, incorporating sophisticated tokenomics, utility-driven features, and community-centric models. With the total market capitalization of meme coins exceeding $100 billion, these assets are attracting both retail and institutional interest. This article explores the strategies to maximize investment potential in meme coins, covering their fundamentals, investment mechanisms, and risks.

What Are Meme Coins?

Meme coins are cryptocurrencies inspired by internet memes, jokes, or cultural trends. Unlike traditional cryptocurrencies like Bitcoin, which emphasize technological innovation, meme coins derive their value primarily from community engagement, viral marketing, and cultural relevance. Examples include Dogecoin (DOGE), Shiba Inu (SHIB), and newer entrants like BullZilla ($BZIL) and Little Pepe ($LILPEPE). These coins often start as humorous concepts but can evolve into projects with tangible utility, such as gaming integrations, decentralized finance (DeFi) features, or non-fungible token (NFT) ecosystems.

Why Are Meme Coins Popular?

Meme coins gain popularity due to their low entry cost, potential for high returns, and strong community-driven narratives. Their appeal lies in:

Cultural Resonance: Coins like Pepe ($PEPE) leverage existing internet culture, creating instant recognition and engagement.

Virality: Social media platforms like X (formerly Twitter) and Reddit amplify hype, enabling rapid price movements.

Inclusive Participation: Low per-token prices allow small investors to hold large quantities, fostering a sense of ownership and community.

Speculative Opportunities: High volatility attracts traders seeking short-term gains, while structured incentives like staking reward long-term holders.

How Presales Work: Early Investment

Presales offer early access to tokens at discounted prices before they list on public exchanges. Projects like BullZilla ($BZIL) and Arctic Pablo Coin ($APC) use presales to raise capital and build community momentum. For example:

-

BullZilla’s Presale: Implemented a "Mutation Mechanism," where token prices increased every $100,000 raised or every 48 hours. Early investors could achieve returns of up to 91,576%.

-

Arctic Pablo Coin: Offered a 300% bonus in its Stage 39 presale, turning a $100 investment into $400 worth of tokens.

-

Presales often include anti-sniper bot protection, zero-tax trading, and vesting periods to prevent immediate dumping.

Benefits of Participating in Presales

-

Discounted Prices: Early investors can acquire tokens at lower costs.

-

Community Building: Presales attract a dedicated group of supporters.

-

Structured Growth: Gradual price increases incentivize early participation.

Scarcity-Driven Tokenomics: Burns and Deflationary Models

Deflationary mechanisms are critical to sustaining value. Projects reduce token supply through burns, increasing scarcity and potential value. Examples include:

BullZilla’s Roar Burn: Permanently destroyed 5% of tokens at each presale milestone, reducing total supply by up to 70%.

Turbo ($TURBO): Used AI-assisted token burns to mimic Bitcoin’s scarcity model.

Bonk (BONK): Implemented deflationary tokenomics on Solana, with burns and buybacks to counter inflation.

Staking Rewards and APY Incentives

Staking allows investors to earn passive income by locking tokens, often with high annual percentage yields (APY). This reduces sell pressure and stabilizes prices. Notable examples:

BullZilla’s HODL Furnace: Offered up to 70% APY for staking tokens for 1–3 months.

Arctic Pablo Coin: Provided 66% APY during its presale, enabling investors to compound rewards before exchange listings.

Layer Brett ($LBRETT): Featured staking APYs ranging from 2,400% to 55,000%, attracting early adopters.

Narrative-Driven Branding and Storytelling

Strong narratives enhance cultural relevance and investor loyalty. Projects like MAGACOIN FINANCE combined political themes with token scarcity, raising $13 million from 14,000 participants. Similarly, BullZilla used a 24-chapter "cinematic lore" to tie financial milestones to storytelling, creating emotional engagement.

Community Engagement and Viral Marketing Strategies

Community is the backbone of meme coins. Successful projects prioritize:

Social Media Activism: Platforms like X and Reddit drive hype, as seen with Bonk ($BONK), which saw a 10% price jump due to whale accumulation and community buzz.

Referral Programs: BullZilla’s "Roarblood Vault" rewarded users for bringing in new investors.

Interactive Events: Pudgy Penguins ($PENGU) hosted airdrops and gaming events to maintain engagement.

Gamified Features: Mine-to-Earn Systems

Gamification enhances user retention. Projects like AI Companions ($AIC) integrated AI-driven gamification, allowing users to monetize interactions with characters. Pudgy Penguins launched "Pudgy Party," a mobile game where players could earn and trade NFTs, tapping into the $200 billion gaming industry.

Cross-Chain Functionality and Zero-Fee Trading

Interoperability expands accessibility. Little Pepe ($LILPEPE) operated on an Ethereum-compatible Layer-2 chain, enabling low fees and fast transactions. Similarly, Pudgy Penguins ($PENGU) supported Ethereum and Solana wallets, allowing cross-chain use for NFTs and merchandise. Zero-tax trading, as seen in Little Pepe, reduced barriers for retail investors.

Political Meme Coins

Coins like Official Trump ($TRUMP) leveraged political narratives, with prices fluctuating based on election news. These coins attract investors seeking to capitalize on geopolitical events. However, they face heightened volatility and regulatory risks.

Integration with NFTs and Metaverse Ecosystems

NFT integrations add utility and value. Pudgy Penguins ($PENGU) linked its token to a popular NFT collection, enabling real-world utility through licensed merchandise sold in retailers like Walmart. Shiba Inu (SHIB) expanded into the metaverse, allowing tokens to purchase virtual land.

Comparing New Meme Coins with Established Ones

FeatureNew Meme Coins (e.g., BullZilla, Little Pepe)Established Meme Coins (e.g., DOGE, SHIB)TokenomicsDeflationary burns, staking APYStatic supply, limited utility

InnovationLayer-2 integration, gamificationReliant on brand recognition

Risk vs. RewardHigh potential returns (e.g., 1000x) but higher riskLower volatility but slower growth

Community EngagementStructured incentives (e.g., referral programs)Organic, viral growth

Risks and Considerations for Meme Coin Investments

Volatility: Prices can swing by over 20% daily, leading to significant gains or losses.

Regulatory Uncertainty: Projects may face scrutiny, as seen with Trump-related coins.

Scams and Rug Pulls: Projects like HAWK Token collapsed by 90% in hours, highlighting the need for due diligence.

Overhyped Narratives: Coins without utility may fail long-term.

Investors should use strategies like dollar-cost averaging (DCA) and stop-loss orders to manage risk.

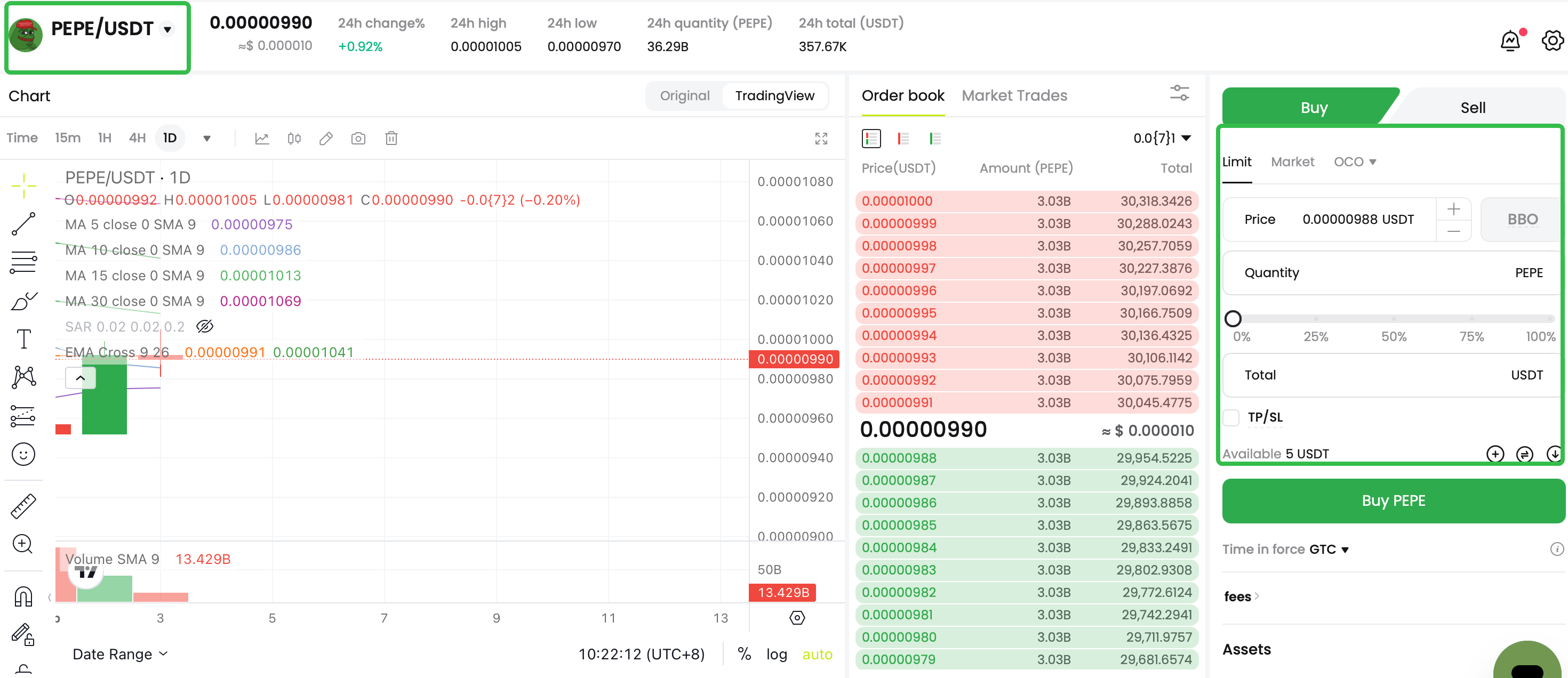

How to Buy Meme Coins on CoinCatch

Purchasing meme coins on CoinCatch is simple. Here are the steps:

Create an Account: If you don't already have an account with CoinCatch,

please create one using your user account.

Deposit Funds: You can transfer money to your CoinCatch account using any accepted means, such as P2P trading.

Buy TREE/USDT: Go to the trading section, type memecoin ticker, and then place an order to buy them. Please note that you can select between a market and a limit order if you wish to do so.

Conclusion

Meme coins represent a high-risk, high-reward asset class driven by community, innovation, and cultural trends. By focusing on projects with deflationary tokenomics, staking incentives, and strong narratives, investors can maximize potential gains while managing risks. As the market evolves, meme coins like BullZilla and Pudgy Penguins are bridging the gap between speculation and utility, offering new opportunities for growth. However, due diligence and risk management remain paramount to navigating this volatile landscape.

References: