Prediction markets have long been theorized as powerful tools for aggregating collective wisdom about future events.

Polymarket

, a decentralized prediction market platform, has emerged as a leading force in turning this theory into a practical, global reality. By allowing users to trade on the outcomes of real-world events—from elections to financial markets—Polymarket creates a dynamic, data-driven pulse on collective expectations. Its journey, particularly regarding U.S. regulation and recent strategic moves, offers a compelling lens through which to view the evolution of decentralized finance (DeFi) and prediction markets. This article explores Polymarket's features, its role in event forecasting, regulatory developments, and why it demands investor attention.

What is Polymarket?

Launched in

2020, Polymarket is a decentralized prediction market platform built on

blockchain technology (primarily Ethereum, Polygon, and Solana) that allows users to trade shares based on the outcomes of real-world events. These shares, tied to binary (Yes/No) or multiple outcomes, are priced between $0 and $1, reflecting the market's collective probability assessment of that event occurring. If the predicted outcome happens, "Yes" shares settle at $1; otherwise, they become worthless.

Trading on Polymarket is conducted using the USDC stablecoin, ensuring price stability and mitigating the volatility often associated with other cryptocurrencies. The platform charges a 2% commission solely on successful winnings.

Key Features and Advantages of Polymarket

Polymarket's design offers several distinct features and advantages:

Decentralization and Transparency: Operating on smart contracts across multiple blockchains, all transactions and market resolutions are

publicly verifiable, reducing counterparty risk and enhancing trust.

High Predictive Accuracy: Research suggests Polymarket forecasts have been notably accurate, reaching

90% a month before events and 94% in the final hours. This leverages the "wisdom of the crowd" effect.

Permissionless and Global Access: Anyone with a compatible crypto wallet (e.g., MetaMask, OKX Wallet) can participate, fostering a diverse user base. However, access restrictions exist for users with IP addresses from specific jurisdictions, such as Russia.

Liquidity Rewards and Staking Yields: Polymarket incentivizes users who provide liquidity to markets through its

daily reward program. Additionally, it offers up to

4% annualized yield for holding positions in designated markets, funded by its treasury.

Diverse Market Categories: Users can trade on events in politics, sports, cryptocurrency, economics, entertainment, and current affairs.

Polymarket in Action: US Election Forecasting

Polymarket gained significant traction during the

2024 U.S. Presidential Election, attracting millions of dollars in volume as users traded on various election-related outcomes. Markets allowed users to bet on the winners of specific states, the overall election winner, and even niche scenarios.

This real-time, money-weighted sentiment gauge often provided an alternative perspective to traditional polls. The platform's performance during such high-stakes events demonstrated its utility as a

real-time sentiment visualization tool and solidified its reputation.

The CFTC No-Action Letter

A pivotal moment for Polymarket and U.S. prediction markets came on

September 3, 2025, when the CFTC's Divisions of Market Oversight and Clearing and Risk issued a

no-action letter to QCX LLC (a designated contract market) and QC Clearing LLC (a derivatives clearing organization).

This letter stated the CFTC staff would not recommend enforcement action against these entities for failing to comply with certain swap data reporting and recordkeeping requirements for specific event contracts executed on QCX and cleared through QC Clearing. This provided crucial, albeit limited,

regulatory clarity for certain event contracts facilitated through a regulated pathway.

It's critical to note this was a no-action letter, not blanket approval. It applies narrowly to the specific circumstances described and does not preclude future CFTC action. Nevertheless, it was widely interpreted as a significant step towards regulatory acceptance for prediction markets under the CFTC's framework.

Polymarket's regulatory developments occur amidst a shifting U.S. regulatory landscape for digital assets. The current administration has been characterized as fostering a more favorable environment for

crypto innovation. Furthermore, the CFTC and SEC have worked to

streamline crypto trading rules, creating a more hospitable environment for registered platforms.

However, challenges remain.

State-level jurisdictions continue to challenge the legality of prediction markets under gambling laws, creating a fragmented regulatory landscape.

Why Should Investors Pay Attention to Polymarket?

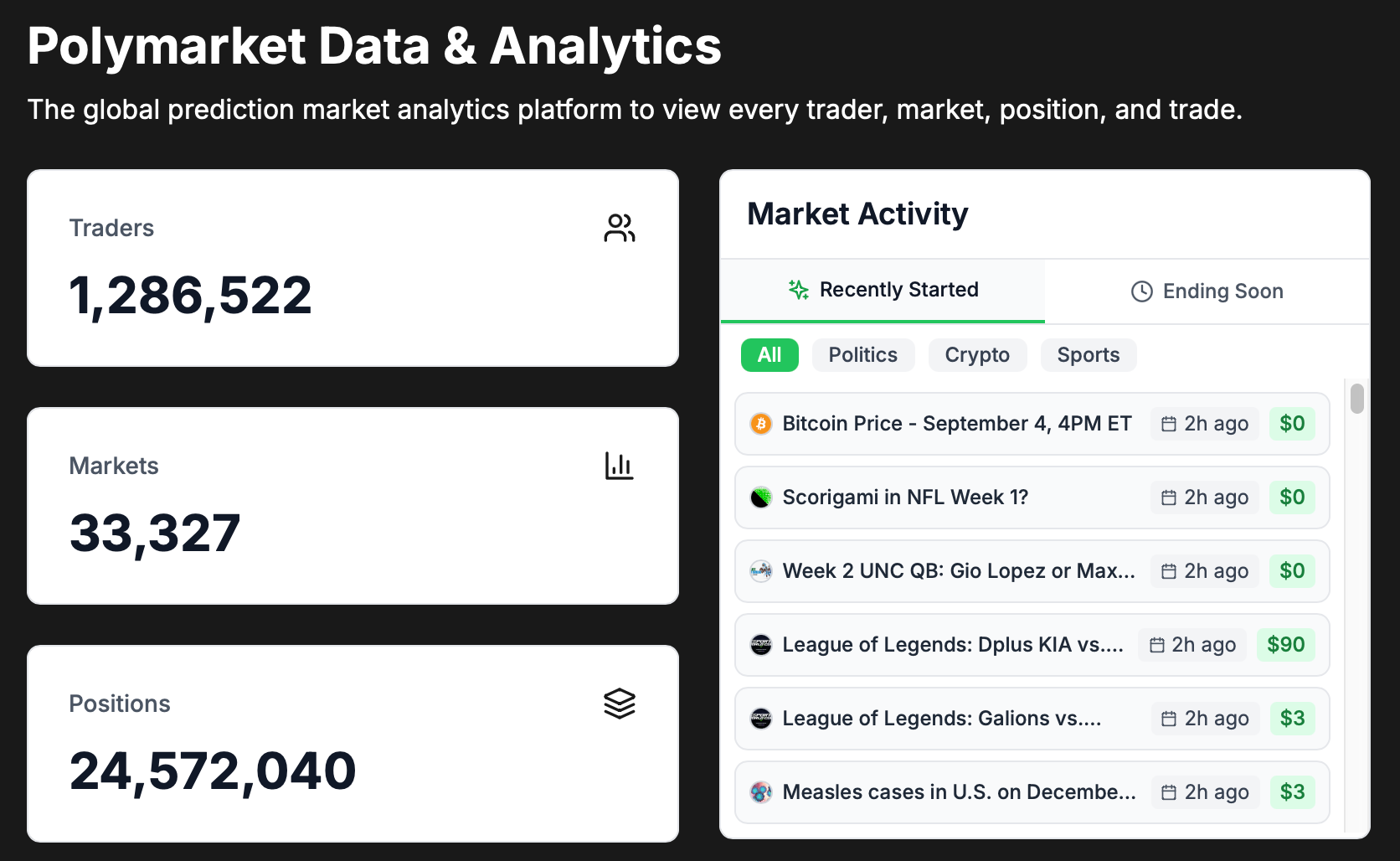

Polymarket Data. Source: Polymarket Analytics

For investors, Polymarket presents unique opportunities:

Novel Asset Class: It offers exposure to a new type of event-driven derivative, uncorrelated with traditional financial markets.

Hedge Against Real-World Risk: Businesses and individuals could theoretically use these markets to hedge against specific event risks (e.g., regulatory outcomes, election results).

High Growth Potential: The prediction market industry is projected to grow significantly, with one report estimating it could reach

$95.5 billion by 2035. Polymarket, as a leader, is well-positioned to capture this growth.

Yield Generation Opportunities: The platform provides avenues for earning yield through liquidity provisioning and staking, appealing to DeFi investors.

Polymarket’s Strategic Acquisition of QCX

Prior to the no-action letter, Polymarket executed a key strategic move. In July 2025, it acquired

QCX, a CFTC-licensed derivatives exchange and clearinghouse, for

$112 million.

This acquisition was central to Polymarket's strategy for

regulatory compliance in the U.S. By operating through a licensed entity, Polymarket gained a potential pathway to offer services to U.S. customers in a more compliant manner, addressing previous regulatory challenges. This move, coupled with the resolution of earlier investigations by the U.S. Department of Justice and CFTC, laid the groundwork for its efforts to re-enter the U.S. market.

Comparing Polymarket with Competitors

The competitive landscape for prediction markets includes both decentralized and centralized players.

| Feature |

Polymarket (Decentralized) |

Kalshi (Centralized) |

| Regulatory Status |

Operates globally, acquiring licenses (e.g., via QCX), recent CFTC no-action letter |

CFTC-regulated registered exchange |

| Access |

Permissionless, global (with restrictions) |

Restricted to U.S. residents (where legal) |

| Technology |

Blockchain-based (Ethereum, Polygon, Solana) |

Traditional centralized platform |

| Currencies |

USDC (crypto-native) |

U.S. Dollars (fiat) |

| Market Scope |

Very broad (politics, crypto, sports, etc.) |

Broad, but subject to CFTC approval |

Kalshi, a CFTC-regulated platform, is a major competitor in the U.S. Its recent $2 billion valuation and substantial funding round underscore institutional belief in this sector's legitimacy. Polymarket differentiates itself through its decentralized, global, and crypto-native nature, while Kalshi appeals to a more traditional U.S. user base comfortable with a fully regulated environment.

The Future of Prediction Markets

The future of prediction markets appears bright. Industry projections suggest significant growth, potentially reaching

$95.5 billion by 2035. As platforms like Polymarket mature and regulatory clarity improve, we can expect:

Institutional Adoption: Use for corporate risk management and real-time sentiment analysis.

Mainstream Integration: Deeper integration with broader financial ecosystems and social platforms.

Enhanced Products: Development of more sophisticated derivative products based on event outcomes.

Continued Regulatory Evolution: Ongoing efforts to define the legal status of various event contracts across jurisdictions.

Conclusion

Polymarket has established itself as a pioneering force in decentralized prediction markets. Its core strengths: transparency, global access, and innovative incentive mechanisms coupled with recent strategic moves like QCX acquisition and the ensuing CFTC no-action letter have positioned it for potential significant growth. While regulatory hurdles persist, the trend appears to be moving towards greater acceptance, at least within certain frameworks.

For investors and observers, Polymarket represents more than a betting platform; it's a fascinating experiment in collective intelligence, a potential new financial instrument for hedging event risk, and a bellwether for the ongoing integration of blockchain technology into mainstream finance. Its journey will undoubtedly continue to be a key narrative in the evolving stories of DeFi, regulation, and the eternal human desire to forecast the future.

Referrence:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.