The blockchain oracle sector has experienced a remarkable transformation in 2025, with

Pyth Network (PYTH)

emerging as a standout performer. Its native token surged nearly

70% in a single day

following a historic announcement from the U.S. Department of Commerce. This article provides a comprehensive analysis of Pyth Network, exploring its technology, tokenomics, recent price performance, strategic partnerships, and future outlook within the rapidly evolving blockchain infrastructure landscape.

Project Overview

Pyth Network is a

decentralized oracle protocol originally launched on the Solana blockchain in 2021. Unlike traditional oracles that often rely on third-party data aggregators, Pyth distinguishes itself by sourcing

first-party financial data directly from some of the world's largest exchanges, market makers, and financial service providers. This approach ensures high-fidelity data with minimal latency, making it particularly valuable for time-sensitive DeFi applications.

The network has expanded significantly since its inception, now supporting

over 40 blockchain through the Wormhole protocol. It provides more than

1,300 real-time price feeds covering cryptocurrencies, stocks, ETFs, forex, and commodities. The protocol's unique architecture enables price updates as frequently as

every 400 milliseconds, making it one of the fastest oracle solutions on the market.

Pyth's recent adoption by the U.S. government for publishing official economic data on-chain represents a significant milestone not just for the project but for the entire blockchain industry. This endorsement has positioned Pyth as a critical bridge between traditional finance and decentralized applications, validating its technology at the highest levels of institutional acceptance.

Technology and Architecture

Pyth Network operates on its own application-specific blockchain called

Pythnet, a fork of the Solana blockchain that leverages Solana's high throughput and efficiency. The network utilizes a

Proof-of-Authority (PoA) consensus mechanism where data providers run validator nodes, staking their reputation to ensure data integrity.

One of Pyth's core technological innovations is its

pull-based design. Unlike push-based oracles that regularly broadcast data to chains regardless of demand, Pyth allows applications to request data on-demand when needed. This model reduces gas costs by approximately

90% compared to traditional oracle models and minimizes unnecessary blockchain congestion.

The network employs sophisticated

data aggregation methods that combine inputs from multiple first-party providers to generate a single reliable price feed for each asset. This aggregation process includes outlier detection and validation mechanisms to ensure data accuracy and resist manipulation attempts.

Pyth offers four main products that extend beyond basic price feeds:

Price Feeds: Real-time market data across 40+ blockchain assets

Express Relay: MEV protection that connects protocols directly with searchers for fairer execution

Entropy: Secure random number generation for NFTs, gaming, prediction markets, and lotteries

Project Categories & Use Cases

Pyth Network primarily serves the

decentralized finance (DeFi) sector, where accurate and timely financial data is critical for protocol functionality and security. Its use cases include:

Derivatives Trading Platforms: Protocols requiring precise real-time pricing for leveraged products, options, and futures contracts

Lending Protocols: Platforms that need accurate price feeds to determine collateralization ratios and liquidation thresholds

Algorithmic Trading: High-frequency trading applications that depend on low-latency data execution

Real World Assets (RWA): The tokenization of traditional assets like stocks, commodities, and bonds requires reliable oracle infrastructure

The network has also found applications beyond DeFi in areas such as:

Gaming and NFTs: Through its Entropy product that provides verifiable randomness

Insurance: Where accurate external data is needed to trigger policy payments

Prediction Markets: Which rely on trustworthy outcome resolution data

With the recent U.S. government partnership, Pyth has expanded into a new category of

official statistical distribution, delivering verified economic data including GDP figures directly to blockchain networks.

Tokenomics

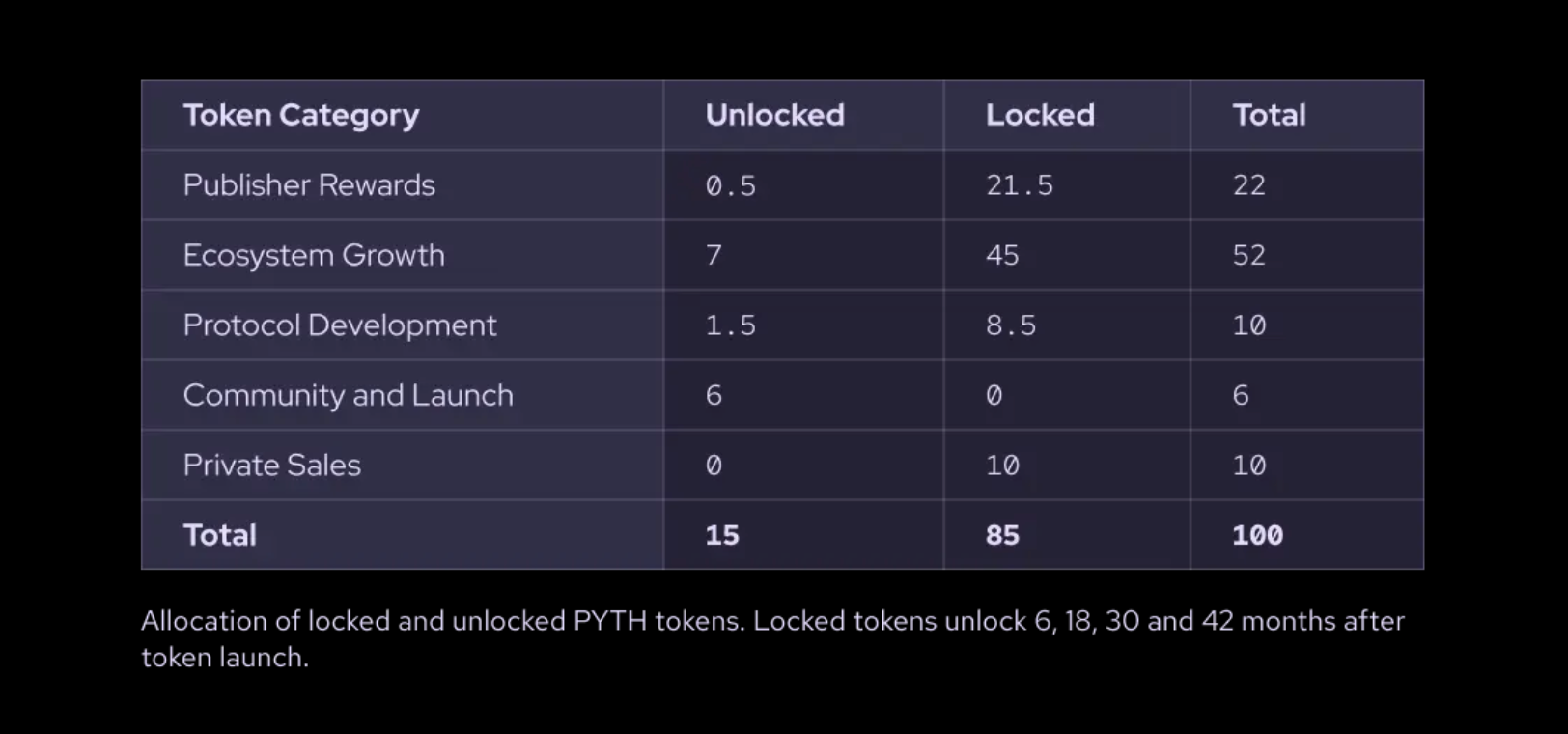

PYTH Token Distribution Table. Source: Pyth Network

PYTH token serves as the native utility and governance token of the Pyth Network with a

maximum supply of 10 billion tokens. The token distribution is allocated as follows:

Ecosystem Growth: 52%

Publisher Rewards: 22%

Protocol Development: 10%

Private Sales: 10%

Community and Launch: 6%

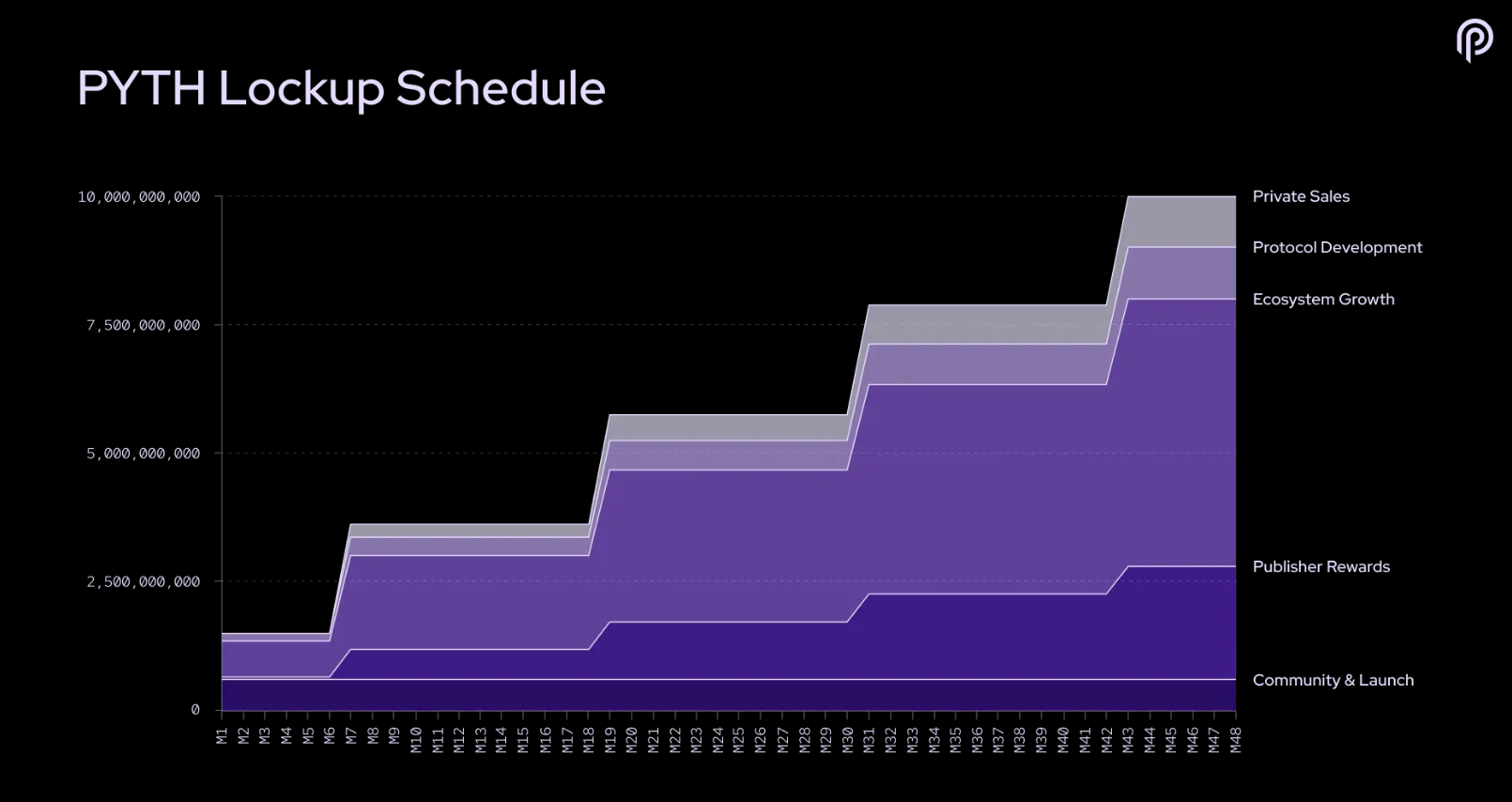

PYTH Token Lockup Schedule. Source: Pyth Network

At launch,

1.5 billion tokens were unlocked for circulation, with the remaining tokens subject to a structured vesting schedule over 6, 18, 30, and 42 months. This gradual unlock mechanism aims to promote long-term network stability and sustainability.

The PYTH token has three primary functions within the ecosystem:

Governance: Token holders can stake their PYTH to participate in on-chain governance votes concerning network parameters, fee structures, and future developments.

Incentivization: Data providers receive PYTH tokens as rewards for supplying accurate and timely price data to the network.

Ecosystem Development: The token supports funding for new integrations, partnerships, and applications built on Pyth.

A significant token unlock is scheduled for September 20, 2025, involving

236 million tokens (approximately 2.36% of total supply). While such unlocks can create selling pressure, the market impact may be mitigated by growing demand from the network's expanding use cases.

Price Analysis

PYTH has demonstrated exceptional price performance in recent days. The token surged approximately

70% in a single day following the U.S. Department of Commerce announcement, breaking through a year-long downward channel pattern.

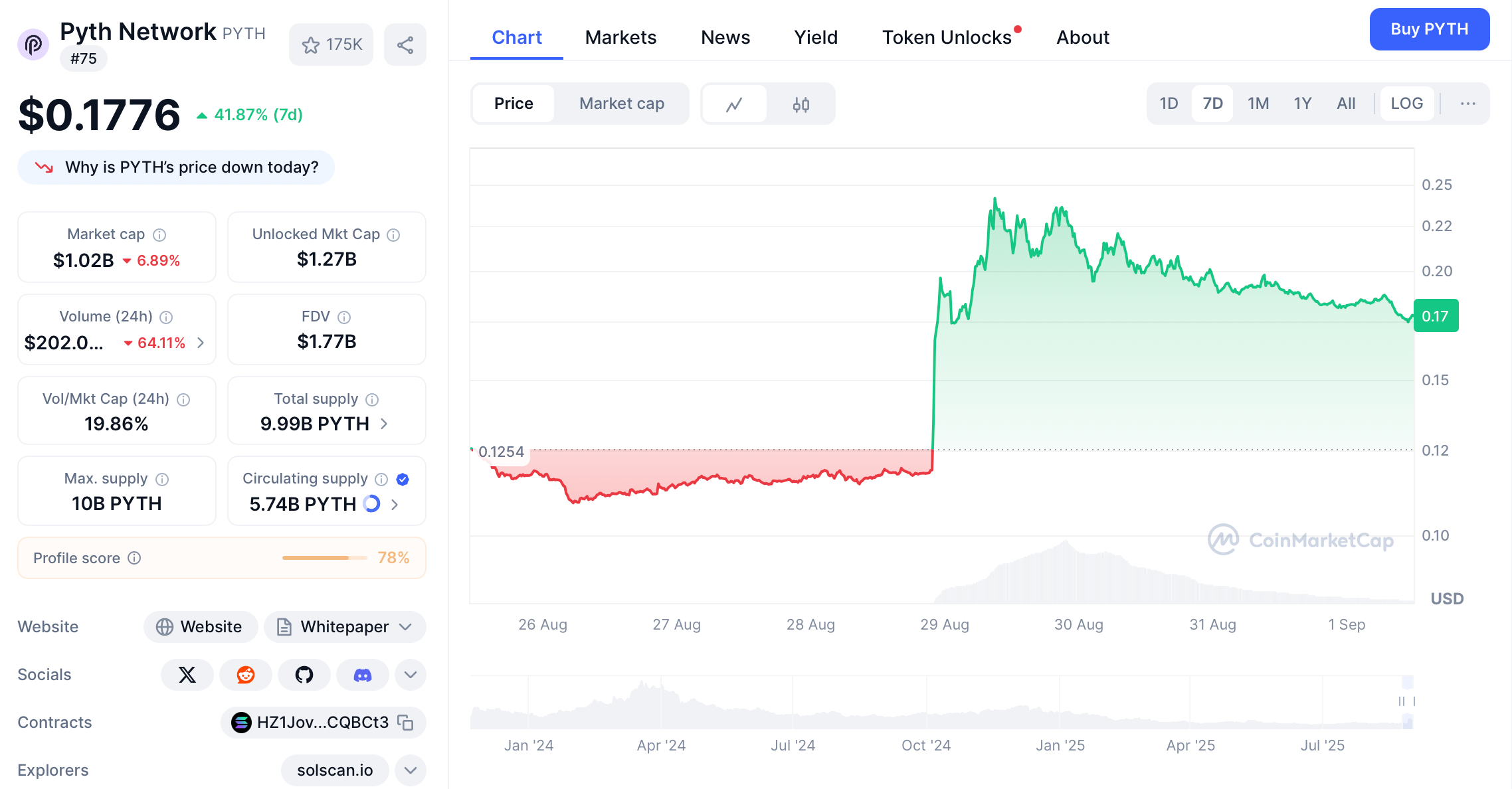

PYTH Price(September 1, 2025). Source: CoinMarketCap

At the time of writing, PYTH is trading around

$0.17, showing consolidation after its dramatic upward move. Technical indicators suggest bullish momentum may continue:

-

The

Relative Strength Index (RSI) is near 74, indicating strong buying pressure without being severely overbought

-

The

Moving Average Convergence Divergence (MACD) remains in positive territory with expanding histogram bars, confirming bullish momentum

-

All key

Exponential Moving Averages (EMAs) have turned bullish, with the 20-day EMA providing strong support around $0.13

-

The

Supertrend indicator flipped bullish at $0.17, aligning with the new bottom established during the recovery

Analysts suggest that if PYTH can maintain support above the

$0.18-$0.20 level, it could potentially target

$0.30-$0.35in the near term. The parabolic SAR dots have moved below the price action, validating the bullish reversal structure.

Fundraising and Financial Backing

Pyth Network originated from an incubator project operated by

Jump Crypto, the cryptocurrency division of Jump Trading Group. This connection to traditional trading provided Pyth with crucial access to institutional data providers from its inception.

In 2023, the Pyth development team established

Douro Labs to oversee the project's development. The leadership includes CEO Michael Cahill, COO Ciarán Cronin, and CTO Jayant Krishnamurthy, all with backgrounds in Jump Trading and extensive experience in financial markets and software engineering.

The project has implemented a

comprehensive grants program to encourage ecosystem development. In May 2024, the Pyth Data Association announced a

50 million PYTH (approximately $21 million at current prices) ecosystem grants program divided into three categories: community grants, research grants, and developer grants. These grants aim to support community members who contribute to Pyth's growth through education, research, and development initiatives.

Risks and Considerations

Despite its strong fundamentals and recent successes, Pyth Network faces several potential risks:

Token Unlocks: The scheduled unlock of 236 million tokens in September 2025 could create selling pressure if not met with sufficient demand

Centralization Concerns: The network relies on a curated set of institutional data providers, which some critics argue compromises decentralization compared to permissionless oracle networks

Team Token Allegations: Recent on-chain data tracking platform reports suggest possible undisclosed "pre-mined tokens" by the core development team. Within two hours, team addresses reportedly transferred 44.86 million PYTH tokens to 12 unknown wallets, raising community concerns about token distribution fairness and potential selling pressure

Competition: Pyth operates in a competitive oracle space dominated by established players like Chainlink, which continues to innovate and expand its partnerships

Market Volatility: As with all cryptocurrencies, PYTH is subject to significant price volatility influenced by broader market conditions beyond its specific fundamentals

Investors should also consider the regulatory environment for cryptocurrency projects, which remains uncertain in many jurisdictions and could impact Pyth's operations and adoption.

Price Predictions and Future Outlook

Based on current technical analysis and fundamental developments, various sources provide optimistic price projections for PYTH:

Table: PYTH Price Predictions 2025-2030

| Year |

Potential Low ($) |

Potential Average ($) |

Potential High ($) |

| 2025 |

0.18 |

0.28 |

0.35 |

| 2026 |

0.24 |

0.34 |

0.42 |

| 2027 |

0.28 |

0.38 |

0.47 |

| 2028 |

0.32 |

0.42 |

0.52 |

| 2029 |

0.36 |

0.48 |

0.58 |

| 2030 |

0.4 |

0.55 |

0.65 |

These predictions assume continued adoption of Pyth's oracle services and expansion of its use cases across the blockchain ecosystem. The recent U.S. Government partnership particularly strengthens the case for long-term growth potential.

The Real World Assets (RWA) tokenization narrative presents a significant opportunity for Pyth. With over

$26 billionin RWA already on-chain and expectations for this to double by year-end 2025, the demand for reliable price feeds is likely to increase substantially.

Government Partnership and Institutional Adoption

The most significant development for Pyth Network in 2025 has been its selection by the

U.S. Department of Commerce to deliver official economic data on-chain. This landmark decision represents the first time a U.S. federal agency has committed to publishing verified statistical data directly on blockchain networks.

The partnership will initially involve publishing

quarterly GDP data from the past five years, with plans to expand to other macroeconomic datasets over time. The data will be distributed across nine blockchains: Bitcoin, Ethereum, Solana, Avalanche, Tron, Polygon, and Stellar.

Notably, Mike Cahill, co-founder of Douro Labs (Pyth's parent company), was the only executive specifically mentioned in the official press release, underscoring Pyth's prominent role in this initiative. This government endorsement effectively validates Pyth's first-party data model and positions it as critical infrastructure for the future of transparent data distribution.

The partnership reflects a broader shift in government attitude toward blockchain technology from cautious regulation to active adoption, and signals recognition of oracles as essential components of financial infrastructure.

Conclusion

Pyth Network has rapidly evolved from a specialized oracle service into a comprehensive Web3 data infrastructure provider. Its unique first-party data model, pull-based architecture, and strategic government partnership position it favorably within the competitive blockchain oracle landscape.

The recent U.S. Department of Commerce collaboration represents more than just a price catalyst. It validates the entire oracle sector as critical infrastructure for the future of transparent and verifiable data distribution. This endorsement, combined with Pyth's growing adoption across DeFi and traditional finance, suggests strong fundamental support for continued growth.

While risks remain, including token unlock events and concerns about distribution fairness, Pyth's technological advantages and institutional adoption create a compelling case for its long-term potential. As DeFi expands, real-world asset tokenization accelerates, and institutions increasingly require reliable data bridges, Pyth appears well-positioned to play a central role in shaping the future of decentralized applications and services.

For investors and developers alike, Pyth Network represents a fascinating case study in how blockchain infrastructure projects can transition from niche solutions to critically important components of both traditional and decentralized financial systems.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.