The recent announcement by Japanese investment firm Metaplanet regarding its additional purchase of 103 BTC, bringing its total holdings to 18,991 BTC valued at nearly $2 billion, is not an isolated event. This move, resulting in a remarkable 479.5% return on its Bitcoin strategy since the beginning of 2025, underscores a broader trend of accelerating institutional cryptocurrency adoption within Japan. Coupled with the conclusion of the high-profile WebX2025 summit in Tokyo Asia's largest Web3 conference , it attracted over 15,000 participants and featured talks from figures like BitMEX's Arthur Hayes and Japan's Prime Minister Fumio Kishida, which signals a pivotal moment for the Japanese digital asset landscape. This analysis delves into the historical context, market dynamics, regulatory shifts, and unique user behaviors that define Japan's crypto market, positioning it as a unique blend of conservative regulation and burgeoning innovation.

Historical Context and Market Evolution

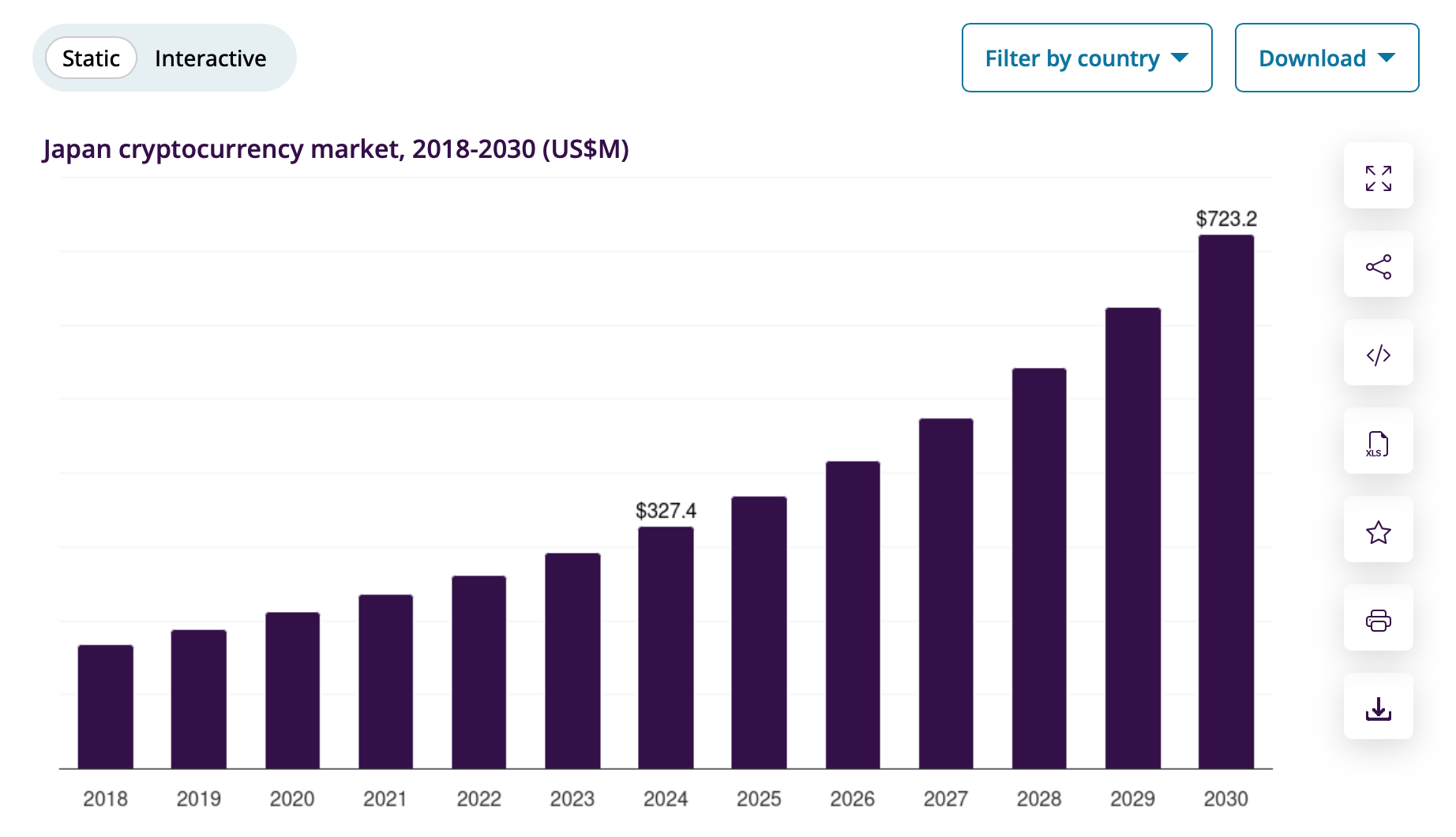

Japan Cryptocurrency Market Trend. Source: Grand View Horizon

Japan's relationship with cryptocurrency has been a journey of cautious engagement and recovery. The market has experienced significant growth, particularly since 2024. The total spot trading volume on Japanese compliant exchanges surged from approximately ¥1 trillion (about $6.8 billion) in 2022 to ¥2.06 trillion (about $14 billion) in 2024, representing an

82% year-on-year increase and signaling the market's substantial expansion. This growth accelerated into 2025, with the number of verified crypto users in Japan reaching

12.419 million by May 2025, a dramatic increase from 5.61 million users in 2022. This user base now represents roughly 15% of Japan's adult population. The total value of assets under custody in Japan has also seen impressive growth, exceeding

¥4.26 trillion (approximately $27.5 billion).

Bitcoin (BTC) dominates trading volumes, accounting for approximately

70% of the market, followed by XRP, which has recently surpassed Ethereum (ETH) in popularity, with ETH holding around

14% share. This preference is often attributed to marketing efforts by compliant exchanges and a conservative investment mindset favoring established assets.

Regulatory Framework

Japan's regulatory framework for cryptocurrencies is among the most structured globally, operating under a

three-tiered model involving the Financial Services Agency (FSA), the Japan Virtual Currency Exchange Association (JVCEA) as a self-regulatory body, and industry groups like the Japan Cryptoasset Business Association (JCBA). This framework mandates strict licensing requirements for exchanges and custodial services, ensuring operational compliance and consumer protection.

A significant regulatory challenge has been the high tax burden on crypto gains. Previously, cryptocurrency profits were taxed at rates as high as

55% (45% miscellaneous income tax + 10% inhabitant tax). This high taxation was a considerable deterrent for investors. However, a major reform is set for

2026, intending to align crypto taxation with traditional financial instruments like stocks by introducing a flat

20% capital gains tax and allowing a

three-year loss carryforward provision. This change is anticipated to significantly boost both retail and institutional participation by reducing compliance burdens and improving investment predictability.

The government has also taken steps against non-compliant offshore exchanges. In February 2025, the FSA initiated a crackdown, resulting in the removal of such platforms from Japanese app stores and issuing notices to influencers promoting them. Nevertheless, Japanese users can still access these exchanges via the web due to the absence of internet restrictions.

Institutional Adoption and Corporate Strategy

The aggressive Bitcoin accumulation by publicly listed companies like Metaplanet and Remixpoint (which holds 1,273 BTC) is a defining feature of Japan's crypto market. Metaplanet's strategy, achieving a

479.5% return year-to-date in 2025, exemplifies using Bitcoin as a

corporate treasury asset and a hedge against economic pressures like the

weakening Japanese yen. This approach mirrors the tactics of Western firms like MicroStrategy but is particularly appealing in Japan due to favorable accounting treatments and the upcoming tax reforms.

Furthermore, Japan is developing robust infrastructure to support institutional involvement. Key initiatives include the development of the

JPYC yen-pegged stablecoin and advanced custody solutions from major financial institutions like

SBI Holdings and Sumitomo Mitsui. These developments are crucial for facilitating secure and efficient large-scale transactions and are projected to unlock significant liquidity.

User Demographics and Retail Investment Behavior

The profile of the Japanese crypto investor is distinct. The market is largely driven by

middle-aged, middle-income salaried workers. The core demographic is individuals aged

30-40, often with annual incomes below

¥7 million (approximately $32,000), seeking long-term,

prudent investment options rather than short-term speculation.

Table: Japanese Crypto User Profile (2025)

| Characteristic |

Detail |

Implication |

| Primary Age Group |

30-40 years old |

Mature, financially stable investors seeking asset allocation |

| Investment Motive |

Long-term wealth accumulation (HODLing) |

Lower trading frequency, reduced market volatility |

| Preferred Assets |

Bitcoin (70%), XRP, Ethereum (14%) |

Preference for established, high-market-cap assets |

| Tax Sensitivity |

High; awaiting 2026 tax reduction |

Current holding patterns; potential selling pressure pre-2026 |

| Platform Dependency |

Reliance on compliant exchanges |

Limited DeFi participation; centralized control |

Their investment behavior is characterized by:

Long-term Holding (HODLing): A strong tendency to buy and hold assets for the long term, partly due to high transaction taxes and in anticipation of the 2026 tax reduction.

Reliance on Compliant Exchanges: Most activity occurs through licensed, domestic platforms. Users value security and regulatory compliance over the wider asset selection and higher leverage often available on offshore platforms.

Limited On-Chain Activity: The majority are not "chain-native" users. They interact with crypto primarily through exchange apps, with minimal engagement in decentralized finance (DeFi) or other on-chain activities.

Influence of Social Media: Investment decisions are heavily influenced by content on

YouTube and X (formerly Twitter), leading to a vibrant ecosystem of crypto-focused influencers in Japan.

Overview of the Japanese Crypto Exchange Landscape

Japan's cryptocurrency market is

highly regulated by the Financial Services Agency (FSA), which enforces strict rules on licensing, security, and consumer protection5. This has created a market where

compliance and trust are paramount. The number of verified crypto users in Japan grew significantly, reaching

12.419 million by May 2025, accounting for roughly 15% of the adult population. The total value of assets under custody also exceeded

¥4.26 trillion (approximately $27.5 billion).

Market Share and Key Players

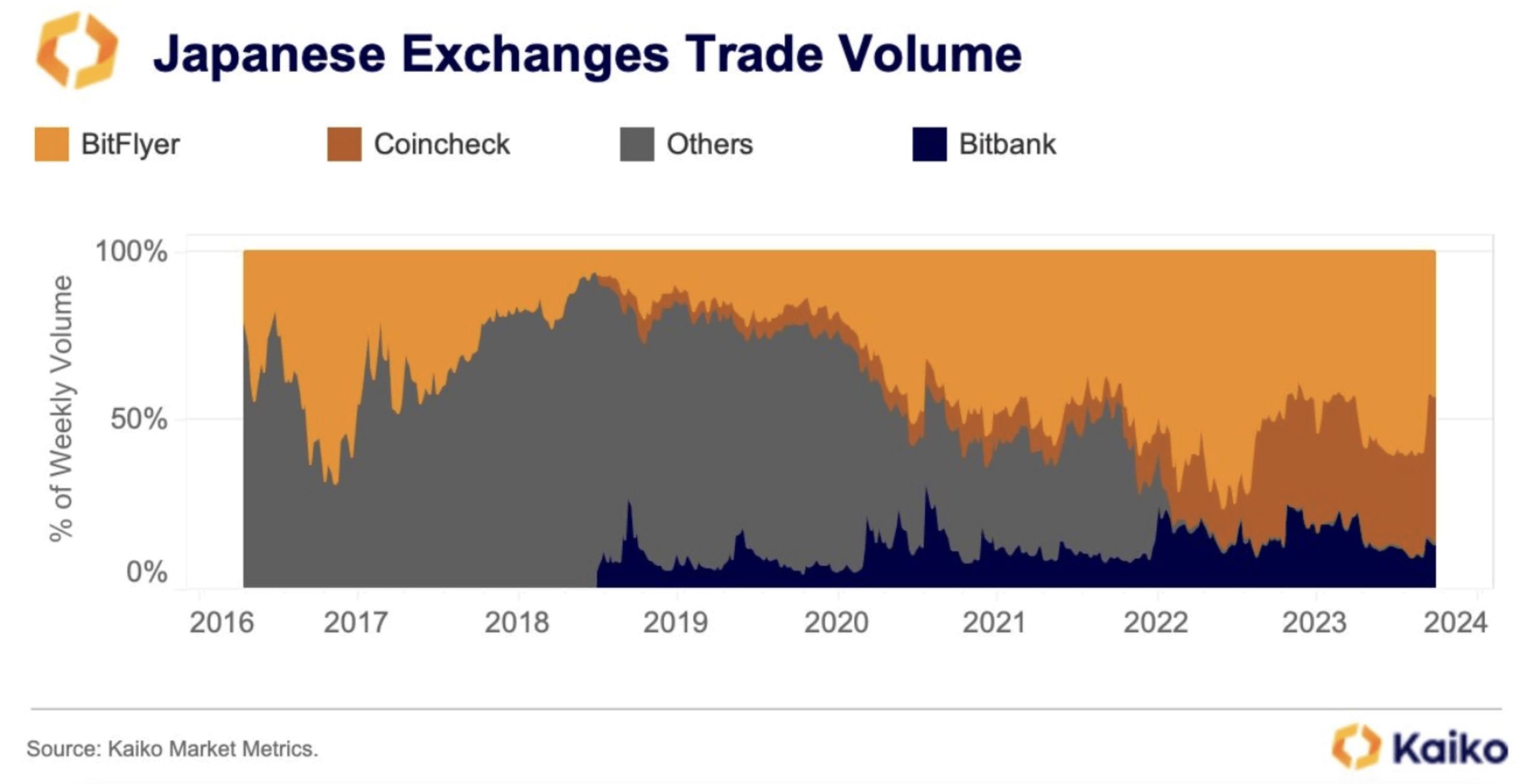

Japanese Exchanges Trade Volume. Source: Kaiko

While precise, universally agreed-upon market share percentages for every exchange are challenging to pin down due to varying methodologies and the private nature of some data, the landscape is clearly dominated by a mix of longstanding domestic players and adapting global platforms. The following table summarizes the key players and their positions in the market.

| Exchange |

Type |

Key Characteristics |

Estimated Market Position & Notes |

| bitFlyer |

Domestic |

One of Japan's oldest and most trusted exchanges. Known for strong security and compliance. |

Often cited as a market leader in terms of trust and historical volume. |

| Coincheck |

Domestic |

Regained user trust after a 2018 hack under new ownership. Known for a user-friendly interface. |

Frequently ranked highly by trading volume (e.g., ~$190M 24h volume cited in early 2025). |

| BitBank |

Domestic |

A major domestic player focused on the Japanese market. |

Often places third in trading volume among domestic exchanges. |

| Binance Japan |

Global (Localized) |

Entered the market via acquisition of a licensed entity. Offers access to a wide array of cryptocurrencies. |

Significant potential influence, but exact market share is complex due to global operations. |

| Bybit |

Global (Localized) |

Popular for its advanced trading tools and extensive asset selection. |

Recognized as a top choice for experienced traders in Japan. |

| Kucoin |

Global (Localized) |

Offers a vast selection of altcoins and trading bots. |

Popular among users seeking diverse altcoin options. |

Dominant Domestic Exchanges: The market has historically been led by established Japanese exchanges like

bitFlyer,

Coincheck, and

BitBank. bitFlyer, one of the oldest exchanges, has often been reported to hold a significant portion of the market share, with one source citing it as high as

38%. Coincheck, despite a well-publicized hack in 2018, was reported to have the highest 24-hour trading volume (~$190 million) in early 2025, followed closely by bitFlyer (~$179 million) and BitBank (~$151 million).

Global Exchanges Gaining Local Footholds: International exchanges like

Binance,

Bybit, and

Kucoinhave also established a presence in Japan by obtaining FSA registration and localizing their services. Their market share is more complex to quantify. For instance, while Binance Japan is registered with the FSA, its trading volume might be partially blended with its global operations, making precise ranking difficult. These exchanges often attract users with their

wider selection of cryptocurrencies and

advanced trading features.

Project Ecosystem and Market Opportunities

Despite a stringent regulatory environment, Japan's project ecosystem is evolving. A notable trend is the presence of international Web3 projects that establish

research and development offices in Japan, but often conduct their operational and token-related activities through

offshore entities (e.g., in the British Virgin Islands) to navigate the complex and costly compliance requirements set by the JVCEA. This has led to a common saying within the local ecosystem: "

People in Japan, but not targeting the Japanese market.".

The WebX2025 conference highlighted key growth areas, including

Bitcoin ETFs, stablecoins, and real-world asset (RWA) tokenization. The potential approval of spot Bitcoin and Ethereum ETFs in 2026, alongside the tax reform, is expected to be a significant catalyst for further institutional investment.

Conclusion

Japan's cryptocurrency market presents a fascinating paradox. It is a

highly mature and regulated market with a large, growing user base of conservative, long-term investors and an increasing number of institutional participants like Metaplanet. Landmark regulatory reforms and significant infrastructure development are strategically positioning the country as a potential hub for institutional digital asset adoption in Asia.

However, challenges remain. The market is still characterized by a

strong preference for Bitcoin over other digital assets,

limited retail engagement with decentralized ecosystems, and a project landscape that often finds it challenging to fully integrate into the local market due to regulatory hurdles.

The recent WebX2025 summit and the continuous Bitcoin acquisitions by listed companies underscore the immense momentum and interest in Japan's crypto scene. If regulatory evolution continues thoughtfully, balancing investor protection with innovation, Japan is poised to become an even more significant and unique force in the global Web3 economy, offering a model of structured institutional adoption combined with a distinct retail culture.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.