Ethereum staking represents a

fundamental shift

in how the network secures operations and distributes rewards. Since Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS) in September 2022—an event known as "The Merge"—staking has become

integral to participation

in the world's largest smart contract platform. Rather than relying on energy-intensive mining, Ethereum now uses staked ETH as collateral to validate transactions and create new blocks. This transition has not only reduced Ethereum's energy consumption by approximately 99.9% but has also created new

economic opportunities

for ETH holders to earn yields while contributing to network security. With over $86 billion worth of ETH currently staked and annual yields ranging from 3% to 12% through various strategies, staking has emerged as a cornerstone of Ethereum's ecosystem and a

significant revenue stream

for both retail and institutional participants. This guide explores everything from basic mechanisms to advanced strategies for ETH staking.

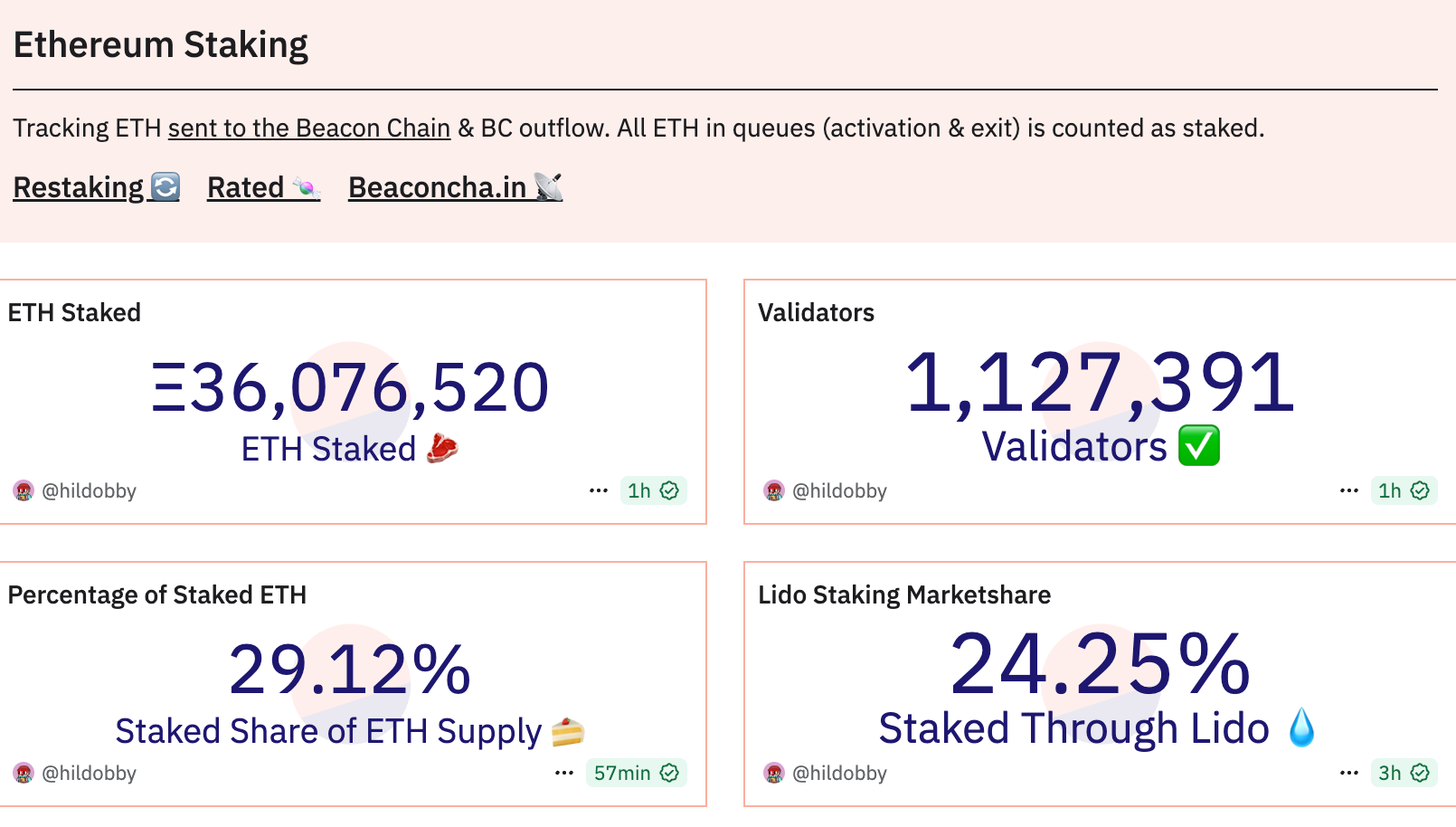

ETH Staking Data. Source: Dune

Understanding ETH Staking

What is Staking?

Staking refers to the process of

locking cryptocurrency to participate in maintaining a proof-of-stake blockchain network. In Ethereum's context, staking involves depositing ETH to become a validator—a node responsible for

processing transactions, creating new blocks, and ensuring network security. Validators are required to stake 32 ETH to activate their validation software, though users can stake smaller amounts through pooled services. The network randomly selects validators to propose blocks while others attest to the block's validity. Participants receive

staking rewards in ETH for performing their duties correctly, with penalties applied for malicious behavior or downtime. This system replaces the computational competition of proof-of-work mining with economic stake as the security mechanism.

The Role of Staking in Proof-of-Stake

Within Ethereum's proof-of-stake consensus, staking serves multiple critical functions. First, it provides

economic security for the network—attackers would need to acquire and stake a majority of ETH (potentially billions of dollars worth) to compromise the chain, making attacks economically impractical. Second, staking

incentivizes honest participation through rewards for proper validation and penalties (called "slashing") for malicious actions. Finally, staking creates a

deflationary pressure on ETH supply—as more ETH gets staked, it becomes temporarily illiquid, potentially increasing scarcity while the yield mechanism distributes new ETH to stakeholders approximately at an annual rate of 3-5% under normal conditions.

Ethereum's Upgrade Roadmap

Ethereum's development follows an

ambitious roadmap of interconnected upgrades that enhance functionality, scalability, and security. The Merge (completed September 2022) marked Ethereum's transition to proof-of-stake, reducing energy consumption by 99.9% and setting the stage for subsequent improvements. The next major phase,

The Surge, focuses on scaling through proto-danksharding and rollup improvements, aiming to dramatically increase transaction throughput and reduce costs. Following this,

The Verge will implement Verkle trees to optimize storage and enable stateless clients, while

The Purge will simplify protocol by eliminating historical data and reducing technical debt. Finally,

The Splurge will address miscellaneous functionality and ensure smooth operation of all components.

These upgrades have

significant implications for stakers. Improved scalability attracts more users and applications to Ethereum, potentially increasing transaction fees and validator rewards. Enhanced security features protect staked assets, while technical improvements make running validators more accessible. Notably, Ethereum's

deflationary mechanism (EIP-1559) burns a portion of transaction fees, potentially making ETH a deflationary asset during high-network-activity periods and increasing its value proposition for stakers.

Primary Methods of ETH Staking

Solo Staking

Solo staking involves

running your own validator node by depositing 32 ETH and maintaining the necessary hardware and software. This approach requires technical expertise to set up and maintain an Ethereum execution client, consensus client, and validator client while ensuring near-100% uptime. The

significant advantages include complete control over your keys and rewards (typically 3-5% APY), maximum security through self-custody, and directly contributing to network decentralization. However, solo staking carries substantial responsibilities—validators face

slashing risks (partial loss of staked ETH) for malfeasance or downtime, must handle regular software updates, and require stable internet connection and power. The hardware costs approximately $1,000-$2,000, and technical knowledge is mandatory for troubleshooting.

Staking-as-a-Service Providers

For those with 32 ETH but lacking technical confidence, staking-as-a-service (SaaS) providers offer a

compromise solution. Users still deposit 32 ETH but delegate node operations to professional providers like Allnodes or BloxStaking. The service manages hardware, software, and maintenance for a fee (typically 10-20% of staking rewards). Users retain control of their

withdrawal credentials (ability to unstake) while the provider handles technical operations. This approach reduces technical barriers while maintaining self-custody of funds. However, users must trust the provider's competence and security practices—though the slashing risk remains lower than with solo staking since professionals manage the nodes.

Pooled Staking/Liquid Staking

Pooled staking services have become the

most popular method for those with less than 32 ETH or seeking flexibility. Platforms like Lido and Rocket Pool pool resources from multiple users to activate validators, issuing derivative tokens (stETH or rETH) that represent staked ETH plus rewards. These

liquid staking tokens can be traded, sold, or used in DeFi protocols while continuing to accrue staking rewards. Lido dominates this sector with over $13.9 billion in staked ETH, offering stETH tokens that integrate seamlessly with DeFi protocols like Aave and Uniswap. Rocket Pool offers a more decentralized alternative requiring node operators to stake 16 ETH while accepting the rest from pools.

Table: Comparison of Primary ETH Staking Methods

| Method |

Minimum ETH |

Technical Skill |

Custody |

Potential APY |

Liquidity |

| Solo Staking |

32 ETH |

Advanced |

Self-custody |

3-5% |

Illiquid until withdrawal |

| Staking-as-a-Service |

32 ETH |

Basic |

Self-custody |

2.7-4.5% (after fees) |

Illiquid until withdrawal |

| Pooled/Liquid Staking |

0.01 ETH |

Beginner |

Protocol custody |

3-4.5% (after fees) |

Liquid via derivative tokens |

Leading Staking Platforms and Projects

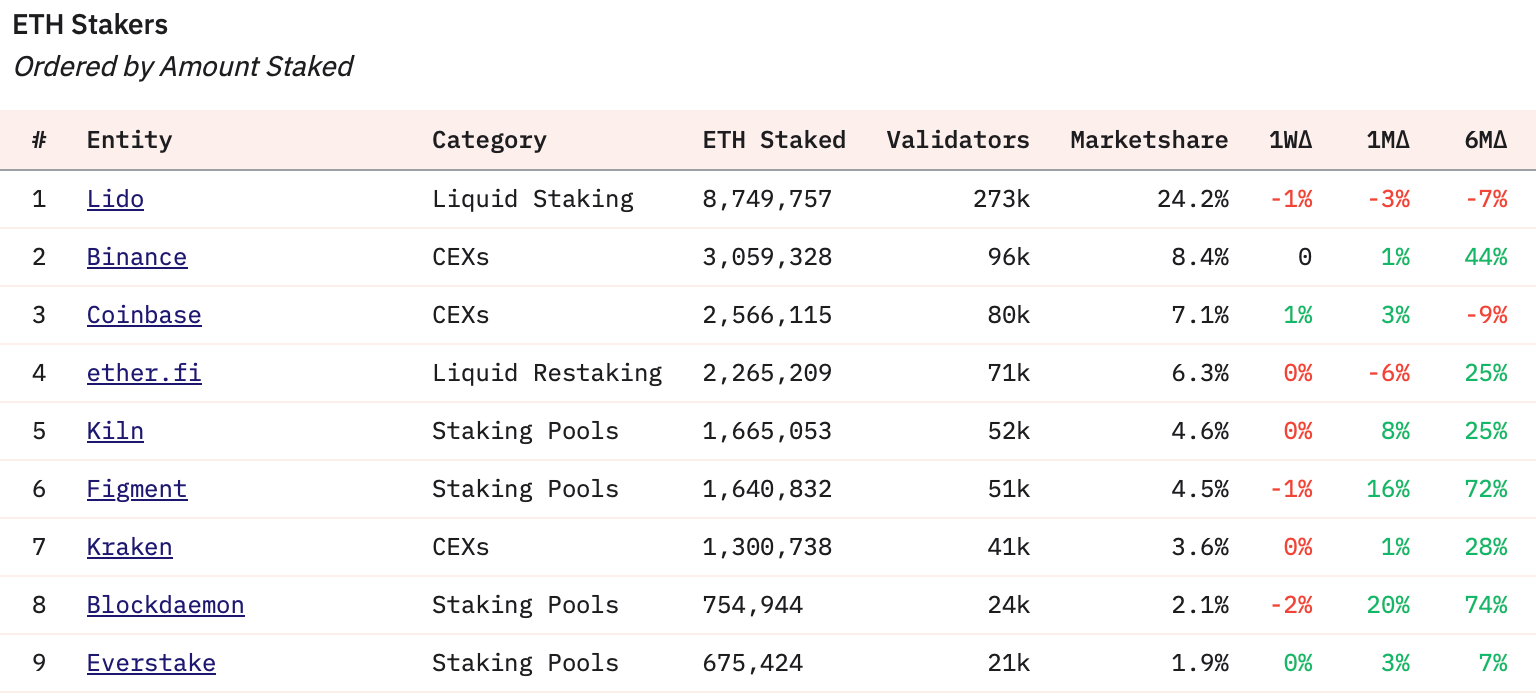

List of ETH Top Stakers. Source: Dune

Lido Finance

Lido has emerged as the

dominant player in liquid staking, with approximately $13.9 billion in total value locked (TVL) as of August 2025. The protocol allows users to stake any amount of ETH and receive stETH tokens, which automatically accrue staking rewards and can be utilized across various DeFi applications. Lido's

significant advantage is its extensive integration with DeFi ecosystems—stETH serves as collateral on Aave, has deep liquidity on Uniswap and Curve, and functions across multiple Layer 2 networks. However, Lido faces criticism over

centralization concerns, the protocol selects node operators rather than being fully permissionless, and its market dominance (controlling nearly 30% of staked ETH) raises potential systemic risk concerns.

Rocket Pool

Rocket Pool offers a more

decentralized alternative to Lido, emphasizing permissionless node operation and lower concentration risk. The protocol requires node operators to stake 16 ETH (instead of 32) while sourcing the remaining 16 ETH from the staking pool. Rocket Pool issues rETH as its liquid staking token and uses RPL tokens to incentivize node operators and provide an additional security layer. The protocol's

design advantages include stronger decentralization credentials, no whitelisting for node operators, and a system where node operators must stake RPL as additional collateral, aligning their interests with network security. However, Rocket Pool's

growth constraints include requiring more active node operators compared to Lido's more capital-efficient model.

Centralized Exchanges

Major centralized exchanges like

Coinbase and

Binance offer user-friendly staking services with low technical barriers. Users can stake any amount of ETH and receive rewards without managing keys or technical infrastructure. These services are

particularly appealing to beginners seeking simplicity and convenience. However, exchange staking involves significant trade-offs—users surrender control of their assets to the exchange (counterparty risk), typically receive lower yields due to higher fees, and contribute to centralization of Ethereum's validation network. Regulatory uncertainty also surrounds exchange staking services, particularly in the United States where the SEC has targeted certain staking offerings.

Staking Risks and Challenges

Market and Technical Risks

ETH staking involves several

substantial risks that participants must consider.

Market volatilityrepresents a primary concern—if ETH price decreases significantly during the staking period, losses from price depreciation might exceed staking rewards earned.

Slashing penalties pose another risk—validators can lose up to 1 ETH for malicious actions (such as double signing) or smaller amounts for downtime, though penalties for minor infractions are typically modest.

Technical risks include software bugs, connectivity issues, or hardware failures that can lead to reduced rewards or penalties. Additionally,

smart contract vulnerabilities present risks, particularly with liquid staking protocols—as demonstrated by the July 2025 RareStaking exploit where an attacker manipulated a merkle root vulnerability to drain funds.

Regulatory and Network Concerns

Regulatory uncertainty continues to cloud the staking landscape, particularly in the United States. The SEC has targeted certain staking offerings as potential unregistered securities, while proposed legislation like the GENIUS Act could impose additional compliance requirements and potentially reduce retail staking yields by 3-5%.

Network congestion presents another challenge—Ethereum's validator exit queue has swelled to 910,000 ETH ($3.91 billion), creating potential delays for unstaking requests during periods of high demand1.

Centralization risks also merit concern—Lido's significant market share and the concentration of nodes in centralized hosting services create potential points of failure despite Ethereum's decentralized design.

Recent Trends and Developments in ETH Staking (2025)

Institutional Adoption and Yield Innovation

The ETH staking landscape has evolved dramatically throughout 2025, characterized by

accelerating institutional adoption and

innovative yield strategies. Major institutions including BlackRock, Fidelity, and even the U.S. government have entered the staking arena—the latter reportedly staking 65,232 ETH (approximately $281 million) as part of its digital asset management strategy. Traditional corporations like BitMine Immersion Technologies, Bit Digital, and SharpLink Gaming have added ETH to their balance sheets with staking as a revenue component. Simultaneously,

yield optimization strategies have proliferated—liquid staking derivatives like stETH can be restaked through protocols like EigenLayer to earn additional yield, potentially compounding returns to 12% or more through sophisticated strategies.

ETF Integration and Regulatory Developments

The

approval and success of spot Ethereum ETFs in 2025 has significantly impacted staking dynamics. These ETFs have accumulated over 2.2% of total ETH supply, creating substantial buying pressure and reducing circulating supply. Major asset managers including BlackRock and 21Shares have filed for

staking-enabled ETFs that would distribute staking rewards to investors—a development that could further institutional adoption while potentially raising regulatory concerns. Meanwhile, regulatory clarity has gradually emerged—the EU's Markets in Crypto-Assets (MiCA) regulation provides a framework for staking services, while U.S. regulators continue grappling with appropriate classification of staking offerings.

Table: ETH Staking Yield Comparison Across Platforms (August 2025)

| Platform |

Service Type |

Estimated APY |

Minimum Stake |

Liquidity Solution |

| Solo Staking |

Independent validator |

3-5% |

32 ETH |

Illiquid |

| Lido |

Liquid staking |

3-4% |

0.001 ETH |

stETH token |

| Rocket Pool |

Liquid staking |

3.2-4.2% |

0.01 ETH |

rETH token |

| Coinbase |

Exchange staking |

2.5-3.5% |

0.001 ETH |

cbETH token |

| Gate.io |

Exchange staking |

6.06% (with bonuses) |

0.00000001 ETH |

Direct redemption |

Conclusion

Ethereum staking has matured into a

sophisticated ecosystem offering various participation methods suitable for different risk profiles and technical capabilities. From solo staking maximizing decentralization to liquid staking providing flexibility, each approach involves distinct trade-offs between control, convenience, and potential returns. The staking landscape continues evolving rapidly, with

institutional adoption accelerating through ETF products and corporate treasury strategies while

yield innovation creates increasingly sophisticated compounding strategies.

Despite its maturation, staking retains

significant risks—market volatility, technical complexity, regulatory uncertainty, and smart contract vulnerabilities all demand careful consideration. Participants should thoroughly research options, assess their risk tolerance, and consider diversification across different staking methods. For most investors,

liquid staking protocols like Lido and Rocket Pool offer an optimal balance of accessibility, yield, and liquidity, while technically proficient users with substantial ETH holdings might prefer

solo staking to maximize returns and support network decentralization.

As Ethereum continues its upgrade roadmap with The Surge, Verge, Purge, and Splurge, staking will likely become increasingly efficient and accessible. The emergence of

layer 2 staking solutions like Starknet's planned 2025 implementation further expands possibilities. With approximately 30% of ETH supply currently staked and yields remaining competitive compared to traditional fixed income, Ethereum staking represents a compelling opportunity for those willing to navigate its complexities and risks.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.