Ethereum DeFi, or decentralized finance built on the Ethereum blockchain, is redefining financial systems by replacing traditional intermediaries with self-executing smart contracts, which also represents one of the most profound changes in modern finance. Unlike traditional systems reliant on banks or financial institutions, DeFi lets individuals trade, lend, borrow, and earn returns without needing permission or middlemen. At its core is Ethereum’s blockchain technology, particularly its ability to support smart contracts.

Why does this matter today? DeFi is building a global financial system that’s more open, inclusive, and user-centric. In this guide, we’ll explore how Ethereum DeFi works, its key strengths, leading projects, and its potential to shape finance for decades to come.

Understanding Ethereum and DeFi

Ethereum is a decentralized blockchain platform that stands apart from Bitcoin by enabling developers to create and launch smart contracts—self-executing agreements with predefined rules encoded in software. These smart contracts form the backbone of DeFi.

DeFi, short for decentralized finance, describes financial tools built on blockchains that operate independently of intermediaries. Instead of a bank dictating loan terms or approving transactions, smart contracts automate these processes based on preset conditions

The guiding principles of DeFi are:

Decentralization: No single entity controls the system, reducing the risk of manipulation or failure.

Transparency: All activities are recorded on a public blockchain, visible to anyone.

Accessibility: Anyone with an internet connection and a crypto wallet can participate, regardless of location or background.

Ethereum is the epicenter of DeFi, as its support for decentralized applications (dApps) and smart contracts makes the entire ecosystem possible.

DeFi’s Core Innovation

Ethereum DeFi reconstructs finance by replacing human intermediaries with algorithmic enforcement.

Smart contracts automate financial logic, collateralization ratios trigger liquidations at Aave without banker discretion, while Uniswap’s constant product formula enables price discovery sans market makers. This architectural shift achieves what traditional finance cannot: 24/7 global access, censorship-resistant transactions, and auditable reserve transparency. The GENIUS Act’s July 2025 passage accelerates this disruption, recognizing stablecoins (80% Ethereum-based) as legitimate payment instruments and mandating federal oversight clarity for DeFi. Consequently, Ethereum now processes 1.87 million daily transactions, nearing historic highs with stablecoins driving 40% of fee revenue, confirming its role as the monetary layer for Web .

Protocol Layer Revolution

Today’s leading protocols exemplify DeFi’s capital innovation.

Lido’s liquid staking model has catalyzed a validator revolution: its $33.36 billion TVL supports 32% of staked ETH, while Pectra Upgrade’s increase of validator caps to 2,048 ETH streamlines institutional participation.

Simultaneously, EigenLayer’s restaking mechanism fractures traditional capital silos, its $17.71 billion TVL allows staked ETH to secure additional protocols like Babylon and Omni Network, effectively enabling "yield stacking" that boosts base returns by 120-300bps.

Most explosively, Ethena’s synthetic dollar protocol has surged to $118.93 billion TVL by blending delta-neutral derivatives with staking yields, creating the first crypto-native "internet bond" yielding 4.72% with minimal volatility exposure. These innovations collectively demonstrate DeFi’s core proposition: programmable money generates superior utility than static deposits.

DeFi’s Scalability

Ethereum’s 2025-2026 technical roadmap directly addresses DeFi’s scalability constraints. zkEVM integration (Q4 2025-Q2 2026) will slash ZK-rollup verification costs by 80%, enabling near-instant settlement for derivatives platforms like Synthetix and GMX. Meanwhile, the RISC-V execution environment, which is slated for 2026 deployment, promises 3-5x smarter contract efficiency, reducing Aave loan origination gas fees by 70% and making micro-transactions economically viable. Most significantly, PeerDAS (Data Availability Sampling) implementation via Pectra Upgrade doubles blob capacity per block, slashing Arbitrum and Optimism fees by another 40-60% and positioning Ethereum to capture 90% of predicted $2 trillion stablecoin volume by 2028.

Key Components of Ethereum DeFi

Ethereum DeFi is a vast ecosystem made up of interconnected components. Here are the most critical ones:

Smart Contracts

Smart contracts are automated programs that trigger actions when specific conditions are met. In DeFi, they govern everything from loan terms to trade executions. Once deployed, they cannot be modified, ensuring trust and fairness in transactions.

Leading DeFi Protocols

Several standout projects are driving innovation in Ethereum DeFi:

Aave

(AAVE): A decentralized, non-custodial lending platform. Users can deposit cryptocurrencies to earn interest or borrow assets using collateral. As of August 14, 2025, Aave holds over $40.177 billion in Total Value Locked (TVL), with $28.636 billion in borrowed assets.

Lido

(LDO): A liquid staking solution for Ethereum. It allows users to stake their ETH while retaining access to their funds for use in other DeFi activities, balancing staking rewards with flexibility. Its TVL of $42.079 billion (as of August 14, 2025) reflects strong community trust.

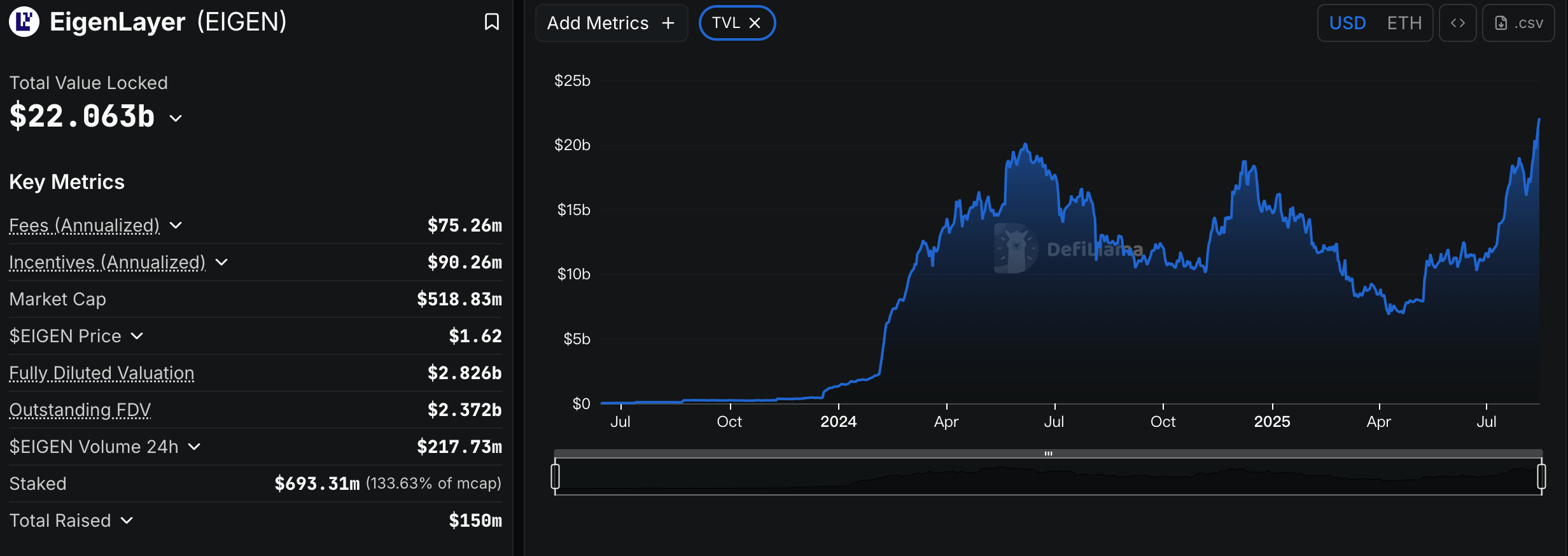

EigenLayer

(EIGEN): Introduces “restaking,” a novel concept where users can leverage their staked ETH to secure additional protocols. This boosts capital efficiency by letting crypto work double duty. With $22.63 billion in TVL, it’s gaining traction among institutional investors.

These platforms demonstrate how Ethereum DeFi has evolved beyond basic token swaps, offering passive income, bank-free borrowing, and cross-protocol security, all within the Ethereum network.

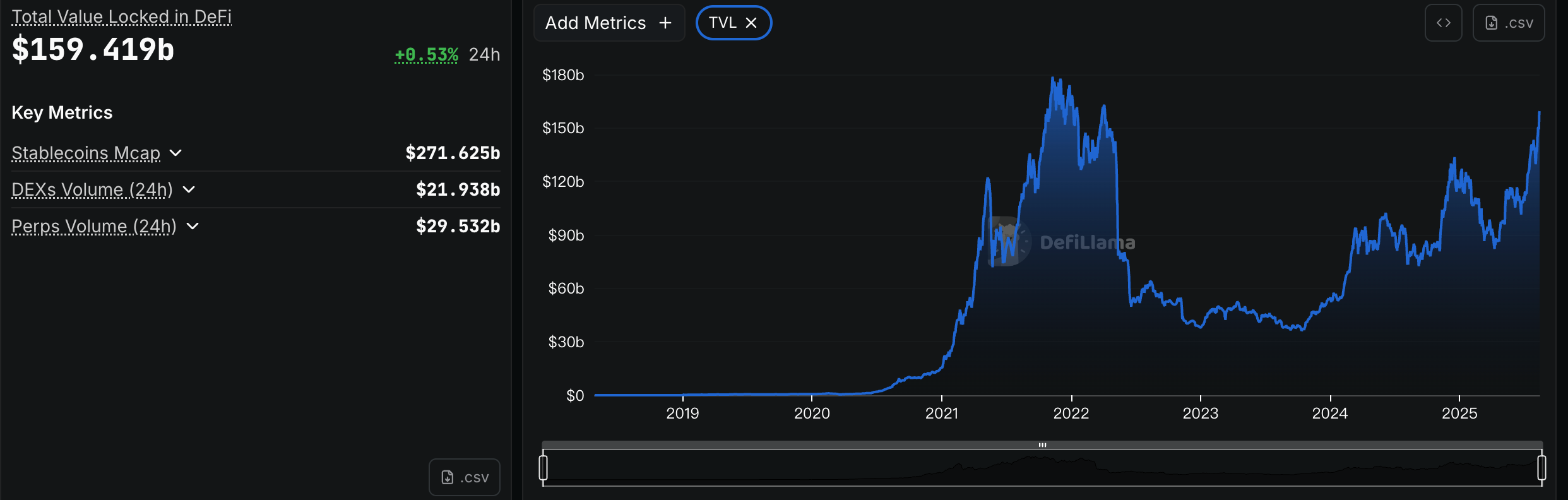

Growth Trends in Ethereum DeFi (2025)

The Ethereum DeFi sector has seen remarkable expansion in 2025. As of August 14, total assets locked in Ethereum DeFi protocols reached $159.419 billion, signaling growing adoption by both individual users and institutions.

Key trends include:

Lido remains the top choice for ETH staking, thanks to its user-friendly approach to balancing staking and liquidity.

Aave’s lending volume has surged, with a record-breaking $25 billion borrowed. Reaching an unparalleled

$25 billion in active borrows is more than just a triumph for Aave; it heralds growing confidence in decentralized finance, accentuating the platform's reliability and essential role in the market.

EigenLayer’s restaking model, a concept barely a year old, is attracting institutional interest, highlighting demand for innovative capital strategies.

This growth isn’t just hype, it reflects a shift in perception: DeFi is increasingly viewed as a viable alternative to traditional finance, not a risky experiment.

The Future of Ethereum DeFi in Global Finance

Ethereum DeFi isn’t a passing trend; it’s a blueprint for a more equitable financial system.

Disrupting Traditional Finance

Traditional finance relies on intermediaries like banks and brokers, who control access, set fees, and often exclude individuals based on location or credit. DeFi eliminates these middlemen, offering faster transactions, global reach, and often higher returns.

Advancing Financial Inclusion

Over a billion people worldwide lack access to bank accounts. DeFi can bridge this gap, providing financial tools via just a smartphone and internet connection—empowering underserved communities.

Regulatory Support

Proposed U.S. Legislation, such as the Genius Act and Clarity Act, aims to create clear guidelines for DeFi. These regulations could boost trust, attract more institutional investment, and foster sustainable growth.

Conclusion

Ethereum DeFi is more than a technological innovation—it’s a movement toward fairer, cheaper, and more accessible finance. By leveraging Ethereum’s blockchain and smart contracts, it removes intermediaries, puts users in control, and introduces new ways to manage money. With over $83 billion locked in platforms like Aave, Lido, and EigenLayer, its momentum is undeniable. As Ethereum scales and regulations evolve, DeFi could become a cornerstone of the global financial system.

Ready to explore? Platforms like CoinCatch offer access to DeFi tokens, while protocols like Uniswap or Aave let you dive into decentralized trading and lending. Stay informed, and watch as Ethereum DeFi continues to redefine the future of money.

Frequently Asked Questions

What is Ethereum DeFi, and how does it differ from traditional finance?

Ethereum DeFi uses blockchain and smart contracts to offer financial services (lending, trading, etc.) without banks or brokers. Unlike traditional finance, it’s decentralized, transparent, and open to anyone with an internet connection, lowering costs and barriers.

What are the most popular Ethereum DeFi applications?

Top apps include Uniswap (decentralized trading), Aave and Compound (lending/borrowing), and Lido (liquid staking). These platforms let users earn interest, trade assets, or stake ETH without intermediaries.

How can I access Ethereum DeFi assets, such as those on CoinCatch?

Use platforms like CoinCatch to buy or trade DeFi tokens (e.g.,

AAVE,

LDO,

EIGEN). Connect a wallet like MetaMask to interact directly with DeFi protocols, or use CoinCatch as a gateway to purchase assets and transfer them to DeFi platforms.

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.