Succinct (PROVE) is a cryptocurrency project that empowers blockchain applications through its PROVE token and fast, secure, and private zero-knowledge proofs (ZKPs). This utility token powers the decentralized Prover Network, enabling developers to use ZKPs to scale blockchains, secure cross-chain bridges, and verify AI computations without requiring deep cryptography expertise.

Succinct, which recently launched on its mainnet and is being adopted by major players, aims to redefine trustless systems by balancing speed, security, and decentralization. In this article, we'll analyze what the PROVE token is, how it works, and why it's causing a stir in the crypto community.

Why Should You Pay Attention to PROVE Tokens Lately?

The crypto world is buzzing about Succinct's Prover Network, which officially launched on August 5, 2025. This launch marked a significant milestone, activating the PROVE token and enabling a decentralized ZKP generation market. The network has already demonstrated real-world traction, securing value on prominent chains like Ethereum and Solana, with plans for further integration.

Furthermore, Succinct's testnet phase attracted thousands of participants who earned PROVE tokens by completing tasks such as staking and testnet participation, demonstrating strong community engagement. With endorsements from industry heavyweights and the growing demand for ZKP infrastructure, Succinct (PROVE) is quickly becoming a token to watch.

PROVE Token Overview

-

-

-

-

Total supply: 1 billion

-

Contract address: 0x6bef15d938d4e72056ac92ea4bdd0d76b1c4ad29

-

-

-

Supported centralized exchanges: CoinCatch

-

Supported decentralized exchanges: PancakeSwap V3 (BSC)

What is the PROVE Token?

Succinct (PROVE) is the native token of the Succinct Prover Network, a decentralized platform built on Ethereum that makes generating zero-knowledge proofs simpler and more efficient. ZKPs are cryptographic tools that enable someone to prove a statement is true without revealing additional details, such as proving you are over 21 without showing your entire ID.

Succinct's mission is to make this technology more accessible to developers, enabling them to develop secure and scalable blockchain applications without requiring specialized knowledge.

Features of Succinct (PROVE)

Decentralized Marketplace: Connects proof requesters (e.g., blockchain developers) with provers who generate ZKPs, creating a competitive, cost-effective system.

Developer-friendly: Using Succinct’s SP1 zkVM allows developers to write provable code in a familiar programming language like Rust, significantly reducing development time.

Cross-chain support: Provides support for applications on Ethereum, Solana, and other blockchains, including rollups, bridges, and oracles.

Scalable infrastructure: Aggregate computing power from data centers to personal devices to form a "decentralized proof cloud" to meet high-demand ZKP tasks.

Secure and trustless: Combining off-chain speed with on-chain Ethereum smart contracts to achieve verifiable and secure proof settlement.

How Does the PROVE Token Work?

The Succinct Prover Network operates like a marketplace, where developers (requesters) need ZKPs for their applications, and provers (those with computational power) compete to provide these services. The PROVE token powers this ecosystem and is used for payments, staking, and governance. Here's a closer look at how it works:

SP1 zkVM

At its core is Succinct's SP1, a high-performance zero-knowledge virtual machine. Unlike traditional ZKP systems, which require complex circuit design, SP1 allows developers to write code in Rust and then convert it into verifiable proofs. This makes it easier to create ZKPs for applications such as blockchain state verification or AI model validation (Succinct, 2025).

Auction-based Proof Distribution

When a developer requests proof, an off-chain auction service matches them with the lowest-biding prover, who stakes PROVE tokens to guarantee reliability. This reverse auction mechanism keeps costs low while ensuring proof generation is fast. Results are settled on Ethereum via a smart contract, ensuring a fair ZKP verification process.

On-chain verification

Smart contracts like SuccinctVApp.sol handle payments and state updates, while SuccinctStaking.sol manages the prover's stake. Each batch of proofs is verified on-chain, ensuring trustless operation. This hybrid design offers Web2-like speed and Web3-like security, making it well-suited for real-time applications.

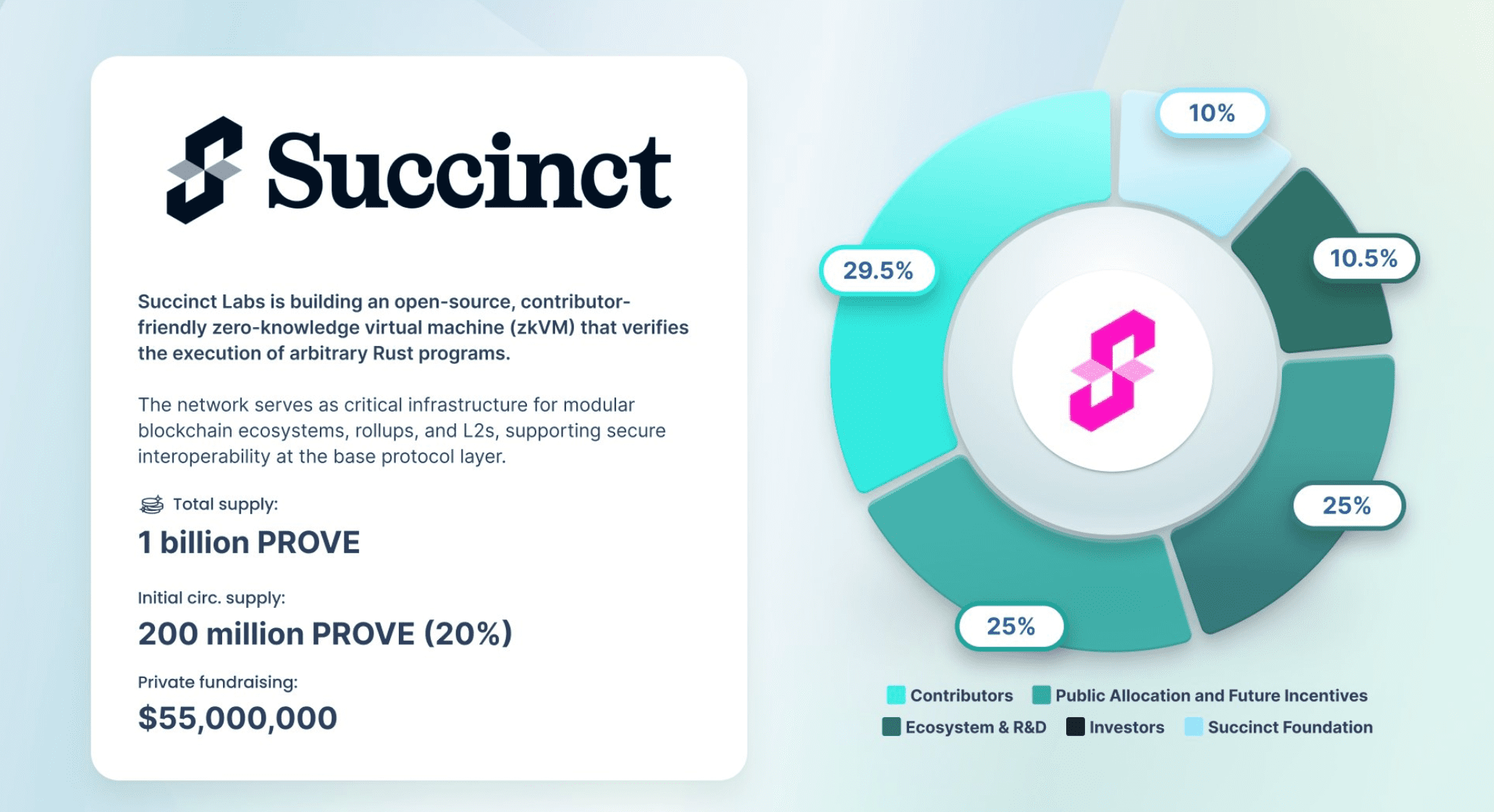

Succinct (PROVE) Funding Information

Succinct raised $55 million in a Series A funding round led by leading crypto venture capital firm Paradigm in 2024. Other investors included Sandeep Nailwal (co-founder of Polygon) and Robot Ventures.

This funding is fueling the development of the Prover Network and SP1 zkVM, with a focus on expanding support for more blockchains and applications. While no new funding has been confirmed, the project’s successful testnet and mainnet launch suggest that more funding rounds are likely in the future as demand for ZKPs grows.

PROVE Token Token Economics

Succinct's token economics are designed to balance incentives and sustainability. The total supply of PROVE tokens is 1,000,000,000, with a circulating supply of 195,000,000 by the time the mainnet launches in August 2025. (Coingecko, 2025) The token distribution structure is as follows:

Public Incentives (25%): Community participation rewards, such as testnet airdrops and ecosystem contributions.

Core Contributors (29.5%): Assigned to the team to build and maintain the network.

Investors (10.5%): Given to early backers like Paradigm to support development.

Foundation Operations (10%): Funds long-term network growth and governance.

Ecosystem and R&D (25%): Driving innovation, collaboration, and adoption of zero-knowledge proof applications.

Provers earn PROVE tokens by completing attestation requests, while delegated stakers can increase their stake and share in the profits. A small amount of protocol fees supports a treasury for ongoing development. This model ensures that active contributors are rewarded while maintaining the decentralization and security of the network.

Is PROVE Worth Buying?

The PROVE token stands out for several reasons. First, the Succinct prover network addresses a critical need in blockchain space: scalable, accessible zero-knowledge proofs. With zero-knowledge proofs powering applications ranging from layer-two scaling solutions to privacy-preserving DeFi, Succinct's platform is well-positioned to capture this growing market.

Second, the project's developer-friendly approach using Rust and SP1 lowers the barrier to entry, potentially attracting a wave of new applications. Third, support from Paradigm and adoption by projects like Polygon and Celestia increases its credibility.

While PROVE’s price may experience volatility like all cryptocurrencies, it has long-term potential given the growing demand for zero-knowledge proof infrastructure and sound token economics. For those bullish on decentralized computing, PROVE is an attractive option.

FAQ

Is Succinct (PROVE) a Good Investment?

PROVE's value depends on the growth of zero-knowledge proof adoption. With strong support, a live mainnet, and real-world use cases, it has solid potential, but cryptocurrency investing carries risks. Always conduct research and assess your risk tolerance.

How to Buy PROVE Tokens?

You can purchase PROVE on exchanges like CoinCatch. Connect an Ethereum-compatible wallet (like MetaMask), deposit funds (e.g., USDT), and trade PROVE using its contract address: 0x6bef15d938d4e72056ac92ea4bdd0d76b1c4ad29.

What Makes Succinct Technology Unique?

Succinct's SP1 zkVM simplifies the creation of zero-knowledge proofs by allowing developers to use Rust instead of niche languages. Its decentralized network of provers can also scale proof generation, making it faster and cheaper than traditional methods.

References:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.