The Crypto Fear and Greed Index is designed to quantify the emotional sentiment of the cryptocurrency market, helping investors make more rational decisions by tracking key psychological factors driving price movements. The sentiments of fear and greed determine most of the pumps and dumps that occur in the crypto market.

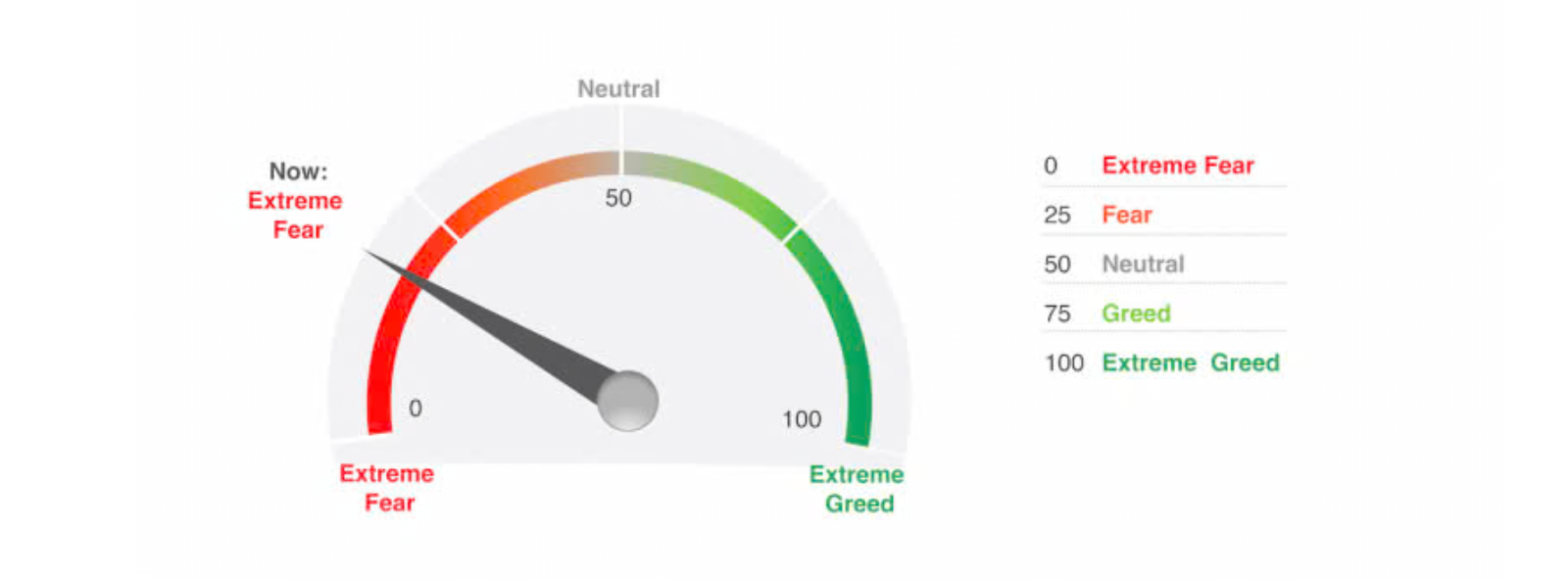

This index assesses the prevailing sentiment within the cryptocurrency market and presents it as a single numerical value, ranging from 0 (Extreme Fear) to 100 (Extreme Greed). Its purpose is to help traders gauge whether the market is currently acting conservatively or becoming overly optimistic. In this article, you will learn what the Crypto Fear & Greed Index is, how it operates, and how you can utilize it to make more informed and emotionally balanced trading decisions.

What is the Fear and Greed Index?

The Crypto Fear and Greed Index measures market sentiment by analyzing multiple data sources to quantify emotions driving cryptocurrency investors' decisions. Created by Alternative.me in 2018, it draws inspiration from CNN Money's Fear & Greed Index for traditional markets. The index generates a score from 0 to 100, where low values suggest widespread market fear and high values point to prevailing greed.

Fear:

-

Definition: In the cryptocurrency market, fear is one of the most identifiable emotions and mainly arises from uncertainty, changes in regulations, sags in the market, or hacking incidents.

-

Effects: Uncertainties can force investors to sell off their assets to avoid loss. This leads to extreme price declines and market downfall.

-

Indicators: An unhealthy amount of fear may be translated into low prices and too much volatility in the market.

Greed:

-

Definition: This is characterized by a strong passion to get rich quickly and is usually observed when prices are on the rise and making profits seems like a piece of cake.

-

Effects: In a greedy market, investing happens at a much higher rate. This leads to higher risks as investors start investing without considering potential loss. This can make the price go tremendously up preparing the ground for a bubble.

-

Indicators: High levels of risk appetite and greed are always associated with rising prices, growing volumes of trading, and upbeat prices seen thereafter.

How The Index Measures Market Sentiment?

The Crypto Fear and Greed Index analyzes trading psychology through six key metrics: volatility, market momentum, social media sentiment, bitcoin dominance, trading volume and Google Trends data. Each metric receives a specific weight in the final calculation. For example, when prices drop sharply, volatility spikes and social media activity increases, the index shifts toward "fear." Conversely, rising prices, high trading volumes and positive social sentiment push the index toward "greed."

Volatility (25%):

Market volatility is one of the parameters included in the Crypto Fear & Greed Index. Volatility describes the level of instability of an asset. Crypto Fear and Greed Index assesses the current volatility and maximum drawdowns of Bitcoin. Most of the time, fear is present in the market when this category has high values or thrashes downward aggressively.

Market Momentum/Volume (25%):

Market momentum and market volume are of great importance as they show the direction and the level of power in any particular market. In the crypto index, this component measures the present trading volume and market momentum regarding Bitcoin. High buying volumes along with strong upward prices indicate a very greedy market.

Social Media (15%):

This section checks Twitter or any other social media platforms to see how the changes in sentiment have been affecting people. The amount and speed of interaction relating to Bitcoin in a certain period (such as hashtags or mentions) are also considered, and a larger amount shifts the trend in the table score higher.

Surveys (15%):

Surveys are a tool for receiving feedback from investors on their subjective opinions about the market. This section deals with online polls or ordinary surveys used in marketing activities, conducted by various crypto exchanges to evaluate the codec’s general beliefs. These surveys can be beneficial in extracting market views and sentiments.

Dominance (10%):

This measures and evaluates the market performance of Bitcoin and compares it with the whole population of cryptocurrencies. Growing dominance means fear as people are allocating their resources to Bitcoin, which is perceived as a safer means to invest.

Trends (10%):

Investigate the Google trends analysis on queries correlating to Bitcoin. Such a manner of analysis shows potential variations in organic visitors’ attitudes toward the case-in-point market.

Understanding The Crypto Fear And Greed Index's Scale

The index's scale reflects market psychology through five distinct zones.

0-24 (Extreme Fear): This means that the market is absolutely in a state of panic. Overtime history suggests that this has oftentimes been a buying opportunity.

25-49 (Fear): The market can be described as still having some fear, but only to some extent.

50

(Neutral): It suggests a state of equilibrium where market participants are neither overly optimistic nor pessimistic. This can mean the market is awaiting a catalyst to move in either direction.

51-74 (Greed): This range indicates that the market investors are becoming greedy and that prices are at risk of becoming too high.

75-100 (Extreme Greed): This shows an extreme greed stage in the market and possibly this indicates that the market is ready for correction.

Investors can make the right investment decisions only when they fully come to grips with the fear and greed cycle. Also, it is necessary to control emotions through logic when trading within the volatile world of cryptocurrency.

Importance of the Crypto Fear & Greed Index

Crypto Fear and Greed Index serves as a very good tool for an investor who wants to capitalize on the technically high-risk returns of crypto investment. It acts as a mechanism to collate the general bias and aids the investors in managing their emotions with facts.

The Fear and Greed index has its advantages in market determination. It summarizes individual behaviors that in turn can be hot indicators for the market’s directional movements. This improves the chances of making profits for the traders.

In their place, this index proves helpful in finding out the prevailing market and predicting a future trajectory as well. For instance, when going through high fear, people will be watching for capitulation, while when going through high greed, they will be searching for bubbles.

Despite this, it is equally important to know the dangers of depending on the Crypto Fear & Greed Index only. Sentiment is just one of the many variables that affect the price of cryptocurrency. Depending too much on the index poses a danger to investors where some opportunities don’t get utilized or losses are experienced.

The index does not cover qualitative factors such as fundamental analysis, technological changes, regulatory, and other environmental factors, or news events. In short, the Crypto Fear & Greed Index is an interesting and helpful tool, but you must not forget that it is only part of the puzzle and must be supplemented with other research.

How to Make Better Trades with the Fear & Greed Index

The Crypto Fear & Greed Index can be quite useful for investors venturing into the risky domain of cryptocurrencies. However, to use the index effectively, other tools for analysis should be combined with it. Thus, for example, one can use the index together with other technical tools such as moving averages or the relative strength index RSI to confirm the existing trends.

For beginner investors, a few strategies would allow them to gain the most out of the index. In the first place, do not wait to look for opportunities until there is extreme fear or greed. On the other hand, consider the use of other research tools along with the index. When the index ticks extreme fear, this could be an opportunity to buy it, but extreme greed could be an indicator of the opposite situation.

The usage of the index is also illustrated by practical examples of the investments and their management. A good example is when this index plunged into extreme fear in early 2020. Investors who saw that situation as a potential bottom would have made good profits later when the prices rose significantly. The same is true for the situation at the end of 2021 during a bull run, when the level of greed reached pretty high and traders started to unwind their positions leading to many successful exits.

Limitations of the Crypto Fear & Greed Index

Data Interpretation:

Precautions should be observed when interpreting the index. In instances of extreme fear, it may be an opportune moment to purchase the stock; however, there is also the potential for further losses during periods of depression. Conversely, extreme greed may indicate the formation of a bubble, although it remains quite possible for prices to continue rising for a while.

Limitations of Data Sources

The data sources utilized for analysis, such as social media, surveys, trading volume, etc., possess inherent limitations. They may not consistently or comprehensively reflect market sentiments, particularly during periods of low activity or instances of market manipulation.

Short-term Indicator

The cryptocurrency markets are indeed characterized by volatility, with sentiment shifting within days. Therefore, the index is more suitable for short-term speculative trading rather than for long-term investment strategies.

Bitcoin-centric Data

A significant limitation is that the index is primarily based on Bitcoin data. Since Bitcoin constitutes the majority of market capitalization, this may obscure the characteristics and trends of other cryptocurrencies, potentially deterring investors who seek a broader perspective.

Current Trends and Future of the Index

According to Marketing, there is an increasing demand in analyzing the psychology of investors as reflected by recent highs in the Crypto Fear & Greed Index. As the interest in cryptocurrency is rapidly growing, several people have started using this index to determine the mood of the market. The index is therefore helpful in making wise decisions.

In the future, such improvements could involve drawing from real-time news to provide quicker feedback and monetization opportunities, for instance incorporating social media analysis to improve the predictive power of the index. Other potential developments might include analysis of online data and individual preferences which will assist investors in creating suitable positions for risk and return.

Remember that the Crypto Fear & Greed Index is an important element in the process of making any crypto investment decision, as it allows for a clearer understanding of the changing nature of the market and its flows and uses to stabilize the investment approach used.

Conclusion

The Crypto Fear and Greed Index is a powerful tool for understanding market sentiment in the cryptocurrency space. By measuring the emotional states of fear and greed, it provides insights that can inform trading strategies and investment decisions. While it has its limitations, the index serves as a valuable resource for both novice and experienced traders. By incorporating the index into a broader analytical framework, investors can enhance their ability to navigate the often tumultuous world of cryptocurrencies. Understanding the dynamics of fear and greed can lead to more informed and rational trading decisions.

Reference:

CoinCatch Team

Disclaimer:

Digital asset prices carry high market risk and price volatility. You should carefully consider your investment experience, financial situation, investment objectives, and risk tolerance. CoinCatch is not responsible for any losses that may occur. This article should not be considered financial advice.